July 28, 2023 | The Federal Reserve hikes rates again

The Federal Reserve hiked interest rates again, to 5.25 percent to 5.5 percent. This is the highest Federal Funds rate in 22 years. The Fed has stated that it is determined to wrestle inflation back under control, which means getting to its 2 percent target or lower.

Has the Fed gone too far in this cycle of rate increases?

The Federal Reserve, led by chair Jerome Powell, meets periodically to debate and decide on monetary policy. They are tasked with two goals, keeping inflation contained and promoting full employment, which is one goal too many.

The Fed doesn’t have the tools to do both tasks simultaneously. Even in the single task of keeping inflation under control the Fed is forced to use a very blunt tool — interest rates — to force banks, businesses and consumers to slow their rate of borrowing and buying which could curb inflationary tendencies. But this means that consumer and business demand must be throttled back, and private sector borrowing reduced, which leads directly to unemployment which conflicts with the Fed’s other goal.

Lately the Fed has stated that the most important goal is to get inflation back under control, even if that triggers a recession. But despite this aggressive stance the Fed has not yet caused monetary conditions to be excessively tight. The Fed has taken its policy stance from “very loose” to something probably close to neutral.

There’s even some substantial evidence that the Fed is following rather than leading the fight against inflation. For example, in this latest round of inflationary pressure, the peak rate of inflation occurred about a year ago and that was before rate hikes had started to bite into loan growth and to reduce consumer and business demand. In other words, inflation had started to moderate from a very fast pace without the influence of the Fed embarking on a tightening of monetary policy.

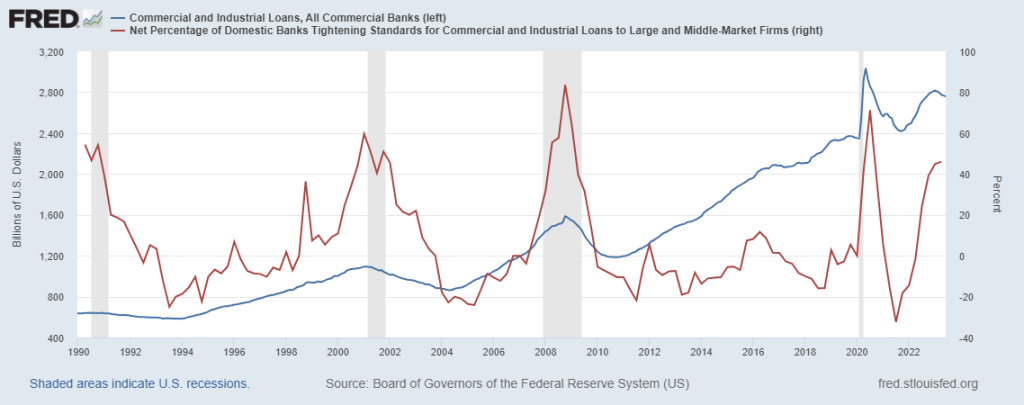

And other factors are at play in this cycle. The failure of several banks earlier this year will cause conditions to tighten for people seeking loans. The chart shows the Senior Loan Officer Survey showing the change in the difficulty of getting a loan from a bank for commercial and industrial purposes in the US.

The current level of loan officers stating that conditions are getting tighter is up to 46 percent, a level only reached about four times in the last thirty years. Usually when that level is reached the economy was in a recession or about to go into a recession. In 2020 conditions tightened only after the recession was over, because that recession was short-lived.

With much higher interest rates and tighter bank lending standards, the Fed is likely to go too far, if it has not already.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth July 28th, 2023

Posted In: Hilliard's Weekend Notebook