September 9, 2023 | Trading Desk Notes For September 9, 2023

King Dollar: higher for eight consecutive weeks

The US Dollar Index touched a 15-month low in mid-July (a Key Turn Date across several markets) and has rallied for eight consecutive weeks.

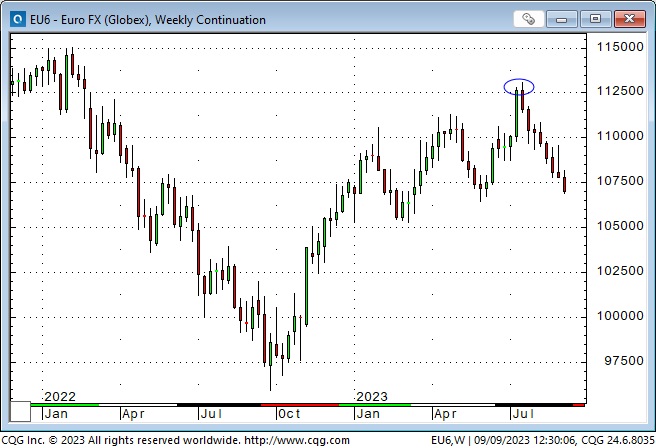

The Euro reached a 17-month high in mid-July, then fell for eight consecutive weeks.

The Yen had a counter-trend rally into mid-July but then made lower lows for eight consecutive weeks. It closed this week at levels that prompted intervention from Japanese authorities last October.

The Canadian Dollar rallied to 10-month highs in mid-July but has closed lower for 7 of the last eight weeks, despite a ~25% rally in WTI since July 1.

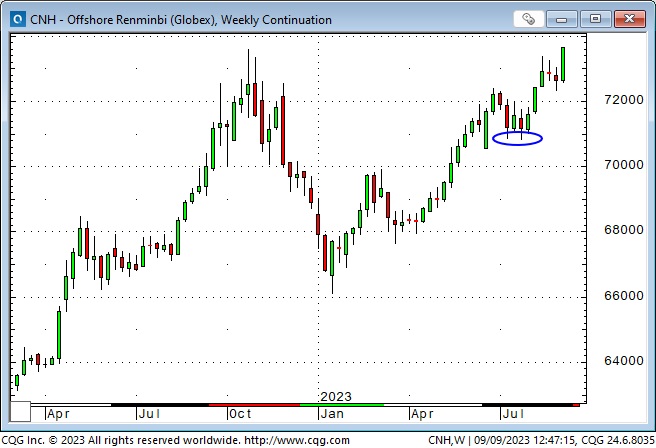

The Chinese RMB made a counter-trend rally in mid-July but closed this week at 16-year lows against the USD. (Higher prices in this chart mean it takes more RMB to buy USD.)

Expectations of where American short-term interest rates would be in September 2024 have increased ~75 bps since mid-July; the idea that American inflation and interest rates would be “higher for longer” has helped boost the USD over the past two months.

Stock markets had their own mid-July turning point

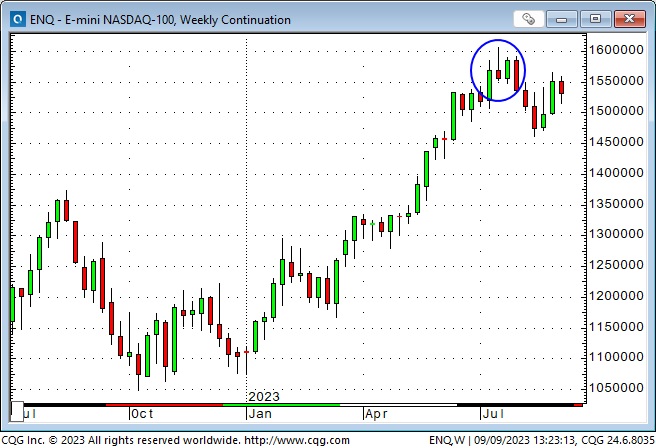

In the July 22 Trading Desk Notes, I wrote about MSFT gaining ~$100 Billion in market cap on Tuesday, July 18 (with the share price touching All-Time Highs). Still, all those gains evaporated within a few days, leaving the weekly chart with an ominous shooting star candlestick pattern.

