September 30, 2023 | Trading Desk Notes For September 30, 2023

August/September: Bond yields, USD and Crude oil sharply higher, stocks and gold down

The yield on the long bond soared from ~3.9% on the mid-July Key Turn Date to ~4.8% (a 16-year high) on Thursday. Bond prices fell as yields rose.

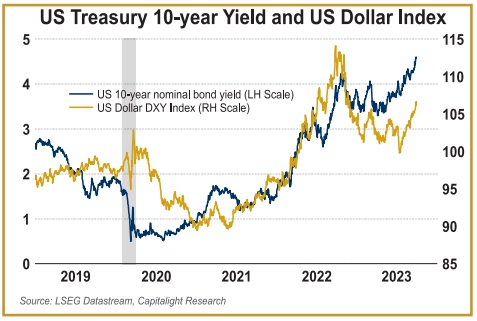

The US Dollar Index rallied ~7% from the mid-July KTD, rising for 11 consecutive weeks.

This chart from Martin Murenbeeld’s Gold Monitor shows the correlation between the US 10-year yield and the USDX.

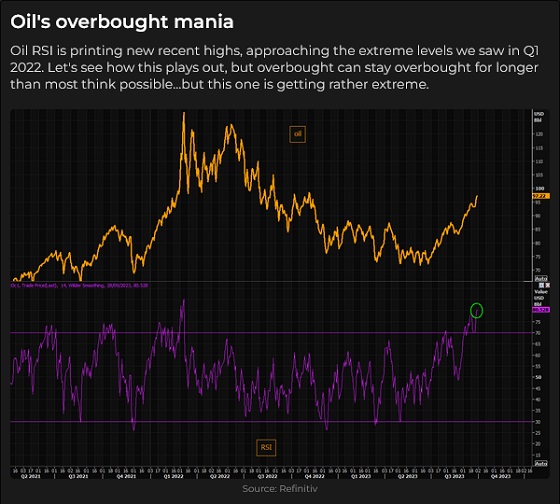

WTI crude oil futures surged ~$28 (42%) from late June to Thursday’s 13-month highs at $95.

Exxon shares hit All-Time Highs this week, up ~20% from the mid-July KTD, while the S&P hit 16-week lows.

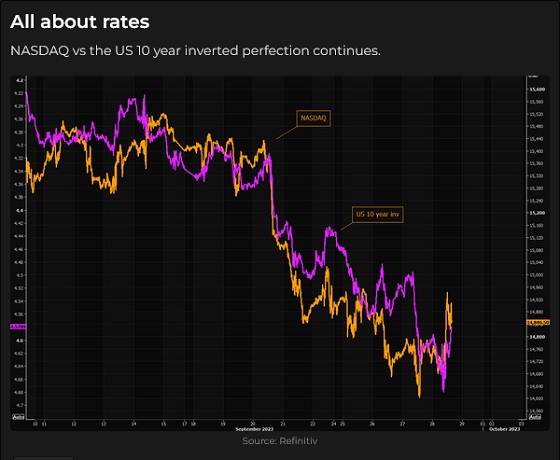

The Nasdaq 100 Index rallied ~45% from January 3 to the mid-July KTD, then fell ~9% to Wednesday’s lows. The combination of higher bond yields, higher WTI and a higher USD contributed to the recent risk-off sentiment in the stock market.

