September 25, 2023 | Captain Tiff

Happy Monday Morning!

Headline inflation ripped higher than expected this week, jumping back up to 4% for the month of August. It turns out Chrystia Freeland’s premature victory lap marked the bottom back in June. There’s a lesson here in base effects, you’d think her economics team would have tapped her on the shoulder back in June. Perhaps they were on summer holidays.

While some were asleep at the wheel, others were crunching the data. Several months ago we highlighted some research from our good friend Ben Rabidoux of Edge Analytics.

“We have more challenging base effects on deck given the low monthly prints from August and September 2022 which will drop out of the annual data set over the next 2 months. In fact, if CPI rises a mere 0.2% each month for the remainder of the year, we’ll end 2023 with an inflation rate north of 4%. And if CPI averages 0.3% monthly gain (in line with the average over the past 6 months), we’ll end up with an inflation rate pushing 5%.”

The concerning thing here is not that Ben was right, but rather how quickly we got back to 4%, and if current trends hold the Bank of Canada will be faced with headline inflation hovering near 5% in the coming months.

The political optics for both the federal government and the BoC would be an unmitigated disaster if inflation retests the 5 handle. One has to think it could be enough to get the BoC back to the rate hiking table despite the obvious carnage it would inflict on Canadian households.

Regardless, here’s what it means right here right now. No rate cuts in sight, those are being pushed further and further out. So even those who were smart enough to have locked in with a fixed rate mortgage are in a race against the bond market.

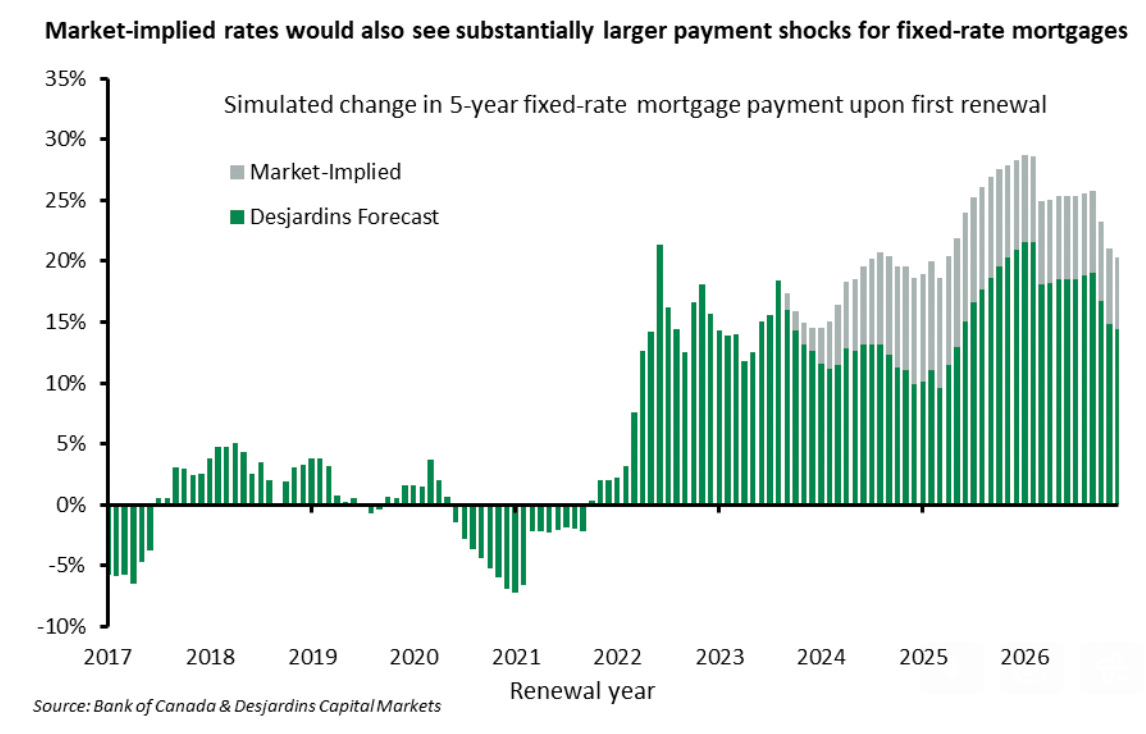

According to Desjardins, if interest rate expectations are correct, fixed-rate borrowers in Canada will see their monthly mortgage payments rising just shy of 30% at first renewal.

And so the race is on. Bond yields continue to push higher. The Canada 5 year bond surged another 25bps last week, reaching its highest levels this year, and the highest levels since October 2007. Several Canadian banks have quickly moved to push mortgage rates up. The most popular 3 year fixed rate mortgage is now mostly north of 6.5%. For those counting at home that means a mortgage stress test of 8.5% on top of national house prices that are up 6% year to date, and in most major metros are not far off from their record highs.

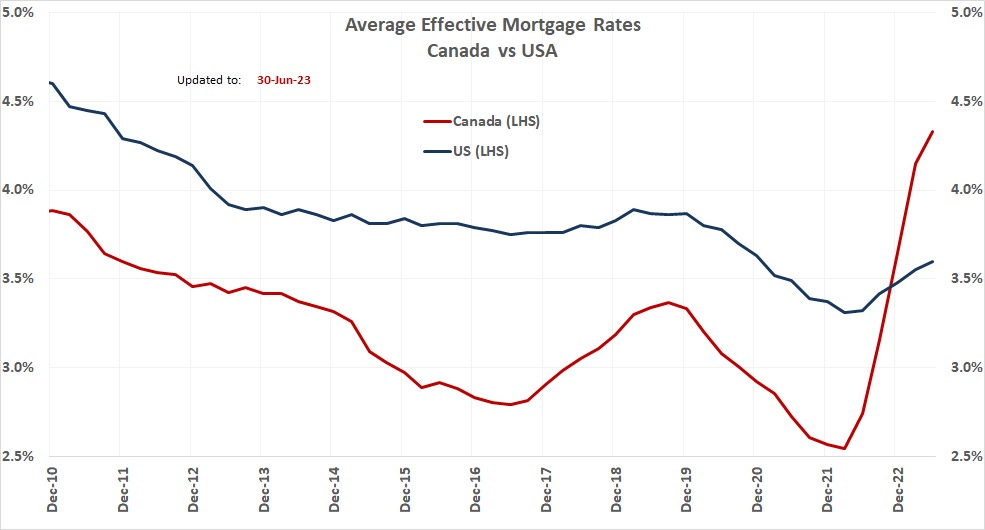

Ultimately the longer rates stay elevated the more homeowners will feel the brunt. They say monetary policy has long and variable lags. It turns out the implied average mortgage rate in Canada is still at a very low 4.3%.

The good news is there’s a way to get rates lower. The bad news is you won’t like it. It’s called a hard landing. If you’re worried about your mortgage renewal you have to hope your neighbour loses their job, and fast.

It’s a sad state of affairs, but I don’t make the rules.

There’s no easy way to land this plane, the engines on fire, and one of the wheels has fallen off, but captain Tiff has the runway in sight and we’re decelerating quickly. Fasten your seatbelts and brace for impact.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 25th, 2023

Posted In: The Saretsky Report