October 23, 2023 | Bell Ringer

Happy Monday Morning!

It’s a big week for Canadian households living on the edge. The Bank of Canada is poised to meet on Wednesday to deliver an update on their rate hiking crusade. It is largely expected they’ll remain on the sidelines, as they should given the slew of weak economic data in recent weeks. Let’s discuss.

Inflation data for September came in softer than expected at 3.8% year-over-year, off the recent bounce of 4%. It remains well above the BoC’s target, so there’s certainly no cuts anytime soon. The good news is the three month moving average of underlying price pressures that Macklem has flagged fell to an annualized pace of 3.67%, from 4.29%, and the largest contributors to headline CPI remain largely self-inflicted with mortgage interest costs up 30%.

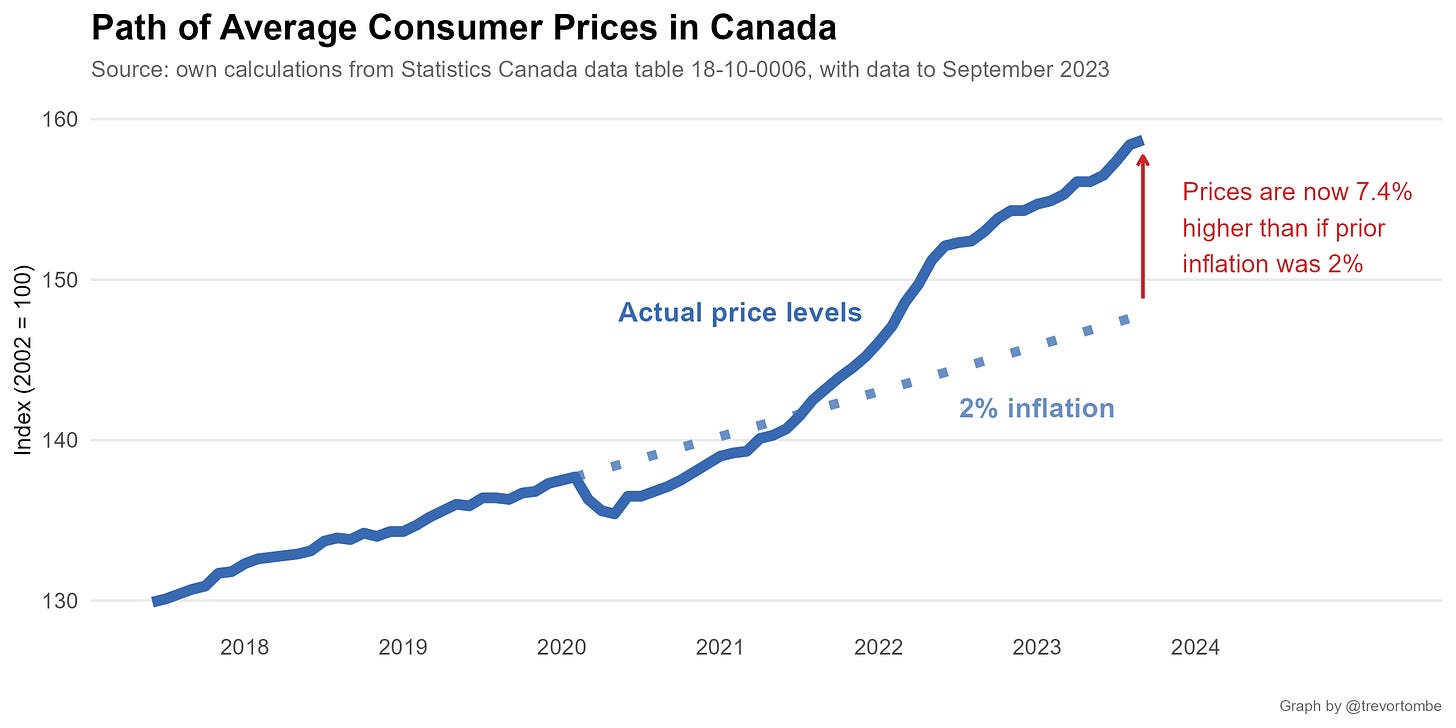

This is not to denounce the devastating impacts of inflation which have wreaked havoc on the bottom half of society. Even when we get back to the BoC’s target of 2%, the damage will have been done. Overall price levels are 7.4% higher from pre-pandemic levels and they’re not coming back.

