October 30, 2023 | Structural Issues

Happy Monday Morning!

As expected, the Bank of Canada held interest rates at 5% for the second consecutive time. BoC’s Macklem flagged everything we’ve been highlighting in this newsletter for several months now. Weaker economic growth and a recent surge in global bond yields is doing most of the tightening for them. Adding, “The path to a soft landing is narrow. In our new projection that path is narrower.” No doubt.

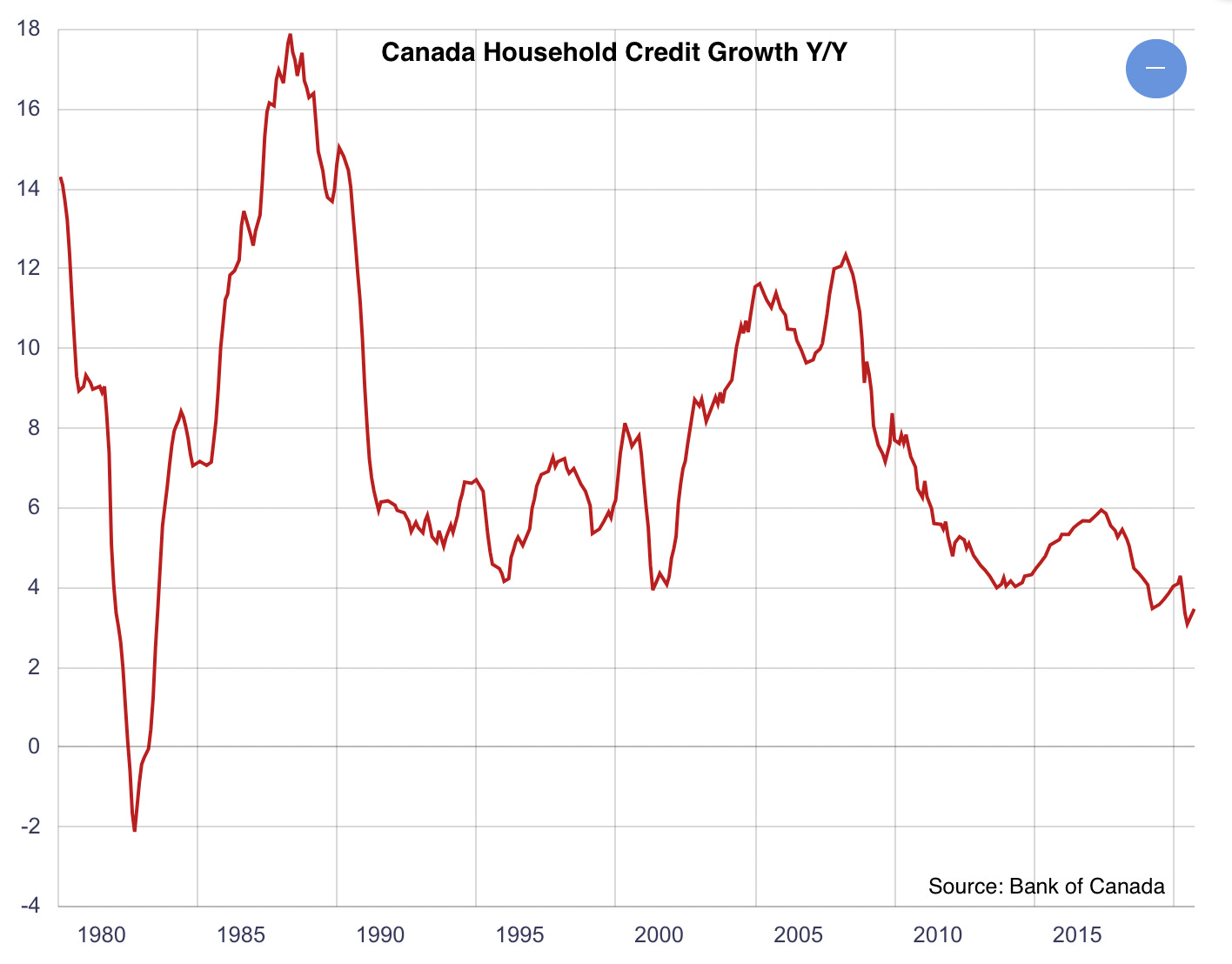

Monetary policy is working, households are pulling back in the midst of surging interest rates. Household loan growth is running at its lowest levels since 1983!

