July 30, 2023 | This Is What a Death Spiral Looks Like

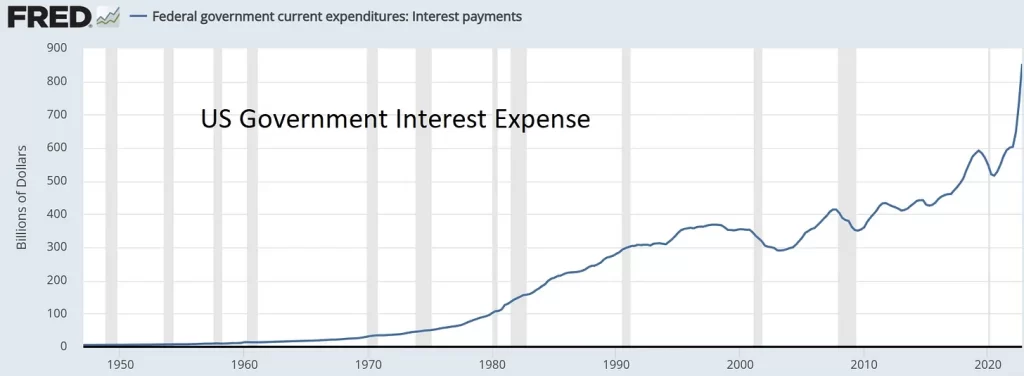

Remember those scary charts of the US government’s rising interest expense? Here’s an example from a few months ago, when the annualized cost of our national debt was approaching $900 billion:

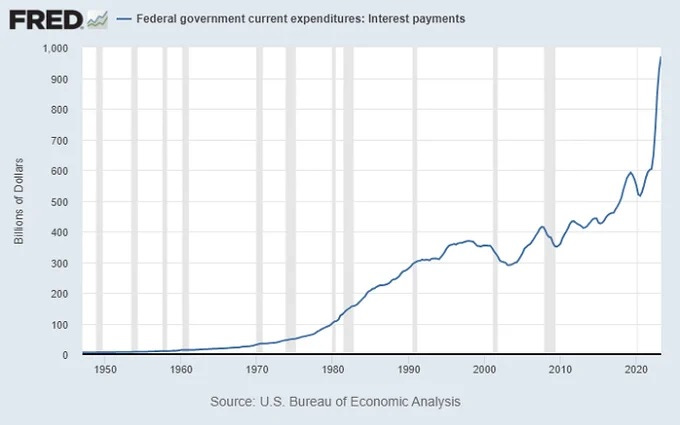

Well, that wasn’t the peak. The latest reading shows interest payments approaching $1 trillion.

And that’s not the end. Not even close. The current average interest rate for Treasury paper is around 5%, so as existing notes and bonds come due and are rolled over, the total carrying cost will rise inexorably towards $1.7 trillion ($35 trillion x 5%) — all of which will be borrowed, turbocharging the increase in total debt, pushing interest costs even higher, and so on.

Looking back on the collapse of our globe-spanning military empire, historians will cite charts like the above to illustrate the point where things spun out of control. And we’re here to see it, yay! (That’s irony — or maybe sarcasm.)

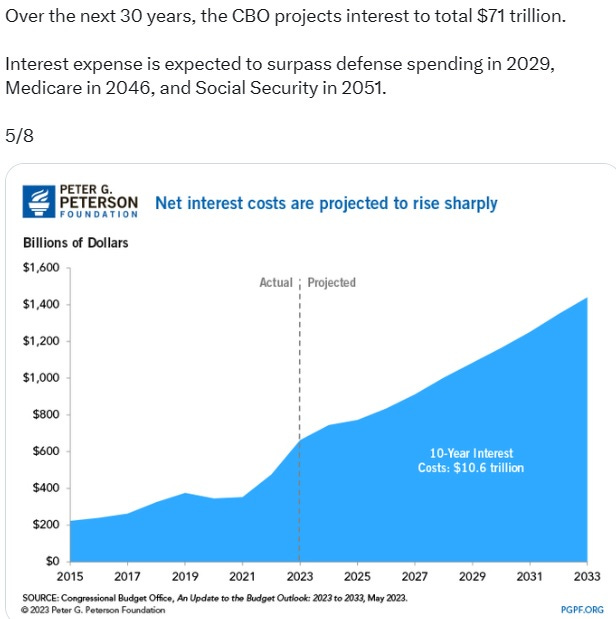

The Kobeissi Letter publishes a lot of interesting financial threads on Twitter and is currently running some charts that are relevant to this story. Here’s a longer-term projection for US interest expense:

And here’s the same data series expressed as a percentage of total tax revenues:

Never gonna happen

These long-term charts are interesting but unrealistic. Parabolic trends contain the seeds of their own demise, and fiscal chaos of the type now playing out will lead capital to flee to safer havens sooner rather than later. Put another way, who in their right mind would view the paper of a government with these kinds of trends as a worthy investment?

On the other side of this debate, there’s the TINA (there is no alternative) argument, which states that sure, American finances are a mess, but where else are you going to go? That’s a legitimate point and probably explains why the dollar is still a reserve currency despite decades of debasement. But it’s not a permanent defense, and will end when the numbers start to look unmanageable. Which they kind of do now.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 30th, 2023

Posted In: John Rubino Substack

Next: Same Faces, Different Places »