Households are responding by pulling back on spending and shifting to lower priced options. Receipts for retailers were flat in September, according to an advance estimate from Statistics Canada released Friday. That followed a 0.1% decline a month earlier. According to Eric Lascelles, chief economist at RBC, with inflation and population growth running higher than normal, “you need retail sales growth of something like 0.4 per cent, 0.5 per cent, 0.6 per cent, just to mean that the average Canadian bought as much stuff as the month before.” Ouch.

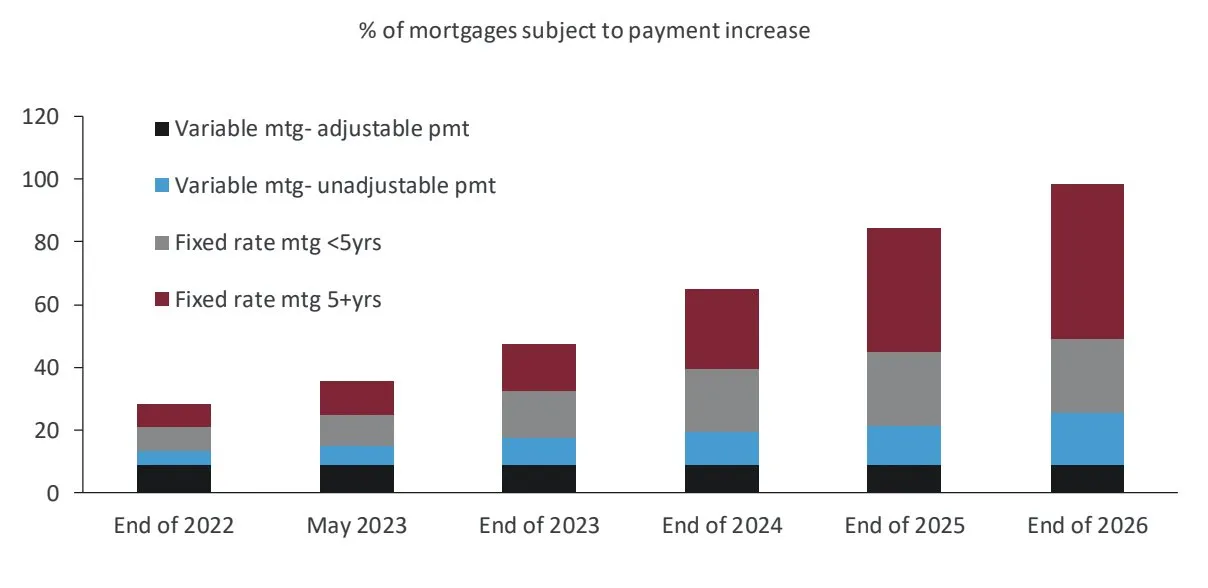

Keep in mind that retail spending is declining despite higher rates yet to hit most mortgage holders. By the end of this year, less than 50% of mortgage borrowers will have seen any payment increase.

Over the coming twelve months, 70,000 mortgages will be renewed each and every month at significantly higher rates. As the saying goes, monetary policy has long and variable lags.

Lets walk through a pretty typical mortgage renewal. Five years ago a borrower took out a $600,000 mortgage on a 30 year amortization at 3%. The monthly payment would be $2524.

They’ve paid off 5 years of their mortgage, the balance is now $533,000. The new mortgage rate is 6% with 25 years remaining on the amortization. The monthly payment would be $3410.

That’s an $886 monthly increase to their mortgage payment. Now you could refinance back to 30 years and lower the payment which would lower the monthly increase to $646. That’s manageable and unlikely to result in a bunch of forced sales. However, given the increase in mortgage payments and the growth in price levels across consumer goods and services, households are going to have to get creative and trim spending where they can.

While we do enjoy sticking it to the Bank of Canada, i’d imagine their team of PhD’s has run these aforementioned scenarios, given consumer spending is close to 60% of GDP.