We can also see demand being crushed for new mortgages. Mortgage loan growth is running at its lowest levels since 2001. It is therefor rather perplexing that house prices haven’t fallen further. This has perplexed the BoC as well.

“Normally, house prices move pretty lockstep with interest-rate increases,” Bank of Canada senior deputy governor Carolyn Rogers said at a news conference last Wednesday. “As interest rates come down, house prices go up a bit. And they’ll come off as interest rates come back up.”

“We’re not seeing the decline in house prices that we would expect,” she continued, adding that there is a “structural lack of supply” of housing in Canada, and that until it is fixed, “interest rates on their own are not going to help us get back to a housing affordability situation or solution.”

The decline in house prices Rogers is waiting for are likely coming. Housing activity in our two largest major metros, Toronto & Vancouver, are frozen solid. The reality is interest rates have barely filtered through the housing market. As we noted last week, by the end of this year, less than 50% of mortgage borrowers will have seen any payment increase. All we’ve done so far is curtail new purchasing activity. Furthermore, the recent bump to 6% mortgage rates are a new headwind, only arriving on scene this fall. The longer mortgage rates stay with a six handle the more price pressures we’ll see.

Right now it looks like prices aren’t dropping because the nice houses are still selling and for top dollar. What you don’t see is all the other homes going no bid. That won’t show up in the price indexes Rogers is monitoring, not until its too late anyways.

In the near term, interest rates will dictate the direction of the housing market. On a longer term basis, Rogers is right, the structural lack of supply will ensure Canadians suffer another decade of housing unaffordability.

