November 18, 2023 | Trading Desk Notes For November 18, 2023

Soft CPI = stocks and bonds up, USD down

The Tuesday morning CPI report was marginally softer than expected; the market took that as “confirmation” that the Fed is DONE – stocks and bonds surged higher, and the USD tumbled – its biggest down day since falling on the softer-than-expected CPI report in November 2022.

The US Dollar Index is back to where it closed at the end of 2022.

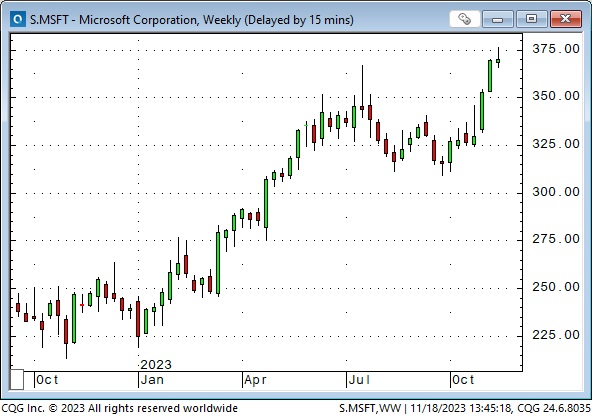

MSFT (the leader of the Mag7 and the entire tech sector since July) rallied to new All-Time Highs after the CPI report, but the momentum of the past two weeks was diminished, and it barely closed higher on the week.

