July 3, 2023 | The Clock is Ticking

Happy Monday Morning!

Headline inflation dropped like a stone in the month of May, now down to 3.4%. Mortgage interest costs surged 30% and remains the largest contributor to the year-over-year CPI increase. Strip out self inflicted mortgage interest cost, and CPI sits at 2.5% in May, back within the Bank of Canada’s control range of 1-3%. The job is done.

Sure, core remains sticky, base effects are favourable, but for the most part prices have moderated. There’s nothing more to do but wait for the highest interest rates in two decades to work their way through a country suffocating on debt.

The BoC has already overtightened, but that won’t prevent them from putting a nail in the coffin later this month. Remember this is an institution that sat idle while national home prices ripped 30% on an annual basis. They eventually raised rates for the first time in March of 2022, one month after the housing market had already peaked. These guys are not forward looking, regardless of how many PhD’s they employ.

So here we are, 450bps later, and still pushing higher, even the banking regulator has been caught off guard. OSFI says these fixed payment variable mortgages are a growing financial stability concern. Interest only mortgages with ballooning amortization schedules.

Information on the share of negatively amortizing mortgages in the market is scarce. CIBC – the only bank that discloses that figure – said in its second-quarter earnings report that the amount of negatively amortizing mortgages fell to $44-billion from $52-billion in the previous quarter.

The bank added that three-quarters of that reduction was driven by customers voluntarily increasing their fixed payments.

It’s ultimately prevented a wave of distressed sellers from hitting the market, but the issue is growing larger as the days go by. This product was never designed to handle a rapidly rising interest rate environment, and i’m told by the always insightful Ron Butler that this product will be phased out later this year at the direction of OSFI.

There are a lot of borrowers who had no idea what a trigger rate was when they signed on the dotted line. They do now. Remember, a whopping 57% of borrowers in January 2022 went with variable rate mortgages in Canada.

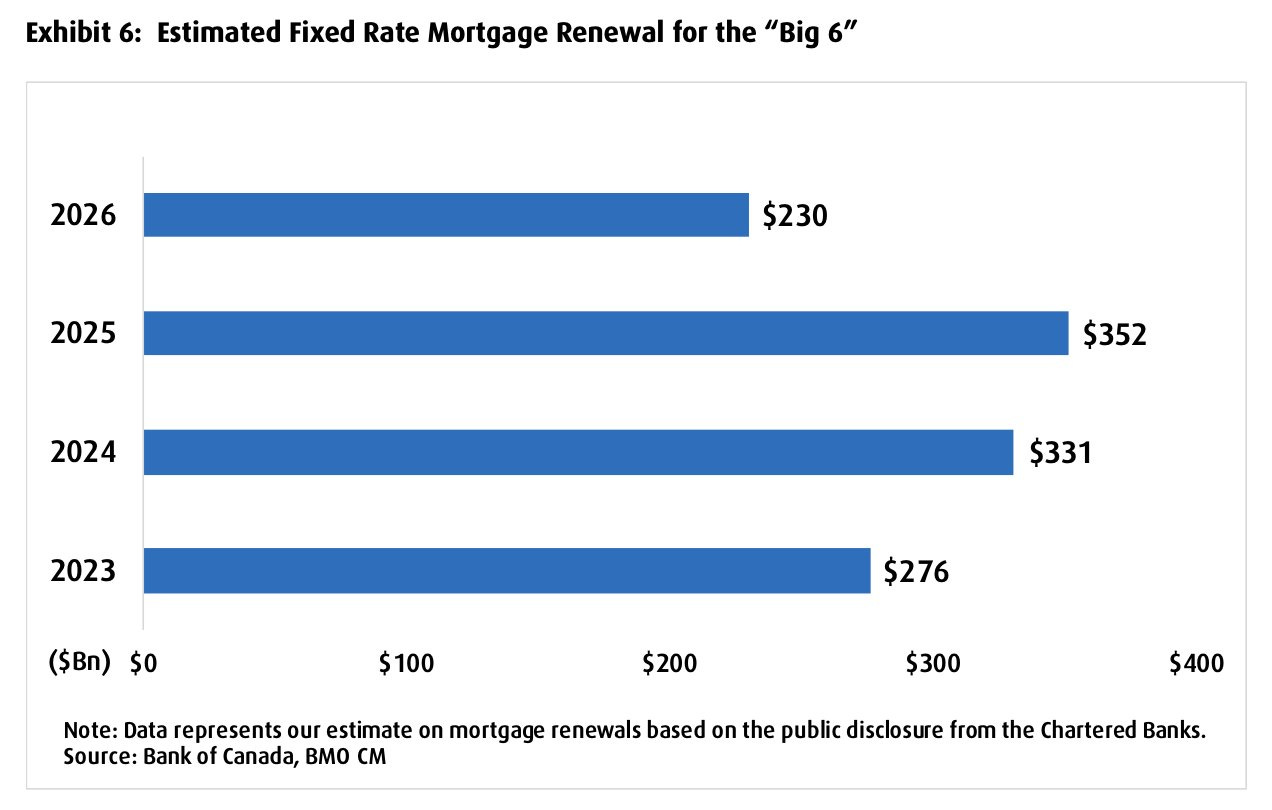

Stress is building and only one third of mortgage holders have seen a monthly payment increase. That’s because there’s still a large chunk of borrowers with very low fixed rate mortgages. The clock is ticking though. Borrowers who enjoyed record low mortgage rates in 2020 and 2021 are set to renew in the years ahead. In 2024 there’s an estimated $331B of fixed rate mortgages coming up for renewal, and $352B in 2025.

Of course the magnitude of the issue will largely depend on the future direction of mortgage rates. Today the most popular three year fixed rate mortgage has jumped nearly 100bps over the past month, sitting at about 5.8%. That’s going to pour cold water on housing activity over the coming months, only exacerbating the BoC’s over tightening campaign. They’re back on deck July 12th, with market odds pricing nearly a 60% chance of another 25bps.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 3rd, 2023

Posted In: Steve Saretsky Blog

Next: The WTC7 Controlled Demolition? »