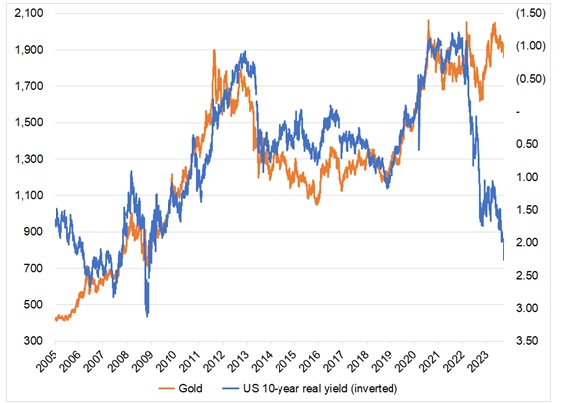

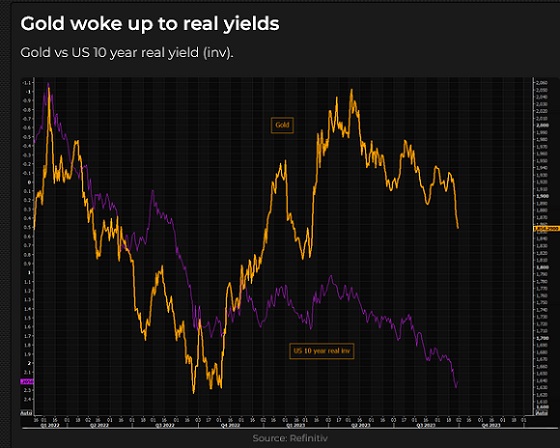

Comex gold futures (very) briefly traded to All-Time highs on May 4, slumped ~$200, rallied ~$100 into the mid-July KTD, then fell ~$175 to Friday’s lowest weekly close since February.

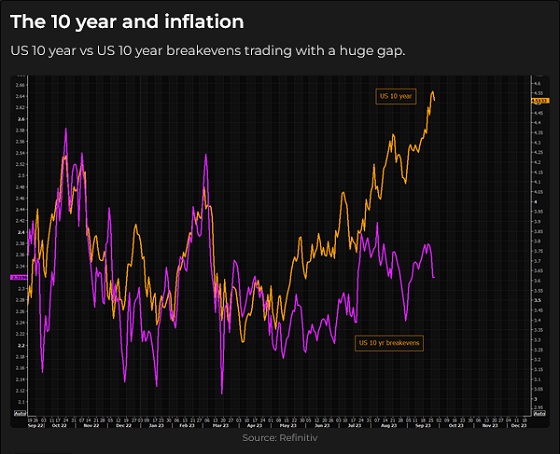

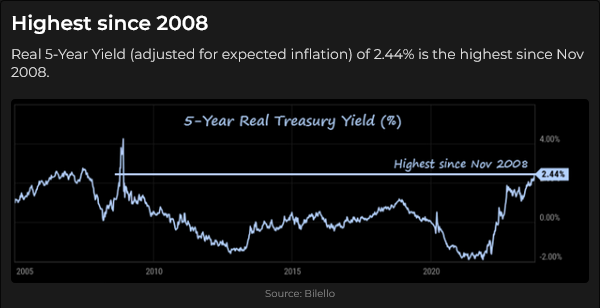

A strong US Dollar and rising interest rates (especially rising real interest rates) are typically a toxic environment for gold. The long-term correlation between gold and real rates seemed to break down this year (perhaps central bank purchases kept gold prices higher than they would otherwise have been), but the surge higher in real rates this week pulled gold down. (Real rates have surged as nominal rates have risen and inflation has fallen.) This chart is from Brent Donnelly.

The bond market

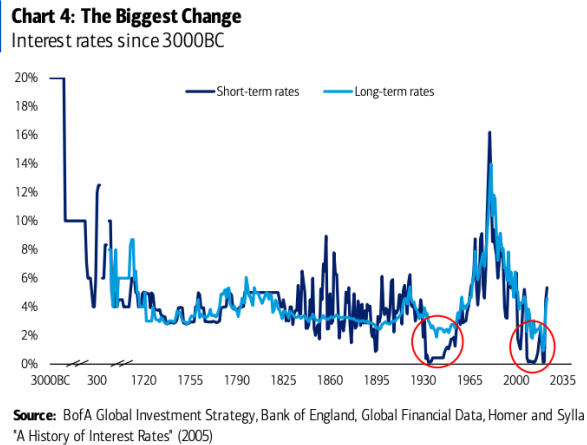

Bond yields have been trending higher since hitting 5000-year lows in August 2020 (when the US 10-year yield hit 0.50%.)