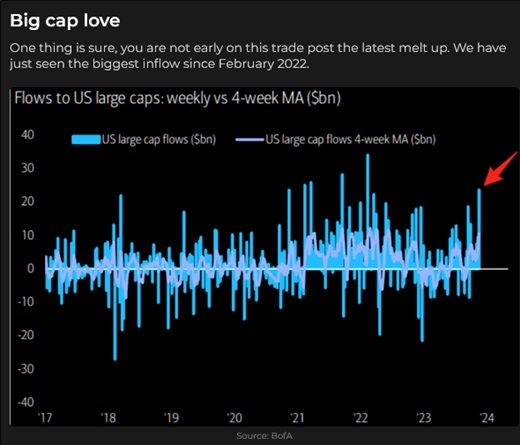

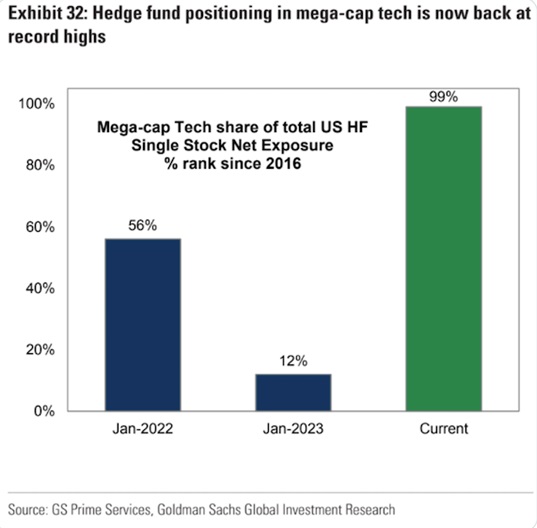

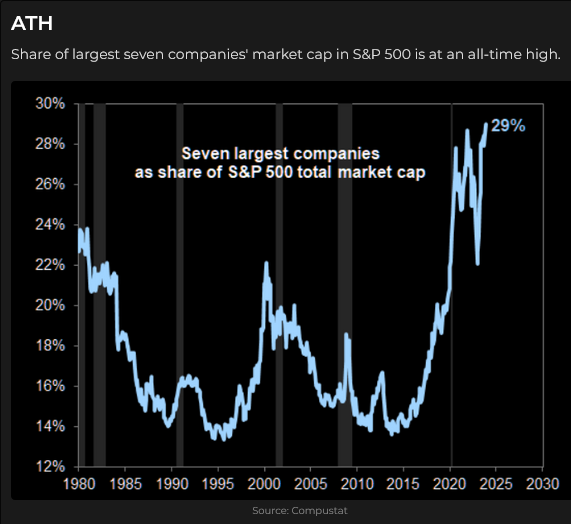

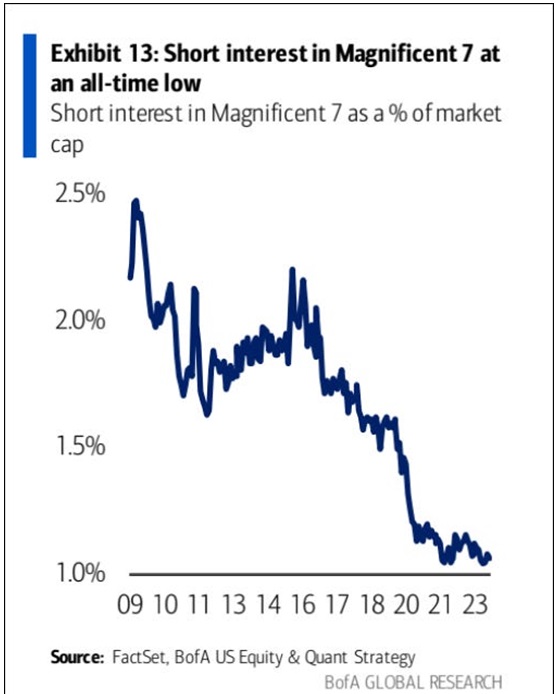

The stock market rally since October last year has been All About Megacap Tech – and increasingly so since NVDA soared following the May quarterly report. Megacap Tech is at All-Time Highs, is at ATH relative to the broad market, has soared relative to the Russell index of small-cap stocks, and American stock indices are at All-Time Highs against all global stock indices – thanks to Megacap Tech.

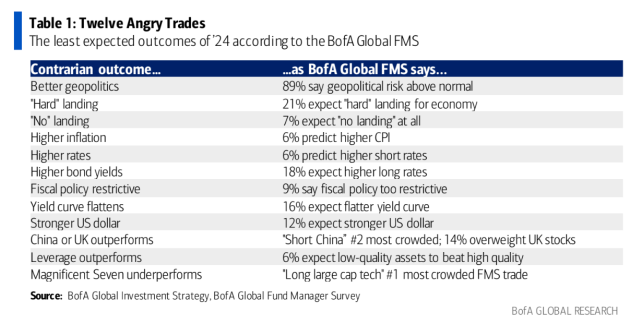

My notes about Mag 7: 1) BoA Fund Manager Survey shows Long megacap tech as the #1 most crowded trade. 2) Is there anybody who would be a Mag7 buyer not already long Mag7? 3) if you wanted to own Mag 7, would you be underweight now? 4) the old saying “Nobody ever got fired for buying IBM” is updated to “buying Mag7.”

Implied volatility collapsed across stock index futures over the past three weeks as stocks rallied from late October lows.

“Nobody” is buying stock market puts.

Bonds

10-year bond yields hit a 16-year high of ~5% in mid-October and fell to ~4.4% following the CPI, but even with “growth risks” and a possible recession, bonds are struggling with an expected tsunami of issuance. Who will buy all those bonds as governments keep increasing deficit spending?

Over the past several weeks, there has been HUGE ” bottom-picking” buying in the TLT ETF. If bond prices turn lower, some of those buyers may become sellers.

Currencies

The Euro (the anti-dollar) surged higher on the CPI report, closing the week at a three-month high.

The Yen was trading at a 33-year low against the USD before the CPI report but rallied along with all other currencies to register its best weekly gains since July.

The Canadian Dollar fell ~4 cents from the mid-July Key Turn Date to 12-month lows on November 1. It rose ~2 cents as stocks and bonds rallied off their late October lows but couldn’t sustain that rally and fell back to ~7250 before the CPI report spurred a 1-cent rally. The CAD dropped back on Thursday as stock market momentum faded, and WTI crude oil plunged ~$6 in three days. (Canadian fossil fuel exports account for ~20 -25% of Canadian exports.)

Energy

Front-month WTI futures fell to a 4-month low Thursday – down ~24% from the $95 high in late September. The market bounced back nearly $4 on Friday amid reports that OPEC+ may cut production at their November 26 meeting.

Uranium shares were higher. Cameco shares hit a 16-year high.

Gold

Gold closed Friday ~$40 above last Friday’s close as the USD and interest rates fell. Gold had spiked ~$200 from October’s low to high on geopolitical stress but had given back ~$80 of that rally at this week’s lows.

My short-term trading

I started this week with a long S&P position established last Friday. When the S&P seemed to stall after soaring on the CPI report, I covered for a gain of approximately 90 points.

