February 6, 2023 | No Bull, Caution Ahead

Happy Monday Morning!

Lots of chatter these days about increased activity in the housing market. It’s true open houses are busier, stale inventory that’s been sitting for months is suddenly under contract, and some new listings are fetching multiple offers. Quite a difference four weeks can make. Is this the end of the housing bear market?

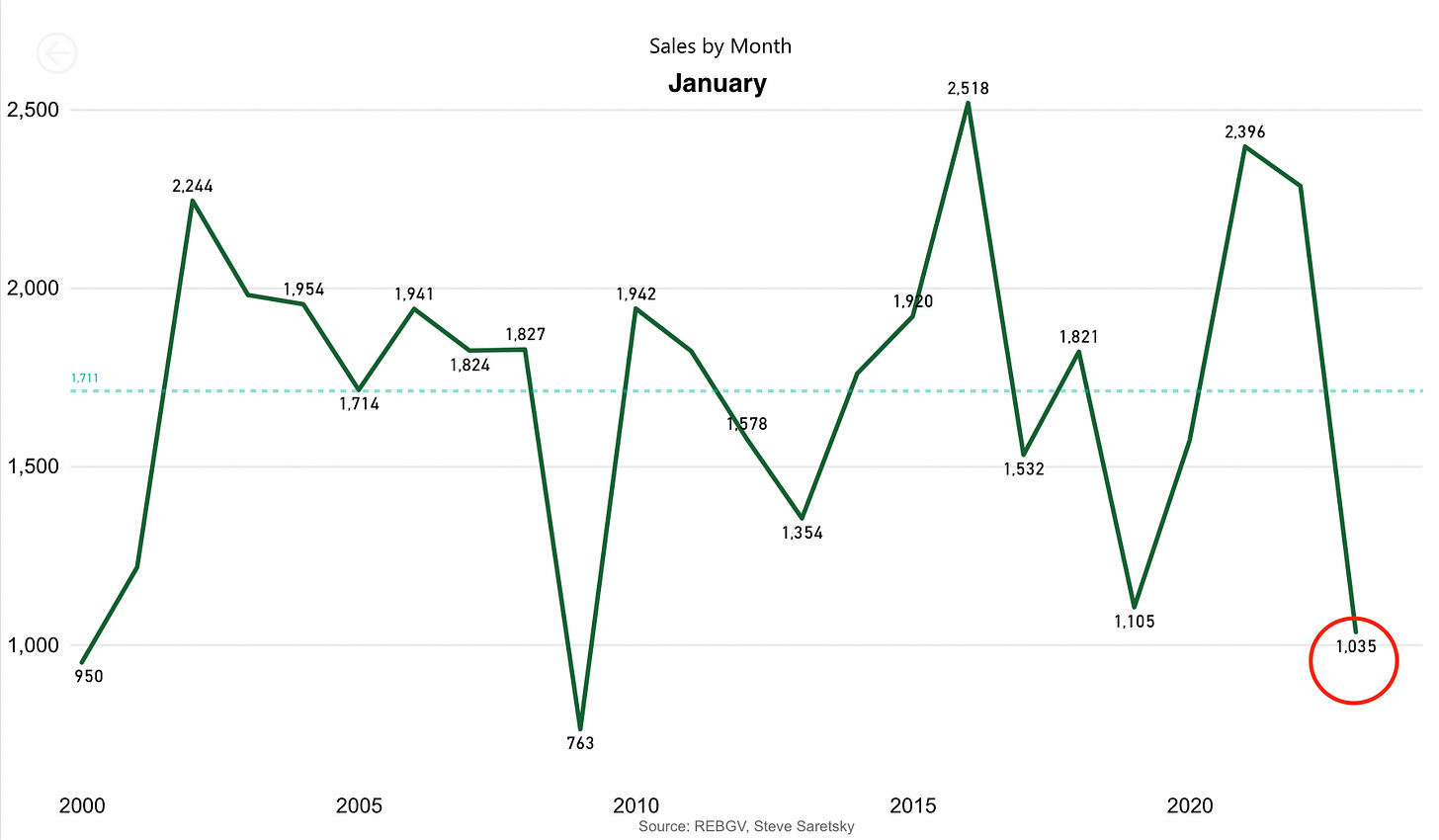

While sentiment has certainly shifted, the data suggests we’re not out of this just yet. For the month of January, Greater Vancouver home sales ticked in at their lowest levels since January 2009.

