July 26, 2023 | Conditions Least Favorable for Equities Since 2007

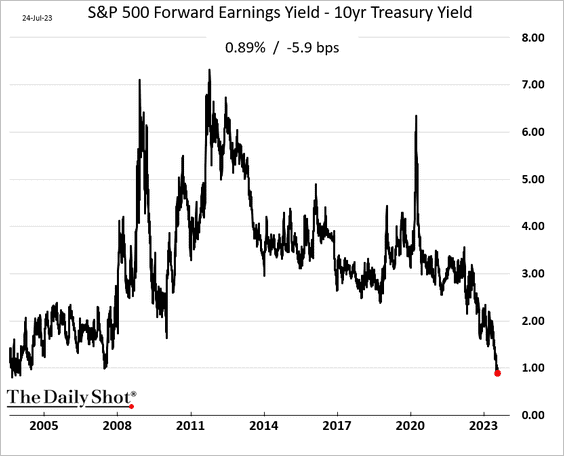

For those who pay attention to risk/reward dynamics, the prospective compensation for equity risk over Treasury bonds is today the lowest since the market peak in 2007-08 (S&P 500 forward earnings yield minus the ten-year Treasury yield).

David Rosenberg, founder and president of Rosenberg Research, talks about the lasting effects of Covid-19 stimulus checks on the American economy. Here is a direct video link.

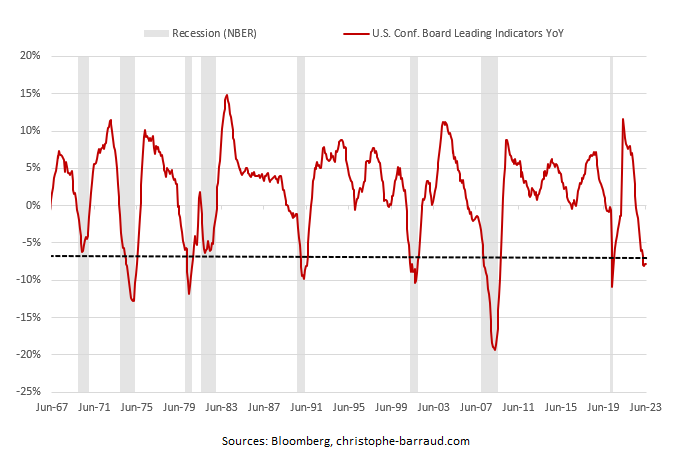

As David mentions in the clip above, the US Conference Board Leading Economic Indicator (LEI below in red since 1967) contracted year-over-year in June for the 15th consecutive month, signalling the onset of recession (grey bars) for the 9th time in 56 years. Historically, the average time from the LEI peak to the start of a recession has been 13 months.

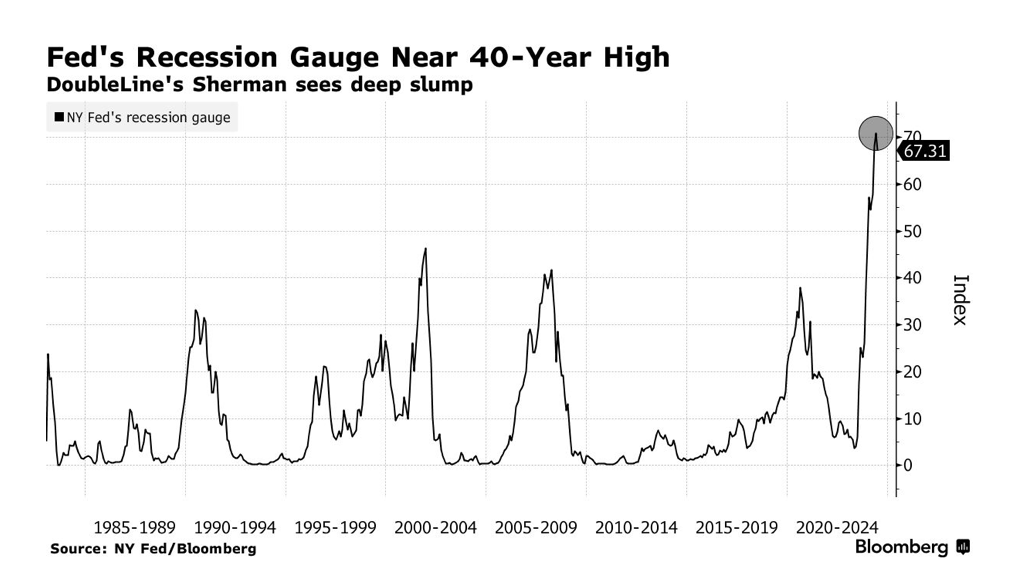

Similarly, the NY Fed’s recession probability gauge (shown below since 1980) has spiked to the highest in more than 40 years.

DoubleLine Capital’s Jeffrey Sherman noted the case for Treasuries this week as follows:

“A multitude of economic indicators we look at are flashing either warning or recessionary signals,” said Sherman, deputy chief investment officer at asset manager DoubleLine, in an interview. “By the time they cut, it will be 100 basis points.”

Ten-year US yields are 3.9%, having dipped after breaking above 4% several times in the past year as markets wrestle with when global central banks will end the steepest rate-tightening cycle in decades. Short-dated yields are still much higher, an inversion that historically has signaled recession, and Sherman is not taking that lightly.

…”The bond market is telling the Fed that they’ve overtightened and they will have to cut rates,” said Sherman. “But the Fed will be a little late to cut, maybe in an emergency meeting. But the idea that the Fed is going to cut 25 or 50 basis points and that’s going to solve everything isn’t going to be the case.”

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park July 26th, 2023

Posted In: Juggling Dynamite