May 2, 2023 | Crash Alert: This Market Has Really Bad Breadth

Way back in the late 1990s, as the dot-com bubble was in its blow-off phase, a well-known short seller named Bill Fleckenstein liked to tell interviewers that “The global economy depends on the US economy, the US economy depends on the US stock market, and the US stock market depends on 20 stocks, most of which don’t have earnings.”

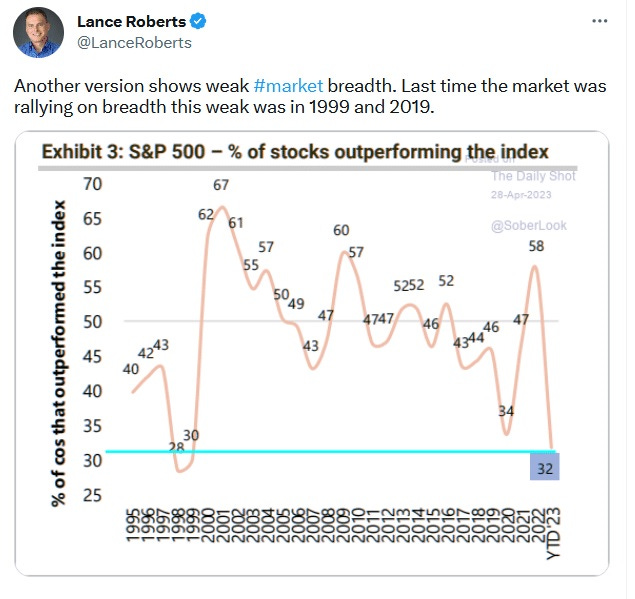

His point was that when “market breadth” — defined as the percentage of stocks that are hitting new highs — contracts beyond a certain point, a bull market is in trouble.

Here’s what happened back then:

And here’s where we are now, in pretty much the same place:

The S&P has rebounded nicely from last year’s bear market, but 90% of that gain is due to only 10 stocks, mostly Big Tech names that have reported good recent earnings. Apple and Microsoft alone now account for 14% of the index’s overall value. That’s a lot riding on the fortunes of a handful of — by most measures — extremely overvalued stocks.

While you’re contemplating this, consider a few of today’s headlines:

PacWest falls nearly 30% as regional bank stocks slide to new lows

Regional bank stocks fell sharply Tuesday as the fallout from the third major bank failure this year continued to put pressure on the sector.

Shares of PacWest fell 28% on Tuesday and was on track for its fourth-straight negative session. The stock was halted for volatility multiple times.

Just in Time for ECB Rate-Hike Meeting: Eurozone Services Inflation Spikes to New Record. Overall Inflation Re-Accelerates

In the 20 countries that now use the euro, the annual rate of inflation in services rose to 5.2% in April, another record in the data going back to 1997, according to the preliminary data released by Eurostat today. Another nasty surprise, another sign that inflation has now shifted deeply into the economy in a fundamental way, despite sharp price drops of energy goods and some durable goods.

Services inflation is the biggie. The majority of what consumer spend their money on goes to services. They include healthcare, education, housing, insurance, telecommunications, streaming, subscriptions, air fares and lodging, restaurant meals, repairs, cleaning, financial and legal services, haircuts, etc.

Dow falls 400 points as banking concerns linger, Fed decision looms

Stocks fell sharply Tuesday, led lower by declines in bank shares, as traders braced for the latest Federal Reserve policy announcement.

The Dow Jones Industrial Average fell 480 points, or 1.4%. The S&P 500 also slid 1.4%, and the Nasdaq Composite dropped 0.9%.

Small and large banks fell, as traders questioned the future of some regional financial institutions after the crisis that engulfed Wall Street in March. Regional banks PacWest and Western Alliance had trading paused after tumbling more than 20%.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino May 2nd, 2023

Posted In: John Rubino Substack