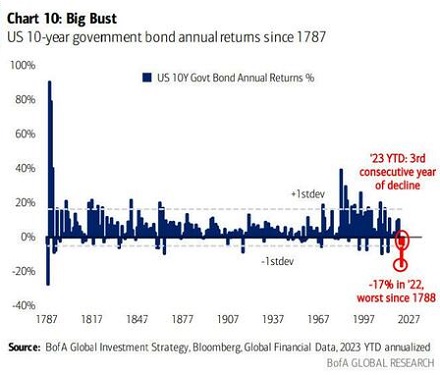

Bonds have never had three years of negative consecutive annual returns in the history of the USA. (But unless there is a BIG bond rally in the next three months, that record will be broken.) Falling bond prices have hurt classic 60/40 investment portfolios.

The latest down leg in the bond market began in May when interest rates across the curve started to rise following the “resolution” of the Silicon Valley Bank crisis, and investors realized that the Fed was not wavering from its “higher for longer” mantra. (Bond yields in the G10 countries, ex-Japan, have followed a similar trajectory to US bond yields.)

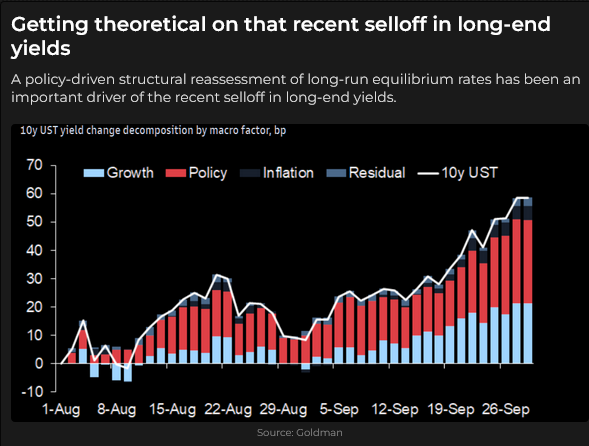

Short-term rates also began to rise in May, but since the mid-July KTD (and especially over the last four weeks), the yield curve has steepened as long rates rose faster than short rates.

In last week’s Notes, I included a link to a Twitter post by Bill Ackman, a hedge fund manager, who provided a “laundry list” of why he was short the bond market. I agreed with most of his points, but I focused on the fact that real rates are driving bond yields higher (bond yields are rising even as inflation metrics are falling.) This chart shows bond yields rising as breakevens (a measure of future inflation expectations) go sideways to down.

My conclusion (and Bill Ackman includes this as one of his reasons to be short) is that bond yields are rising not so much because of inflation fears but because of the coming supply tsunami as governments continue running deficits.

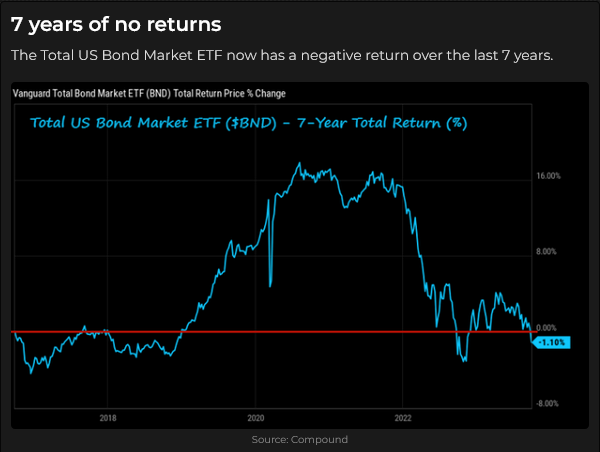

The mark-to-market value of the popular TLT ETF (20+year Treasury bonds) has fallen by ~50% over the past three years to a 16-year low.

