The International Monetary Fund warned this month that the downdraft in China’s real estate sector has contagion implications globally:

In the near term, the sharp adjustment in China’s heavily indebted property sector and the resulting slowdown in economic activity will likely spill over to the region, particularly to commodity exporters with close trade links to China. Beyond this, an aging population and slowing productivity growth will further temper growth over the medium-term in China, amid rising risks of geoeconomic fragmentation, and bear upon prospects in the rest of Asia and beyond. In a downside scenario where “de-risking” and “re-shoring” strategies take hold, output could decline by up to 10 percent over five years in the Asian economies most closely linked to China’s economy.

The latest data shows that property investment — the largest driver of China’s economic activity — continues to slump, with home prices and consumer sentiment falling. (Sound familiar, Canada?)

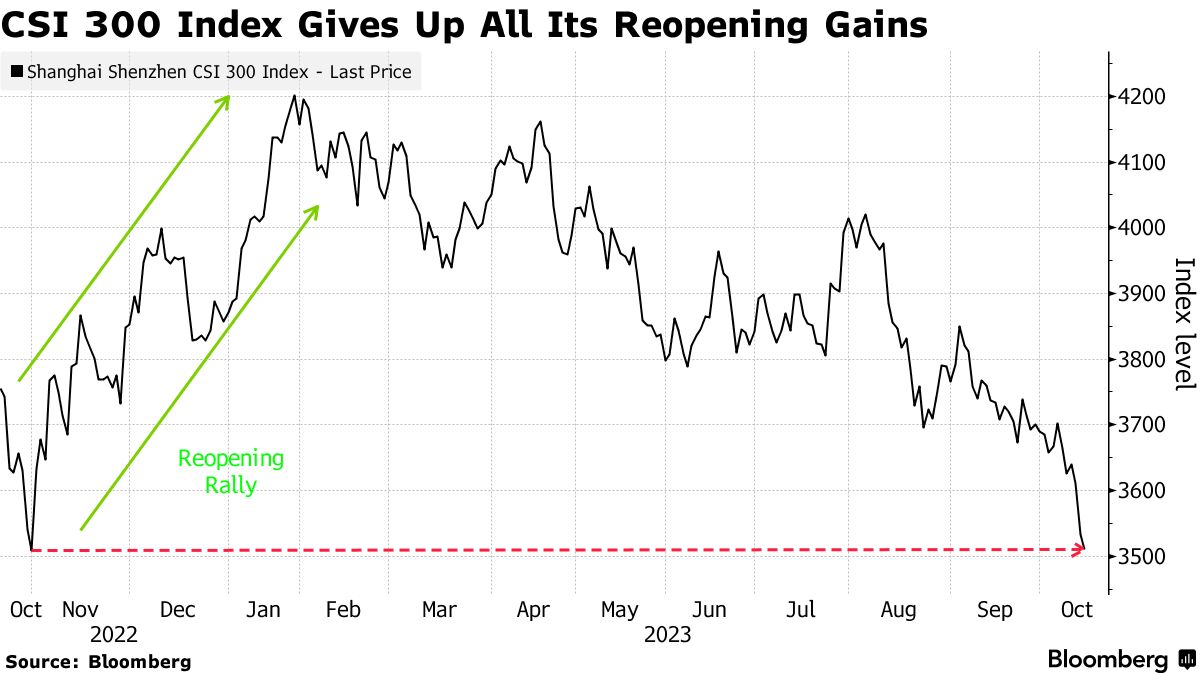

Notwithstanding intervention efforts from Chinese authorities, China’s primary CSI 300 Stock Index has erased all its gains during the so-called reopening rally in the final quarter of last year. See China’s Property Woes Pour Cold Water over Efforts to Boost Stocks.

The Chinese stock market is today 40% below its manic cycle peak in October 2007, 16 years ago. When asset prices dramatically overshoot reasonable valuation metrics, it is typical for them to halve and not recover prior peaks for many years. Word to the wise.

The video report below offers a worthwhile overview and update.

China’s real estate industry is collapsing in slow motion. Major developers like Evergrande and Country Garden remain stuck in spiralling debt problems. So-called ‘ghost cities’ dot the Chinese countryside. And now the International Monetary Fund just cut its global growth forecasts for 2024 and called out China’s real estate crisis as a big reason why. Here is a direct video link.