May 22, 2023 | No Need to Panic, Yet

Happy Monday Morning!

Inflation came in hotter than expected in April. Headline inflation ticked in at 4.4%, well above the 4.1% that was expected. It was the first month over month increase in the rate of headline inflation since June 2022. Naturally, panic ensured shortly thereafter.

Markets immediately removed their expectations for a rate cut this year and have suddenly reversed course. There’s now an 11% chance of a hike at the June 7 meeting, and nearly a 40% chance of a hike by September 6 according to OIS markets. Furthermore, Scotiabank, who has been incredibly hawkish throughout this tightening cycle is putting their stamp on another 25bps hike in June.

That’s bad news if you’re sitting on a variable rate mortgage. According to Desjardins, there are a lot of people up shit creek without a paddle. More than 75% of all variable rate mortgages in Canada have already breached their trigger rate. In other words, the interest owed is greater than the original monthly mortgage payment. These borrowers, along with the banks who dished out these loans, are in extend and pretend mode as amortizations climb to dizzying heights.

It’s estimated these borrowers will need to increase their payments by approximately 40% to maintain their original amortization schedule, assuming a renewal in 2025 or 2026, assuming interest rates follow the Bank of Canada’s projected path.

Suffice to say Tiff Macklem isn’t making a lot of friends at cocktail parties these days. But rest assured, this too shall pass. In a presser this week Macklem assured markets that April’s inflation increase was an anomaly. “Inflation has come down. It is coming down. We expect it will continue to come down.”

In other words, an ongoing pause remains the most probable outcome from a governor trying to maintain whatever credibility he has left.

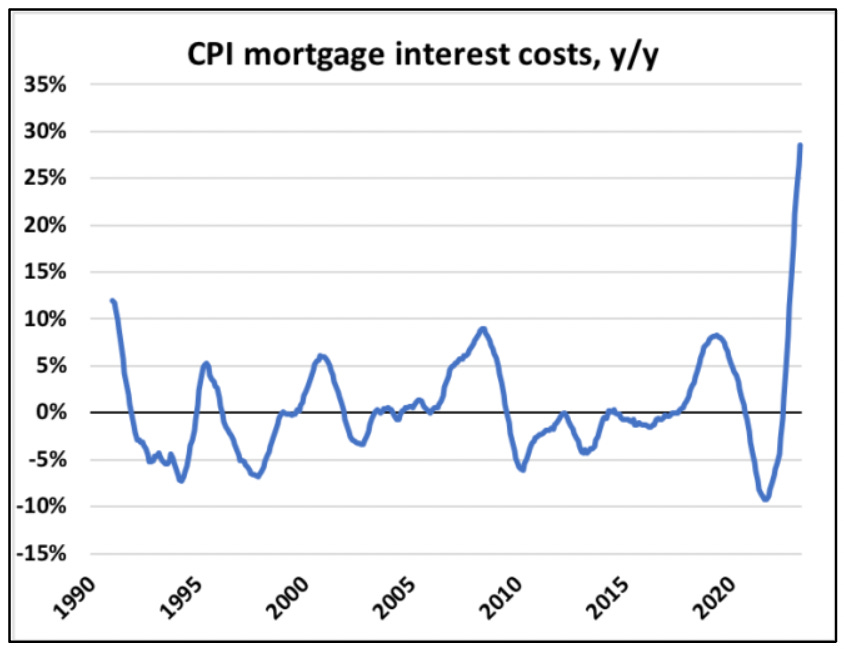

To his defence, there are certainly reasons to expect inflation to ease further. After all, the increase was largely driven by shelter, a notoriously lagging component of the CPI basket. Mortgage interest costs, which Macklem largely controls, were up a whopping 29% from last year.

If you strip out mortgage interest costs headline inflation would have ticked in at 3.6%. That’s a staggering 0.8 percentage points, which makes it the largest contribution to CPI on record. Surely we can all see the irony here.

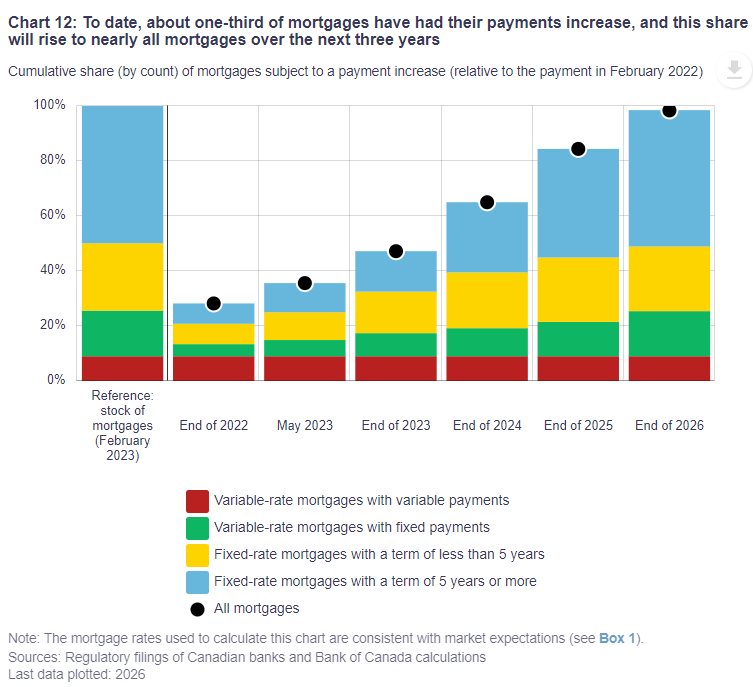

Let’s also not forget that monetary policy works with long and variable lags. Higher interest rates have not been fully passed through. For example, only one third of all mortgages have actually endured an increase to their monthly mortgage payment. That number will push higher over the next few years as fixed rate mortgages come up for renewal, prompting highly indebted households to pull back on their spending.

While it’s true the housing market has accelerated higher in recent months which is cause for concern on the inflation front, we must also acknowledge that this is largely a function of inventory, not demand. New listings on a national basis ticked in at another 20 year low last month. Clearly this is not sustainable, at some point sellers will return to the market. Demand has likely peaked for this spring and should cool as it usually does in the summer months. In other words, no need to panic, yet.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky May 22nd, 2023

Posted In: Steve Saretsky Blog