March 24, 2023 | Central Banks Must Choose Between Fighting Inflation and Saving The Banks

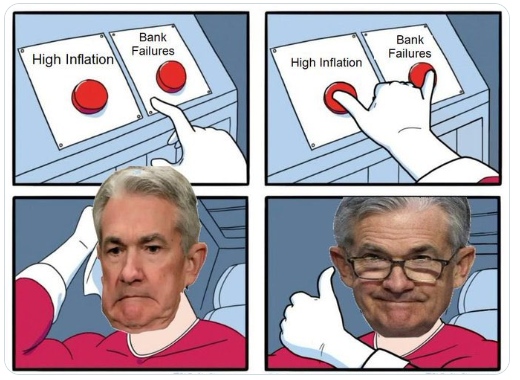

Central banks, especially the Federal Reserve, are caught between a rock and a hard place. It seems that they might have to choose between saving the banking system and fighting inflation.

Their recent statements, until this week, indicated that they would make fighting inflation their only priority, even if that means triggering a recession.

But several small bank failures have forced central bankers to reconsider.

Will the central bankers abandon their fight against inflation?

The European Central Bank (ECB) gave a clear message in this week’s announcement:

Source: Bloomberg News

President Christine Lagarde said “A sizeable policy adjustment is already behind us … we have raised interest rates by 350 basis points. However, inflation is still high, and uncertainty around its path has increased.” These remarks came after the huge Swiss bank, Credit Suisse, had to be rescued through a merger with another large Swiss bank, Union Bank of Switzerland.

Although the ECB is not Switzerland’s central bank, the problems in the banking system there must be affecting the resolve of the ECB.

While Lagarde emphasized how many basis points had been added it is important to note that the hikes came from a base of zero interest rates, or in some parts of Europe, even negative rates that prevailed for years.

In the US the Fed Chair Jerome Powell announced an increase of 25 basis points on Wednesday. Some observers had started to expect no change in rates, reasoning that the failure of Silicon Valley Bank and a couple of other smaller banks might push the Fed off its determination to hike rates until it hurts. Like Lagarde, Powell emphasized his determination to corral inflation.

Source: Twitter, @GRDecter

So far, the Fed’s rate hikes have had little effect on inflation. Inflation started to moderate in 2022 even before the rate hikes started to bite, and it could be argued that the Fed rate hikes were not the major factor as hikes operate with a long time lag.

But this old saying has proven right again: “The Fed will hike until something breaks”.

However, If the “something” that breaks is the financial system, the Fed could abandon its firm stance on inflation and make the banking system its highest priority.

And bank failures might do the Fed’s work for it, by making investors more cautious about taking risk and that will affect demand for goods and services, reducing upward pressure on inflation.

The closely watched financial conditions indicator is based on many factors and one component is the willingness of banks to make loans to riskier borrowers. The banking problems were not directly related to bad loans, but bankers are human, and it is certain that these high-profile failures will make it likely that loan officers will become very careful when approving applications for loans. When asking to borrow money, expect to have to dot every I and cross every T.

We can expect more turmoil and vacillations between fighting inflation and heightened worries about preserving the banking system.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth March 24th, 2023

Posted In: Hilliard's Weekend Notebook

Next: Financial Stress Spreading »