On July 22, I had this to say about the Nasdaq:

The bullish enthusiasm for MSFT on Tuesday spread to other stocks, and the leading American stock indices all rallied to new multi-month highs, with the Nasdaq up ~45% YTD (its hottest-ever first-half performance.) The Nasdaq traded marginally higher on Wednesday but closed lower on the day. On Thursday, it had its most significant YTD daily decline, and it dropped further on Friday, creating a bearish shooting star on the weekly chart. (After Wednesday’s close, TSLA and NFLX quarterly reports weighed on sentiment.)

Mid-July was the YTD high for the Nasdaq 100, but the S&P and the DJIA traded marginally higher into the end of July / beginning of August before turning lower.

The bond market also had a turning point in mid-July

The bond market had a counter-trend rally into mid-July, then tumbled until mid-August, with the yield on the long bond rising to a 12-year high of ~4.45%.

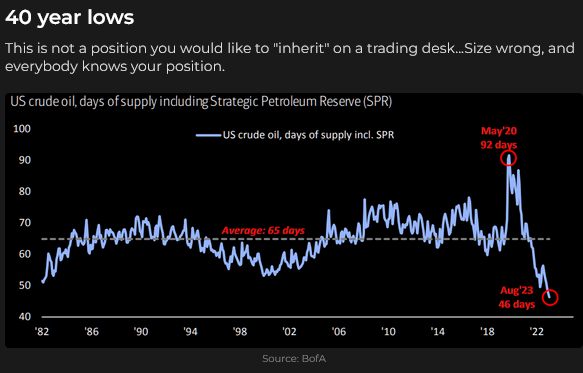

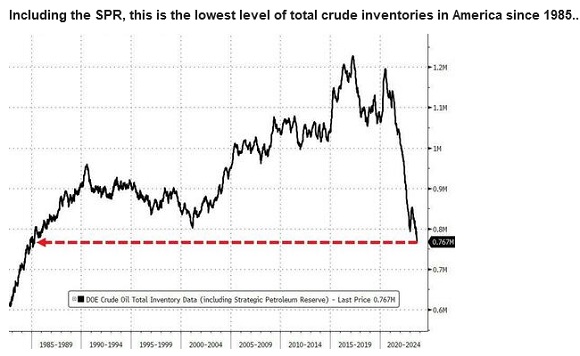

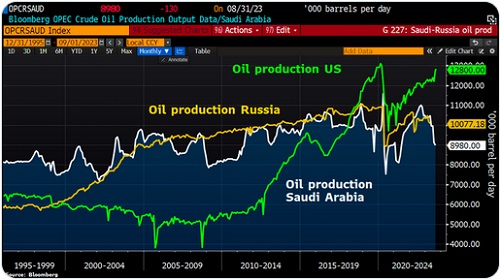

WTI crude oil closed this week at 10-month highs

WTI has rallied ~$20 (30%) from June lows to 10-month highs. Saudi Arabia and Russia extended their production cuts to year-end.

