November 24, 2023 | Gold Is Due For A Rally

The price of gold jumped above $2,000 per ounce this week, as the market started to expect an interest rate cut in 2024.

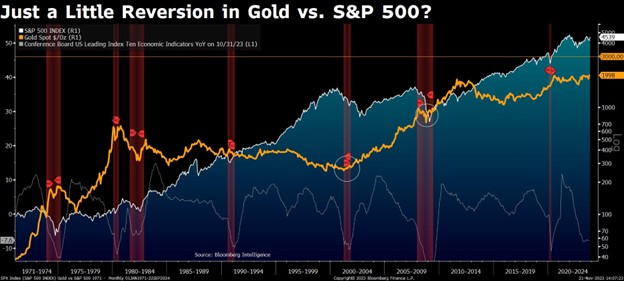

Gold and gold shares have performed well during recessions and during periods when the stock market sold off.

The price of gold has performed well in the last seven recessions, when US stocks have retreated.

During the long run-up in stock prices since 2009, which took the S&P 500 up about 7-fold, gold performed poorly, rising from $1,000 to $2,000. So gold is overdue for a period of outperformance, if there’s a recession.

Other signs point to a rally in gold. The recent breakout above $2,000 — which is only a round number and has no real meaning for valuation — could attract some buyers who watch the charts.

An important driver of gold price performance is the level of real rates. When real rates decline the gold price goes up. If rates stay high the opportunity cost of gold is too high to allow a substantial rally in gold.

If real rates decline and interest rates go below the rate of inflation, gold can do well.

Central banks are purchasing gold at a faster rate than any time since 2010. China especially has been buying aggressively, purchasing 150 tonnes of gold so far in 2023. Other substantial buyers are Poland, Singapore, Libya and India.

Central banks’ purchases show a preference for gold over adding to US government bond holdings.

Physical demand — gold that is used for jewelry and some industrial applications — is stronger this year. Gold imports to China are now matching previous highs seen in 2018. China and India gold imports are about 24 percent higher than the long-term average.

But most of gold demand comes from investors and speculators who hold gold as an investment or speculation in bullion or an ETF, often as a hedge against a crisis. But gold provides no interest or dividend income and costs money to store in physical form. In China the property market is in trouble, and investments in bonds, stocks and cash are down, but gold is up about 7 percent year-to-date.

The bear case for gold is the US economy stays strong, avoids a hard landing, and stock markets continue to rally in a new bull market causing gold speculation to fade.

Wars and geopolitical conflicts can trigger interest in gold, again as a hedge, although that impulse is usually short-lived when the crisis fades. The current Israel-Hamas conflict is responsible for an uptick in the price of gold.

What is the best way to hold gold?

I prefer gold mining company shares over bullion.

Gold share investing offers the exciting potential for a major discovery, or an expansion of reserves as the price of gold rises. There have been no discoveries of large orebodies recently, so perhaps it will happen soon.

But always remember what Mark Twain said:

“A gold mine is a hole in the ground with a liar beside it.”

Hilliard MacBeth

pinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth November 24th, 2023

Posted In: Hilliard's Weekend Notebook

Next: Is Gold A Manipulated Market? »