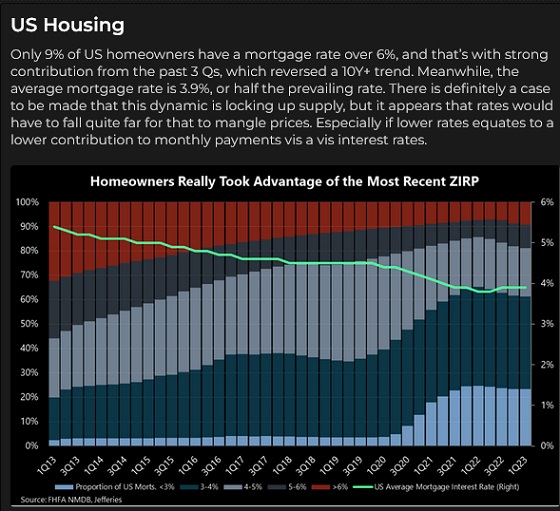

American 30-year fixed mortgage rates hit a 23-year high this week at ~7.8%. (They were below 3% in 2020.) The good news is that the average homeowner mortgage is ~3.9%, as many people locked in low rates over the past few years.

Is something going to break?

The sharp rise in interest rates (as the market finally embraces the “higher for longer” mantra) begs the question, “Who is at risk from higher rates, and is something going to break?”

Is there “someone” out there with a (leveraged) portfolio of “Hold To Maturity” bonds that has to sell bonds to raise cash and will suffer HUGE realized losses? (Someone other than an American bank that qualifies for the Bank Term Funding Program.) Could that be a risk-parity fund? A hedge fund? An insurance company? A pension fund?

Is there someone out there who needs to refinance long-term assets (like commercial real estate), but with long-term rates so much higher, their business model doesn’t make sense anymore?

A turning point?

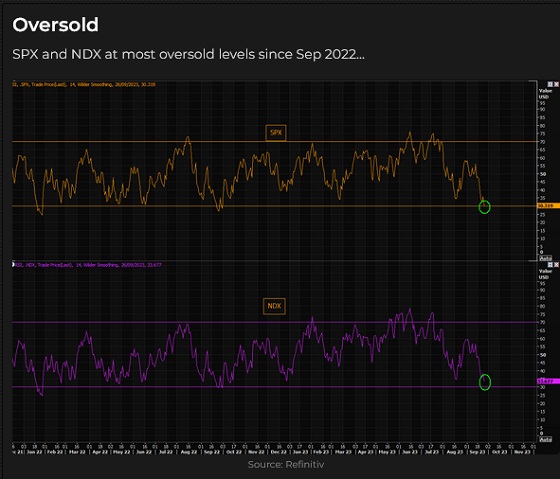

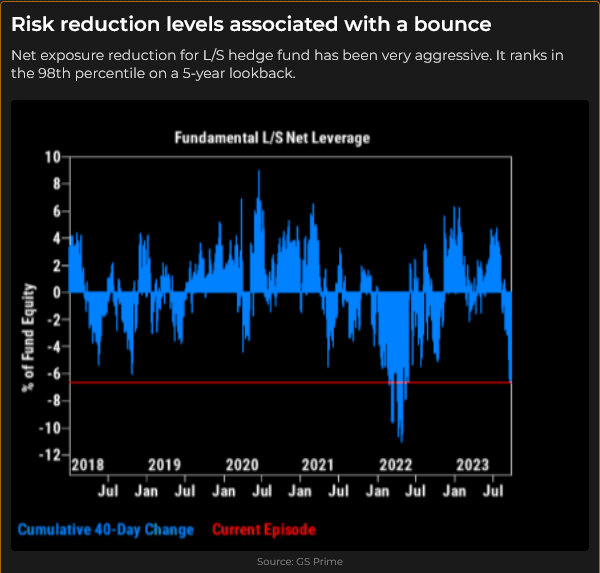

Sentiment and price action got “so extreme” this week that, from a short-term perspective, Wednesday/Thursday may have been a turning point across markets. The S&P and NAZ RSI are at the lowest levels since last September (a big rally started in mid-October.)

Stock market seasonality points to a turn to higher prices “around now.”

If sentiment in the bond and stock markets has reached a turning point, we may also see “corrections” in currency and energy markets. The RSI on WTI futures is the highest since the Russian invasion.

