September 11, 2023 | It Tastes Awful, and it Works

Happy Monday Morning!

The Bank of Canada moved to the sidelines once again, appeasing premiers in BC & Ontario who publicly pleaded with the BoC last week. It’s no secret these two provinces have the most to lose, their coffers largely built on a highly levered housing market, but we’ll get to that in a second.

Here’s the coles notes from Tiff Macklem post pause.

“Monetary policy is working to bring inflation down—and we are encouraged by the progress we’ve made so far. Consumer price index (CPI) inflation was 3.3% in July, roughly in line with what we expected in our July Monetary Policy Report. Our 2% target is now in sight. But we are not there yet and we are concerned progress has slowed. Monetary policy still has work to do to restore price stability for Canadians, and we are committed to staying the course.”

In other words likely no more hikes, but also no cuts. That’s no bueno for Canadian households which are finally showing signs of buckling under mounting interest rates.

When Sarah Dueck and her husband bought a new house in Langley, B.C., two years ago, interest rates were low. They had little doubt they could pay off their variable-rate mortgage.

“All the messaging from the Bank of Canada was that, you know, interest rates would be low for a while and that they’d increase slowly when they did,” she told The Current’s Matt Galloway.

“So we thought, you know, on a five-year term, we’re pretty confident that variable rate was a good way to go.”

But as interest rates skyrocket, Dueck doesn’t know how much longer they can keep paying for the home.

Dueck and her husband are now staring at mortgage payments of $6,300 per month — up by $2,700 a month in payments since they bought the house.

They’ve cut various expenses to make ends meet, from cancelling investment contributions to cutting back on family visits to Ontario.

“My husband’s a teacher, so potentially he could start working [another job] in the summer,” she said. “That’s the last way that we think that we could find any more money.”

Me again.

You can multiply this story across a good chunk of the country. It’s happening at scale, I know because I talk to homeowners, Realtors, and mortgage brokers on a daily basis. Remember, 57% of all new mortgages originated at the top of the housing market were variable rate mortgages. However, this isn’t just a variable rate mortgage story.

Homeowners who are renewing their fixed rate mortgages are also being served a spoonful of Buckley’s. A 6% mortgage rate will slow consumer spending fast and hard.

Here’s a real life scenario of a 5 year fixed rate mortgage renewing today.

$750,000 Mortgage taken out in 2018, 3% mortgage rate, 30 year amoritization. Monthly payment $3155.

Mortgage balance outstanding after 5 years, $666,797. New rate 6.2%, on remaining amoritization of 25 years. Monthly payment $4346.

That’s an extra $1200 out the door.

Like I said, it tastes awful and it works.

Yes wages are up, but so is the cost of living. You could push the amortization back to 30 years but that only lowers the payment by about $300. However you also have to QUALIFY. Pushing back the amortization would require the borrower to pass a stress test of 8.2%- good luck with that.

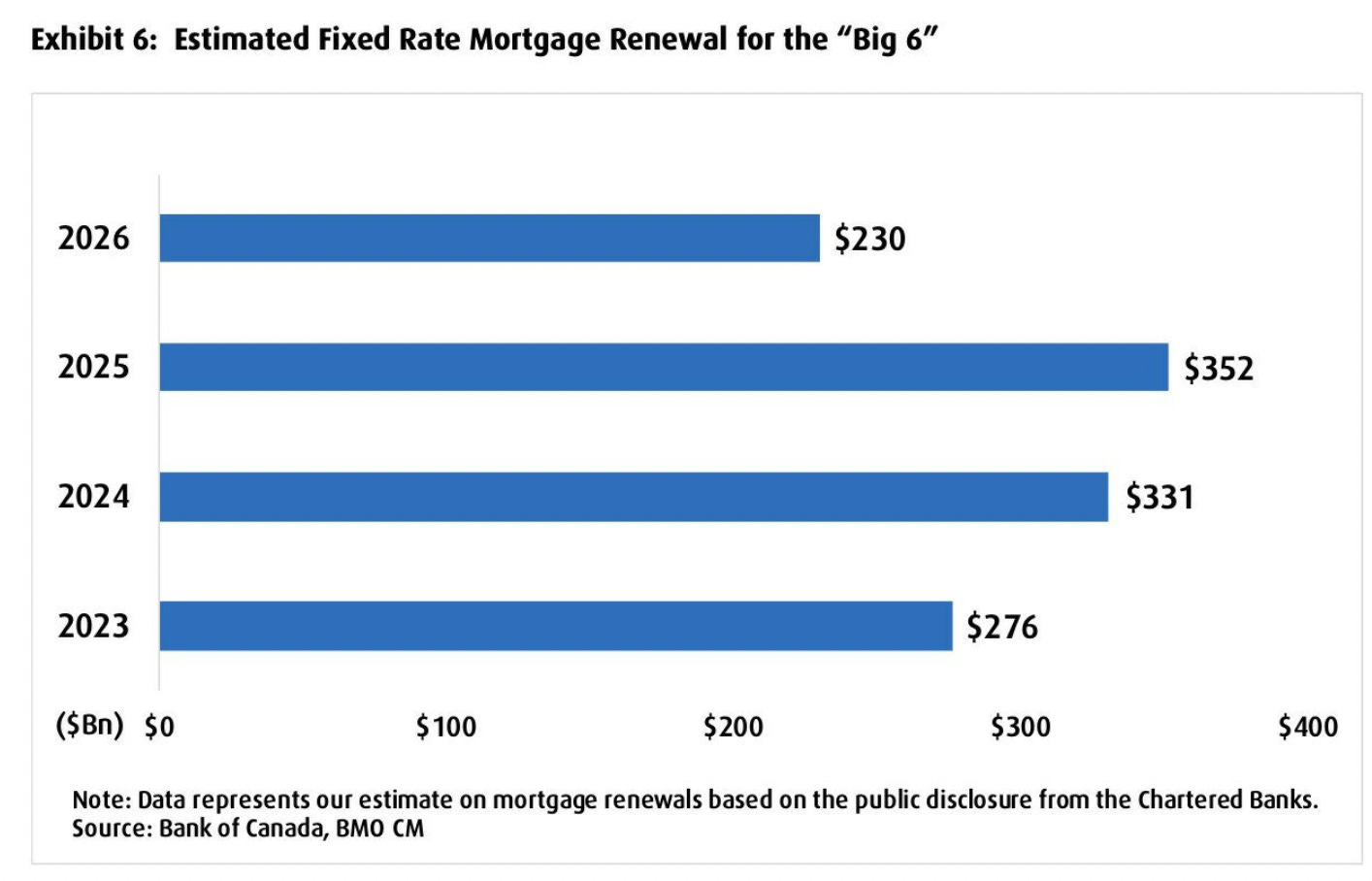

This is the reality facing plenty of Canadian households if rates don’t come down, and fast. Remember our mortgage renewal wall.

It should come as no surprise that second quarter GDP contracted, the only thing that’s surprising is how long it took and how far off the BoC’s estimate was for 1.5% growth.

The housing market has been isolated from the pain of rate hikes thanks to multi-decade lows in new listings for most of this year. I get a sense that might change soon based on the anecdotal conversations i’m having across the industry.

Unfortunately, the BoC doesn’t get to rely on anecdotes, and has to wait for the data to officially turn, sometimes requiring several revisions to boot. It’s like watching a cruise ship pull a U-Turn. Bon voyage!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 11th, 2023

Posted In: Steve Saretsky Blog

Rates won’t come down. A 7% mortgage is the historical normal. The ultra low mortgage rates of the past decade were an abnormality. Investors and home buyers should be prepared to pay normal 7% mortgages for many decades.