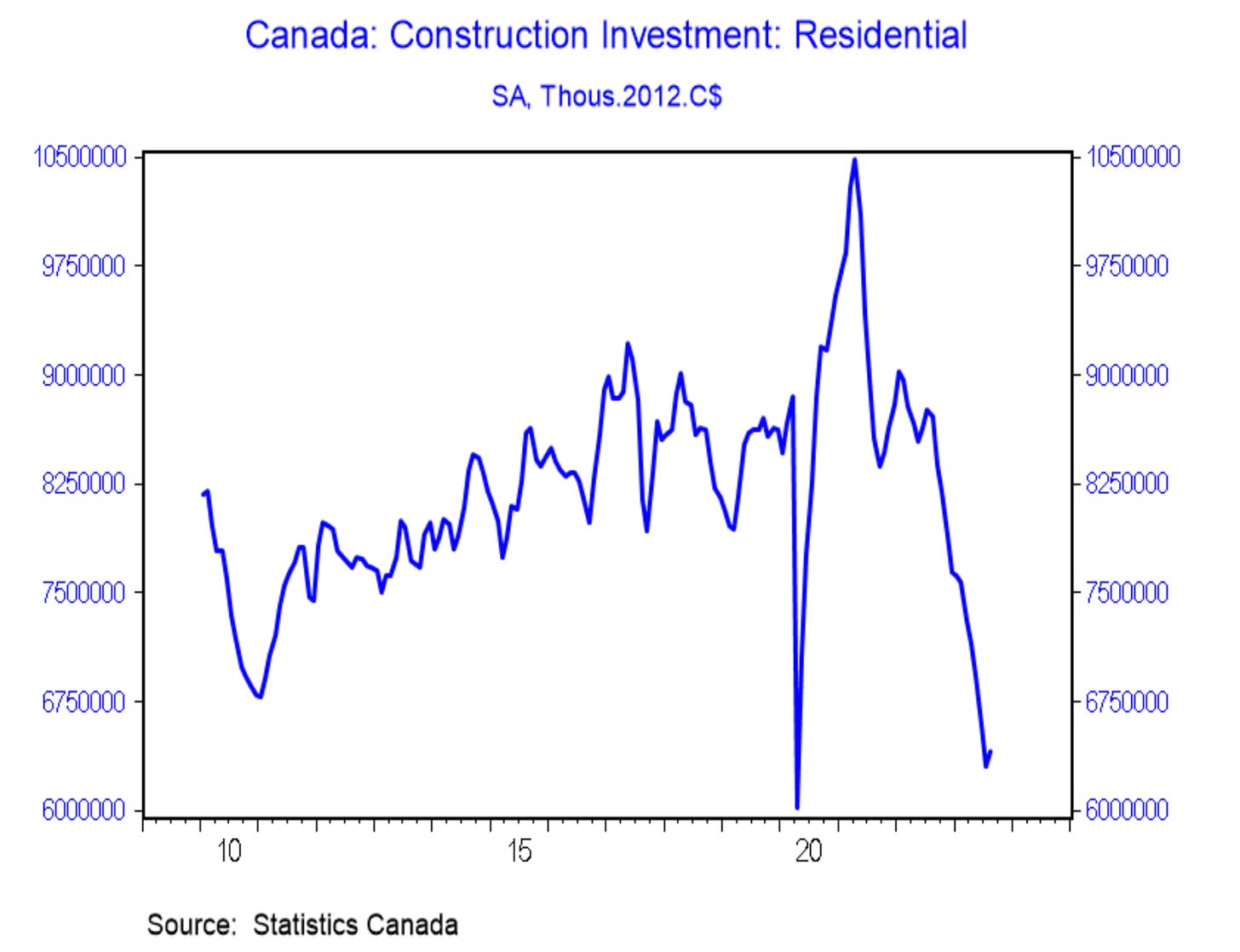

In case you missed it, here’s what we learned this week. Canada’s immigration minister says he won’t curtail international students. Metro Vancouver municipalities approved a tripling in development fees. Residential construction spending crashed to its lowest levels since 2011.

At a time when population growth is running at its fastest pace since 1957 and in the midst of the worst housing affordability since the 1980s the federal government won’t look at slowing immigration.

Instead, they’ve tried to dangle a carrot in front of municipalities to build more housing. There’s just one problem, the municipalities are starved for tax dollars.

This past week, Metro Vancouver Regional District’s board of directors approved a tripling to development cost charges associated with new building developments. The new fees will go into effect in 2025, and will add big costs to residential projects. Depending on the location it will add $18,506 to $24,106 per single-family lot, $16,952 to $22,182 per townhouse unit, and $11,360 to $14,657 per apartment unit.

What transpired between the federal and municipal governments after the announcemnt was rather telling, bringing us full circle into the world of politics.

Federal Housing Minister Sean Fraser warned Metro Vancouver it could cause the senior government to rethink housing funding.

“Given the spirit of the Housing Accelerator Fund and the work that the federal government is doing to change the financial equation for builders, large increases in development charges are at odds with these goals,” remarked Federal housing minister Sean Fraser.

Port Coquitlam Mayor Brad West says he feels these fees are needed, and says the federal government’s concern isn’t about affordability — rather he thinks it’s about politics. In fact, West says the idea of the federal government framing their concern around affordability is “somewhat laughable.”

New West Mayor Patrick Johnstone agrees and says Fraser’s demands look “more like politics than responsible government.”

We could go on but you get the point.

Here’s the takeaway. The Bank of Canada is desperately raising interest rates to crush demand, killing new supply in the process. The Feds realize this, and are being forced into action given how badly they are doing in the polls. They’ve finally cut the first cheques from the housing accelerator fund and removed GST on rentals. However, they waited too long and are still immigrating a million people a year. While the municipalities might want to play ball, they desperately need tax dollars. Everyone is fighting for a shrinking piece of the pie.

The end result, residential construction spending has crashed to lowest levels since 2011.

Housing is fundamentally broken in this country, and i’m sure we’ll be saying the same thing ten years from now.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky October 30th, 2023

Posted In: Steve Saretsky Blog