My short-term trading

I started this week with a long T-Note position established on Friday last week – I was looking for a bounce! I was stopped for a loss overnight Sunday. I repurchased TNotes on Monday, Tuesday and Wednesday and was stopped each time for losses of a few ticks. I was buying low and selling lower! The total losses on the four trades were less than a whole point.

I realized I was stubborn, but I was trading small sizes, taking losses quickly, and my intuition sensed a turn.

I repurchased Notes on Thursday and held the position into the weekend, with unrealized gains of about a half point.

I shorted WTI on Thursday after it reversed from trading at 13-month highs and held that position into the weekend.

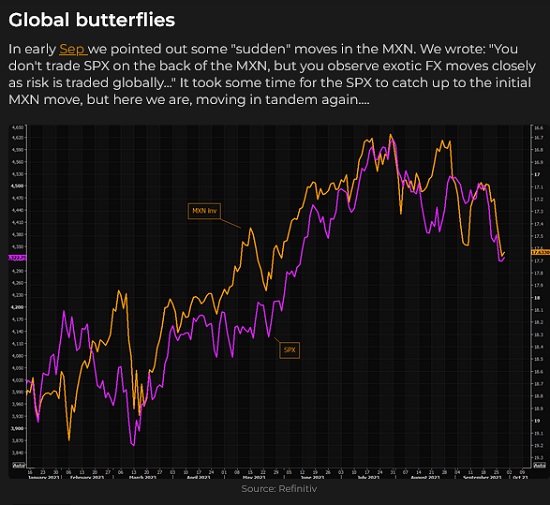

I shorted the Mexican Peso on Friday and held that trade into the weekend.

Thoughts on Trading

It was a hectic week, with bonds plunging to multi-year lows, stocks breaking down, gold in free-fall, and the USD relentlessly climbing higher. I was back and forth between thinking that the moves were WAY overdone and that maybe BIG, WILD moves were just getting started.

I had lost a little money the previous two weeks and felt out of sync. I decided it was a good time to be cautious rather than betting big.

On my radar

I’ll let price action be my guide. I could see short-term corrections across markets and then a return to recent trends. I could see Friday’s price action as month-end and quarter-end squaring up, and come Monday, market stress will be back big time.

Bottom line: We “blew it out” this week and will get corrective price action next week. I noticed that volatility dropped across markets on Friday.

The Barney report

Our endless summer is over, and we’ve had a few days of rain. Darn! It’s cold when I take Barney out in the mornings, and the sun isn’t up until nearly 7 a.m. Some mornings, I’m packing a flashlight!

We’ve had some great off-leash walks despite the changing seasons. Here’s a photo of the Barns in French Creek, looking to make his next move!

Here, he is on top of an old Douglas Fir stump. He loves to jump up on things to get a good look around!

And here he is, just “hanging out” on top of the living room couch (which is covered in “dog blankets!”

Catch the Energy Conference in Calgary on Saturday, October 14

My long-time friend (and excellent energy market analyst!) Josef Schachter is hosting his annual conference in Calgary two weeks from now. You can get all the details here.

I will attend the conference. I have been impressed every year at the quality, expertise and technological innovations of the energy companies that come to his conference to “tell their story.”

The Premier of Alberta, Danielle Smith, will be the opening speaker this year.

I recommend buying a quarterly subscription to Josef’s Black Gold Service (C$249 – use coupon code MT23 to get $100 off), which also gets you two tickets to the conference. Such a deal!

Listen to Victor talk about markets

This morning, I talked with Mike Campbell for about 8 minutes on his top-ranked Moneytalks podcast. We discussed the surge in interest rates and the impact that is having across markets. His special guest this week is Martin Armstrong. You can listen here. My spot with Mike starts around the 58-minute mark.

I did a 30-minute interview with Jim Goddard on September 23 on the This Week In Money show. We discussed Central Banks, currencies, interest rates, the stock market, gold and crude oil, and some of my core trading principles. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 30th, 2023

Posted In: Victor Adair Blog

Next: Cyclical Forces »