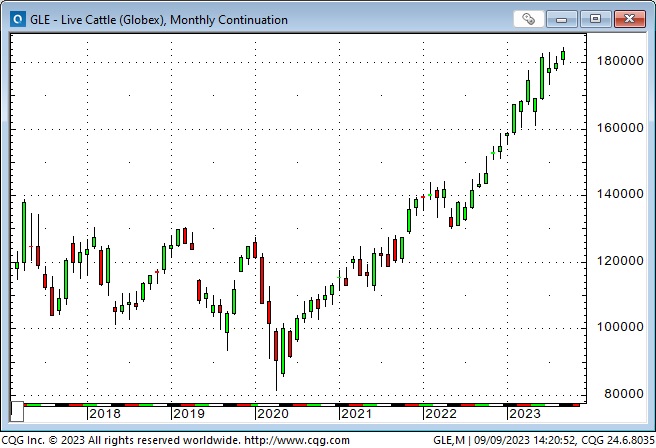

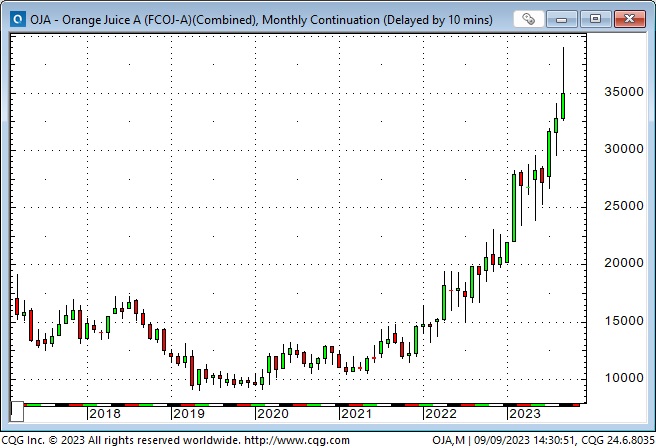

The Goldman Sachs commodity index had its highest weekly close this week since January. The index has a heavy fossil fuel weighting, but energy prices are not the only thing driving it higher. Live cattle futures touched All-Time Highs this week, up ~125% from 2020 lows. Sugar and Cocoa are near 12-year highs, and Orange Juice has soared to All-Time Highs, nearly quadrupling from 2020 lows.

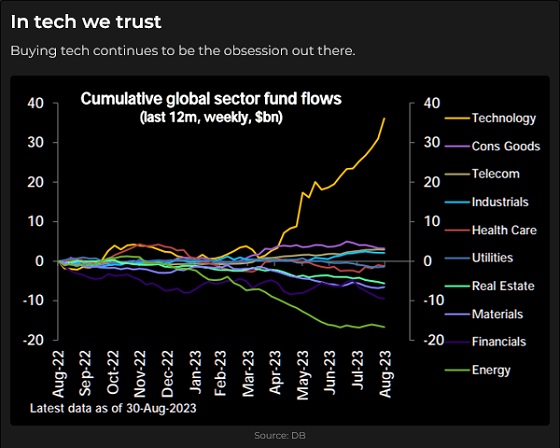

The combination of a stronger USD, higher energy prices and higher interest rates may signify an increased risk for financial markets

Gold

Comex gold futures (very) briefly rallied to an All-Time High on May 4 at ~$2,085, then dropped as much as $80 from those highs the next day. By mid-August, prices were down ~$300 from ATH.

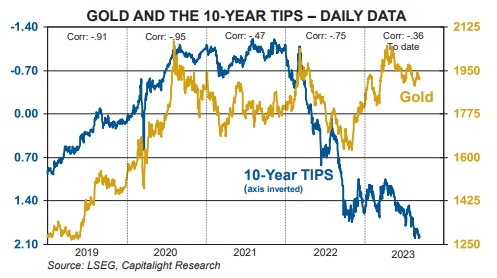

Gold prices were down ~$50 from mid-July highs this week – which seems modest given the sharp increase in the USD and interest rates. (If gold had maintained its multi-year correlation with real interest rates, it would be much lower. This chart is courtesy of Martin Murenbeeld.)

When correlations between markets break down, I wonder why. In this case, I wonder why gold hasn’t fallen more when the USD and real interest rates have risen sharply (and investors have been net sellers in the gold ETF and futures markets.)

Central banks have been BIG buyers, which may be the best explanation for the relative strength of the gold market. But I wonder if a “lack of selling” may account for gold prices not falling. If the combination of a rising USD, higher energy prices and higher interest rates (not to mention rising geopolitical stress) may signify an increased risk for financial markets, would thoughtful investors shy away from shorting gold?

Thoughts on trading

“There are no solutions. There are only trade-offs.” Thomas Sowell

Is there going to be a recession? When will it start, and how severe will it be? What will the Fed do? If China is “uninvestable” for foreign capital, will its economy and commodity demand weaken? Who will win the US Federal election next year, and what impact will that have on markets? Did the Saudis cut production because they were worried about falling demand for crude, or were they hoping to create higher oil prices to “catch up” with inflation – or were they sending a message to the White House?

