August 29, 2023 | Economic Weakness Leads Unemployment, Not The Other Way Around

Many cite US and Canadian unemployment levels today near 5o-year lows as grounds for economic optimism. Unemployment is a lagging indicator that commonly inspires misplaced confidence heading into recessions and then pessimism as it rises into subsequent economic expansions.

For leading employment indicators, we look to readings on the average manufacturing workweek, average overtime manufacturing hours, initial jobless claims and the ratio of voluntary to involuntary part-time labour (the part-time ratio). All have reflected a weakening job market in recent months.

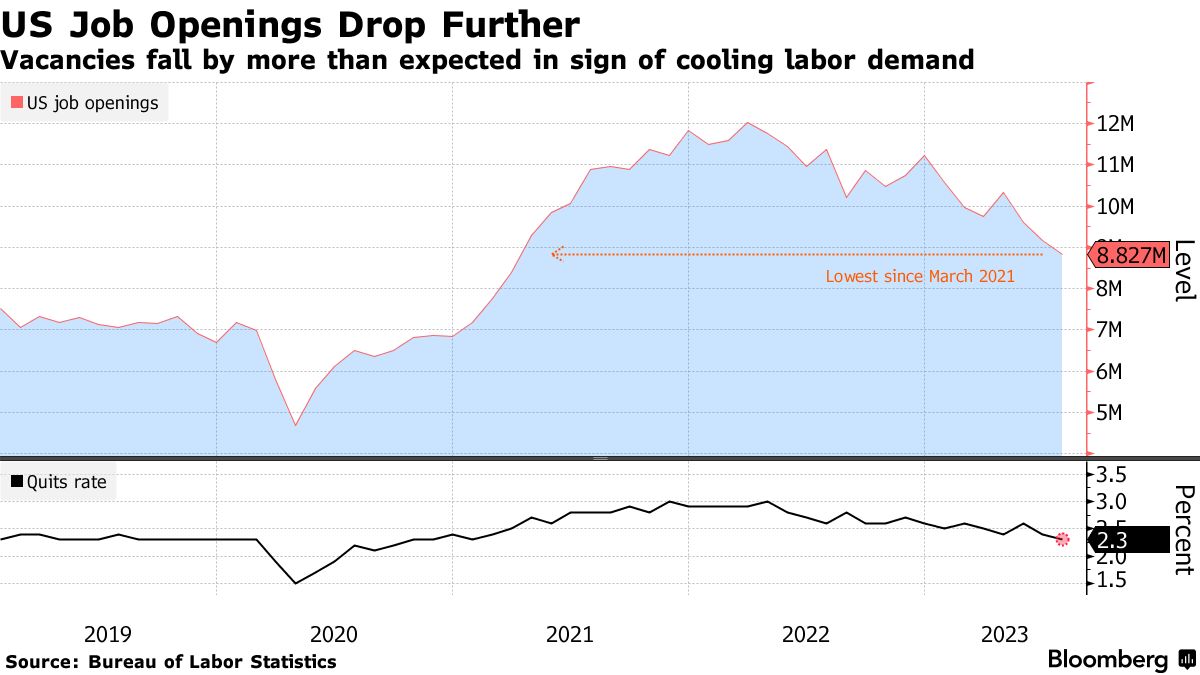

Today, we learned that US job openings fell in July by more than expected to a two-year plus low, and over the past three months, by the most on record. Moreover, the job quit rate fell to the lowest since January 2021 as workers report growing pessimism about their employment prospects. See, US Jobs Openings Decline to Lowest since early 2021.

Hires declined to the lowest level since January 2021 and have dropped by 458,000 over the last two months, the largest decrease since the end of 2020.

It bears noting that the stock market has never bottomed before the Fed pauses its tightening efforts and only after interest rates have been falling with economic output and employment for many months. The longest Fed pause between the last rate hike and the first cut was 15 months (July 2006 to September 2007), and the average was eight months. In every case since 1969, recessions began at or shortly after the first rate cut, with the stock market bottoming 13 to 33 months after the last Fed hike.

Moreover, when we enter economic downturns at historically low unemployment rates (like today), central banks have been slower to start easing again than when unemployment rates are relatively higher. Hence, the next easing cycle is likely farther away than many hope.

Maybe July was the last rate hike this cycle, or perhaps it will be in September or November. In any case, the case for capital protection today is extraordinary.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 29th, 2023

Posted In: Juggling Dynamite