December 1, 2023 | Canada Heads into an Economic Contraction

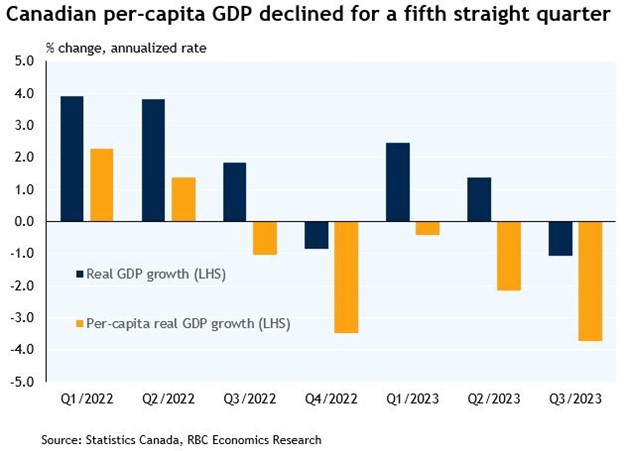

Canada’s economy is shrinking, based on per capita GDP numbers.

GDP results showed a contraction for the quarter ending September 30, 2023.

Is Canada in a recession? Will there be a household debt crisis?

Canadian GDP numbers, adjusted for inflation and population growth, showed a negative result for the third quarter. This means that there’s been five consecutive quarters of contraction, leading many to believe that a recession has begun.

Well-known Canadian economist David Rosenberg believes that a recession has already started, pointing out that population growth and a stagnant economy points to an annual GDP contraction of about 1.6 percent. But no official announcement of the arrival of recession has been forthcoming.

On Wednesday November 29, 2023 Rosenberg gave an interview to the Financial Post.

The headline — “Rosenberg sees Bank of Canada slashing interest rate to avert household debt crisis” — leaves no doubt about his opinion – Canada is in trouble.

Here’s a chart showing the decline in GDP, adjusted for inflation and population growth:

Many borrowers have yet to feel the impact of higher rates. The policy is to allow people with variable rate mortgages to continue paying a monthly payment based on the rates before rate increases. If those people were forced to pay current rates there would be higher mortgage payments of $2,000 or even $4000 per month. Some, already facing higher food costs, will be unable to handle the additional expense. After all, most variable rate borrowers could only afford their mortgage by opting for the lowest rate, in some cases as low as 1.5 to 2 percent.

When all mortgage holders are brought up to current rates the impact of those higher payments on the economy will be substantial as discretionary consumer spending is cut back to meet those increased debt payments.

Households are not the only ones struggling. Business borrowers are facing increased interest rate burdens also, as the prime rate is now 7.2 percent. Most small-to-medium size businesses, who borrow from $1 million to $5 million, are paying the prime rate plus 3 percent or 10.2 percent. In a severe recession some of those businesses will be unable to pay their loans. And that problem will cascade into the personal finance area because most of those borrowers were forced to sign a personal guarantee to get that business loan, and residential real estate is the collateral for most of those loans.

Starting in the 1980s governments in the developed world responded to every financial crisis (1987, 1998, 2000, 2006 and 2020) with a flood of newly printed money, bailing out lenders and borrowers. The government goes much deeper into debt, as happened in Canada in 2020, and the private sector soaks up those dollars. But Canadians still have a growing debt problem.

Canada won’t get back on track until debts in the private sector are substantially reduced or completely liquidated, as happened in the U.S. in 2006-2012.

The recession has started, but lower rates are not the solution.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth December 1st, 2023

Posted In: Hilliard's Weekend Notebook