I shorted the CAD on Wednesday. Of all the currencies I follow, it had the weakest rally on the CPI report, and when it fell back from intra-day highs on Wednesday, I got short. It broke down nicely on Thursday as the stock market rally stalled and WTI plunged to 4-month lows, so I lowered my stop. I was stopped on Friday for a 20-tick gain.

I shorted the S&P on Wednesday when the momentum from the Tuesday rally seemed to die, but I was stopped for a tiny loss.

I shorted the S&P on Friday (again, the momentum seemed to be gone) and stayed with that trade into the weekend.

My P+L had a good week, and if the S&P falls next week, I may try to add to my short position. If the market rallies, my stop should take me out with a slight loss.

On my radar

On a short-term time frame, “worries” about inflation (and what the Fed might do about it) are over. The emerging concern (at least for some people!) is the prospect of “growth risks.” Are consumers going to cut back? Is unemployment or under-employment rising? Is a recession looming?

The bond market seemed to be the “driver” of everything. Rising yields in September and October pulled the stock market lower and boosted the USD while falling yields in late October/early November boosted stocks and weakened the USD. Correlations change, especially when they get this obvious.

Option vol is down across markets, so making a directional bet buying options is cheaper than it was.

Seasonality, corporate share buybacks, and re-balancing (portfolio managers can’t be underweight equities going into yearend) support the idea that stocks go higher from here – but I think a LOT of that is in the price.

The American Thanksgiving Holiday is Thursday, and Friday will be a semi-holiday.

Thoughts on trading

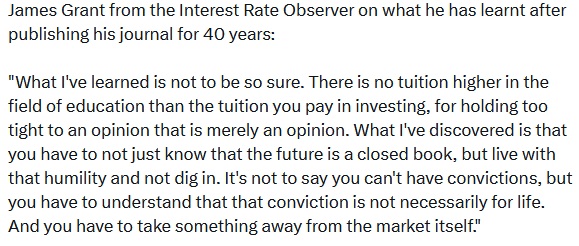

I highly recommend an excellent 1-hour interview with Jason Shapiro, the author of the Crowded Market Report and one of the “Unknown Wizards” in Jack Schwager’s latest book. You can watch the interview with Jack Farley here.

I agree 100% with so many things that Jason says in this interview, for instance:

1) Trading is not about predicting the future,

2) People want to develop a view of “events” that makes sense to them – markets don’t make sense,

3) Find a way to trade that suits you,

4) pay attention to positioning and market action (find setups to) fade markets with good risk/reward bets when positioning gets extreme, and NEVER chase a market.

You can find Jason on YouTube, and he is on Twitter.

Quote of the week

The Barney report

We’re getting into winter weather here, which means frequent freezing temperatures overnight and at least a little rain most days- this is the Pacific Northwest rainforest! My wife bought Barney some raincoats, and he stands patiently while Papa tries to get the darn things on him properly. He still loves climbing up on rocks or logs to better look around. These days, he weighs nearly 70 pounds.

Listen to Victor talk about markets

Mike and I discussed the impact of the CPI report on stocks, bonds, and the currency markets and “what’s wrong” with the Canadian dollar on this morning’s Moneytalks podcast. My segment starts around the 50-minute mark. You can listen to the whole show here.

The World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

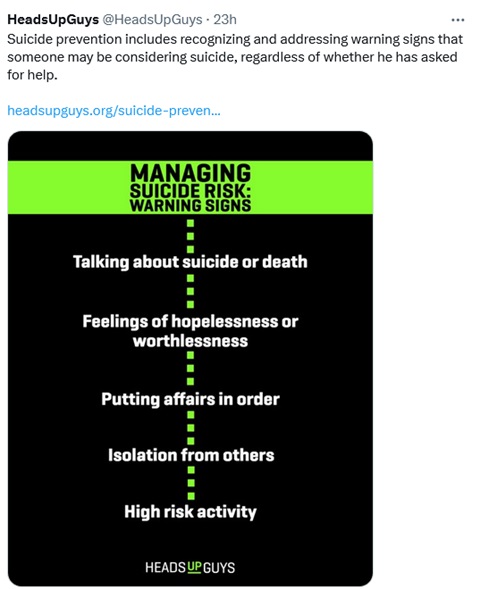

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair November 18th, 2023

Posted In: Victor Adair Blog

Next: Socially Insecure »