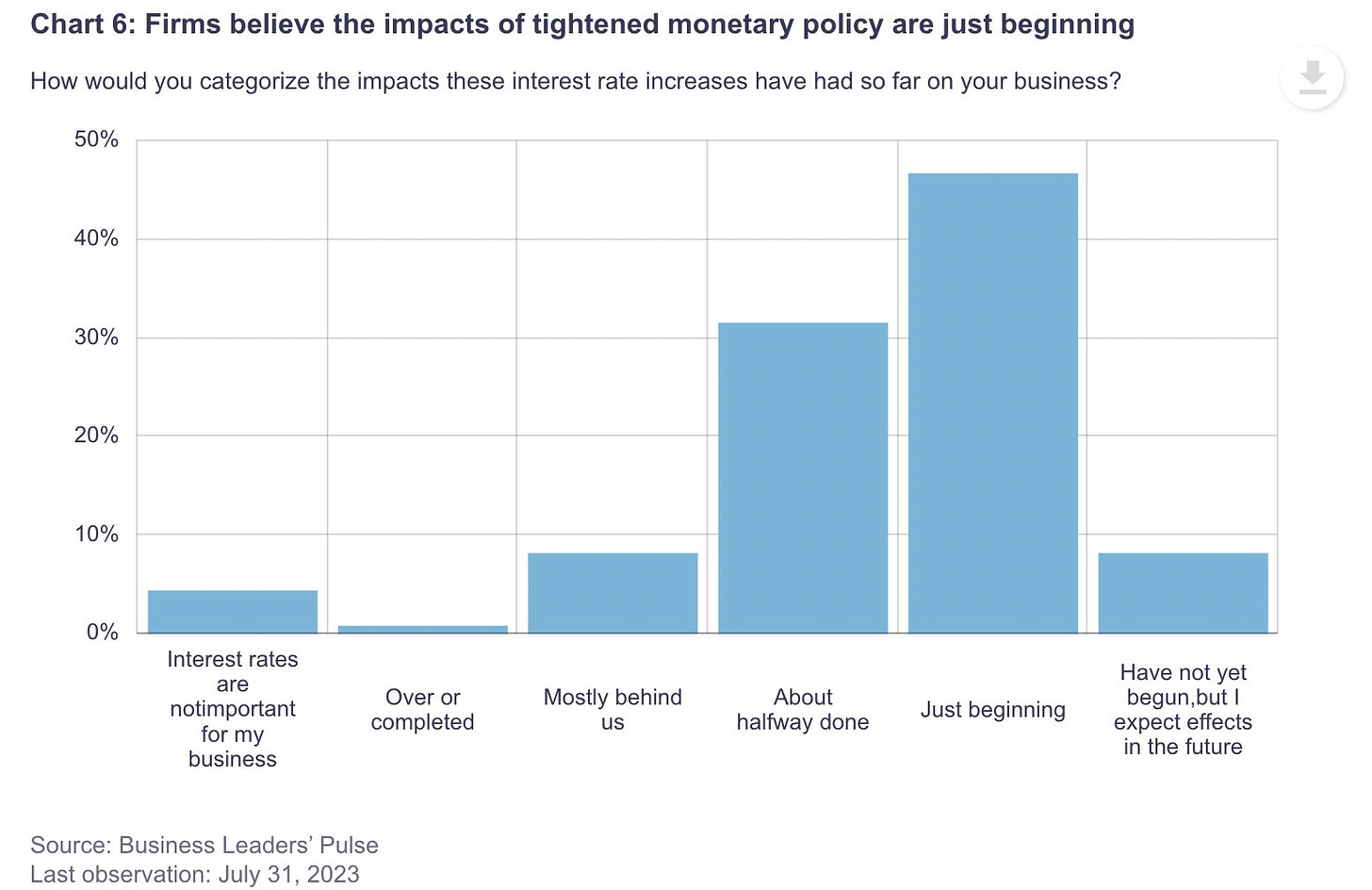

After all, their business outlook came to the same conclusion. Businesses are bracing for weaker sales. The business outlook survey, as measured by the BoC is now at its lowest levels outside of the pandemic and the GFC.

Furthermore, most businesses believe the impact of higher interest rates are just beginning. All 500bps of them!

So while the BoC is likely done, the impacts of this rate hiking cycle are not. Speaking of which, did you see Toronto’s tallest condo tower, all 85 stories of it, just went belly up. If that isn’t a bell ringer for this credit cycle I don’t know what is.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky October 23rd, 2023

Posted In: Steve Saretsky Blog