I know I don’t know the answer to any of those questions, and yet I’m willing to risk my capital trading markets that will ebb and flow as sentiment shifts and people think they “know” what will happen.

I make money from trading, not because I’ve got a great crystal ball, but because I’m good at managing risk. My objective is to protect my capital (mental capital and the money in my account.)

Trading is not a “game” of perfect. My win/loss ratio varies from time to time (sometimes I have a streak of winning trades, sometimes I have a streak of losing trades), but over time, I lose money on more trades than I make money on, but my average profit is bigger than my average loss. I could have made more money on every winning trade if I had made better judgements about entries and exits. I often get out of winning trades too early.

I form opinions about where I think markets may go (what is the path of least resistance?), and then I wait for a good risk/reward setup. I often “miss” getting into a market that goes where I thought it might because I couldn’t find a good entry setup.

Risk is not static; it increases and decreases, and being aware of that is a fundamental part of managing risk.

I’m constantly checking my “assumptions.” For instance, if I plan to make a trade based on my assumption that some “information” is correct, I need to double-check it.

I remember reading a golf book by Pia Nilsson and Lynn Marriott that used the expression, “Control what you can control, and let the other stuff go.” I think that’s excellent advice for trading (and for golfing!)

Last week, I wrote about trading size and said, “I kept my trade size small over the last three years because I’m “learning” how to make a living from trading rather than from being a broker.”

After posting last week’s blog, I remembered a great piece from Peter Brandt posted under the “Trading Life” section of my website. Peter distinguishes between trading for income and trading to make a fortune.

Re-reading Peter’s piece made me realize that I’ve been trading for income rather than to make a fortune. I still plan to increase my trading size but won’t be “swinging for the fences!”

My short-term trading

I started this week short the Mexican Peso, the Dow and gold. I was also long Japanese Yen calls.

I covered the Peso for good gains on Tuesday.

I covered the Dow on Tuesday for a small profit and switched to being short the S&P. I covered that trade Wednesday for a good gain.

I covered the short gold on Wednesday for $17 per ounce.

I bought T-Notes and the S&P on Thursday (looking for a bounce) and covered both trades on Friday for modest gains.

The Yen calls were virtually worthless all week and expired at zero on Friday.

Overall, my P+L had good gains for the week, and I was flat going into the weekend.

Old friends

Last week, I noted that Jimmy Buffet’s death reminded me I had been “putting off” visiting old friends. I vowed to change that, and on Labour Day, I drove down-Island to spend the afternoon with my favourite University professor. This week, I’ll visit an old friend who lives on one of the Gulf Islands, and next weekend, I’ll play golf with my son and two other old friends on my favourite Vancouver golf course – King’s Links. I plan to visit several more old friends over the next few months. I also renewed my season pass for the local ski hill.

On my radar

The US CPI report is on Wednesday morning; the ECB meets on Thursday (which could be a big day for the Euro), and the UAW probably goes on strike on Thursday. The FOMC meets the following week (September 20) and will likely stand pat, but the odds of a 25-bps increase in November or December are now ~45%.

I will travel on Tuesday, Wednesday, and again on Saturday so I will be cautious about trading next week.

The Barney report

I regret that the days are getting shorter, but the great summer weather has continued, and Barney and I have had some tremendous off-leash walks on the forest trails.

Barney loves to sit beside me while I’m having my morning toast and coffee because he knows that he not only gets some toast, but he gets to lick the honey off the plate! Then he waits patiently for me to stop playing on my computers and take him for another walk!

Listen to Victor talk markets with Mike Campbell

Mike and I discussed the strong US Dollar and why it was up against nearly all other currencies. His feature guest this week was Doomberg. My segment with Mike starts around the 1 hour and 10 minute mark. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys and talk with him.

Active listening requires practice, but it can reduce feelings of pressure and judgment to support someone’s mental health.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 9th, 2023

Posted In: Victor Adair Blog

Next: Cycle Review »