May 12, 2023 | Canadian Banks Must Focus on More Productive Loans

The concentration of economic activity in the residential real estate sector is hurting Canada’s future. Residential real estate investment is not desirable when compared to other activities that generate intellectual property, jobs and increased productivity.

Why are Canadians so enthralled with investing in non-productive residential real estate?

In a recent article in the Globe and Mail, Dr. Paul Kershaw of the University of British Columbia and founder of Generation Squeeze says,

“Our country badly needs a new strategy to promote economic prosperity through a shift in lending and borrowing from mortgage loans to business loans. This is crucial regardless of whether you care about generational fairness, or just plain-old economic prosperity.”

Other countries, like China, are also overinvested in residential real estate. But China is a manufacturing giant, with world-leading capability to build and export goods. For example, Chinese companies are building more electric vehicles than any other nation and a Chinese company, BYD, is exporting battery-electric vehicles to Germany. China is focused on intellectual property and creating jobs in new technologies.

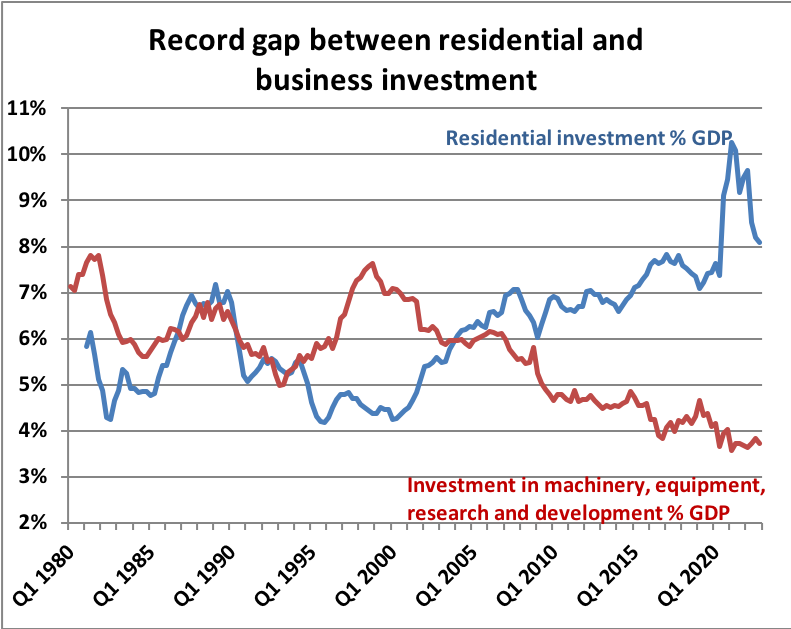

Ben Rabidoux, of North Cove Advisors, provided this chart that shows the decline in non-real estate investment:

Sources: Statistics Canada and Ben Rabidoux

Residential investment grew rapidly for the last 23 years while average house prices quadrupled, an increase of approximately 7 percent per annum. This alone would have encouraged people to borrow more to invest in housing and less in things that carried more risk and did not yield such a great return.

But this overview of the sectors misses a key part of the picture — the role of commercial banks as the most important lenders to the residential real estate sector.

What are the incentives that encourage banks to concentrate on real estate?

Banks love real estate and are reluctant to lend to businesses. Anyone who has tried to get a business loan knows that it is almost impossible unless the borrower has real estate as collateral and a personal guarantee.

Banks have a huge incentive to support residential real estate because of regulatory rules. Banks are required to meet or exceed minimum common equity capital ratios based partly on lending risk.

Bank capital, in the form of common equity, is increased by retained earnings and reduced by dividends. Investors love dividends.

Residential real estate is classified as low risk so common equity requirements are small while business loans are high risk and require more capital.

If a mortgage is insured, the equity requirement can be zero. But even uninsured mortgages, with a minimum down payment of 20 percent, are lower risk than business loans.

So, banks focus on real estate to increase their ability to pay ever-increasing dividends and use maximum leverage.

But these incentives are distorting investment in productive sectors like research and development while reducing the number of high-paying jobs. Canada is falling behind.

On an urgent basis, authorities must introduce new rules that encourage bank loans for more productive ventures and discourage residential real estate borrowing.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth May 12th, 2023

Posted In: Hilliard's Weekend Notebook