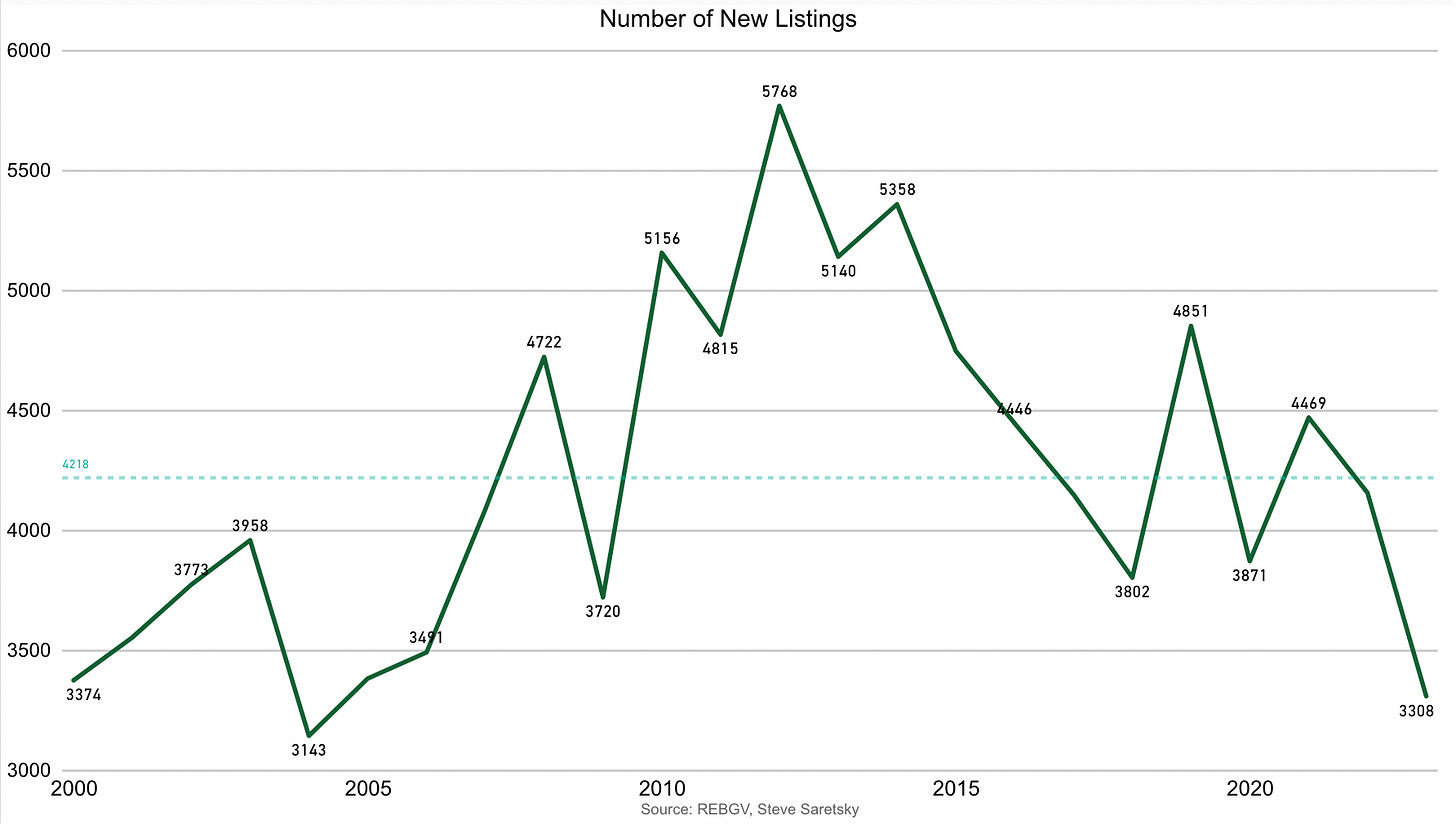

Yes sales were in the dumps, but housing bulls will scream, “But there’s nothing to buy!” and this is also true. New listings trickled in at their lowest levels since 2004!

Very hard to get lower prices when new listings are basically running at 20 year lows. This doesn’t account for the increase in housing stock over the past two decades either. There’s been a narrative building over the past year that a bunch of distressed sellers would flood the market as higher interest rates bite. That has not happened.

So we’re stuck with very low inventory levels as we approach the busier spring selling season. Current inventory levels today would normally result in double digit price growth. However, demand remains WEAK and thank god for that. Otherwise we’d be in a situation where house prices were accelerating higher as the Bank of Canada tries to quell inflation.

It’s a similar story in the GTA. Sales for the month of January were the lowest since 2009. New listings were the second lowest in 20 years. Overall, active inventory is higher this year, yet sales were still 44% lower than last year.

To summarize, it is very premature to draw any conclusions that the bear market has ended given the extreme volatility in the data.

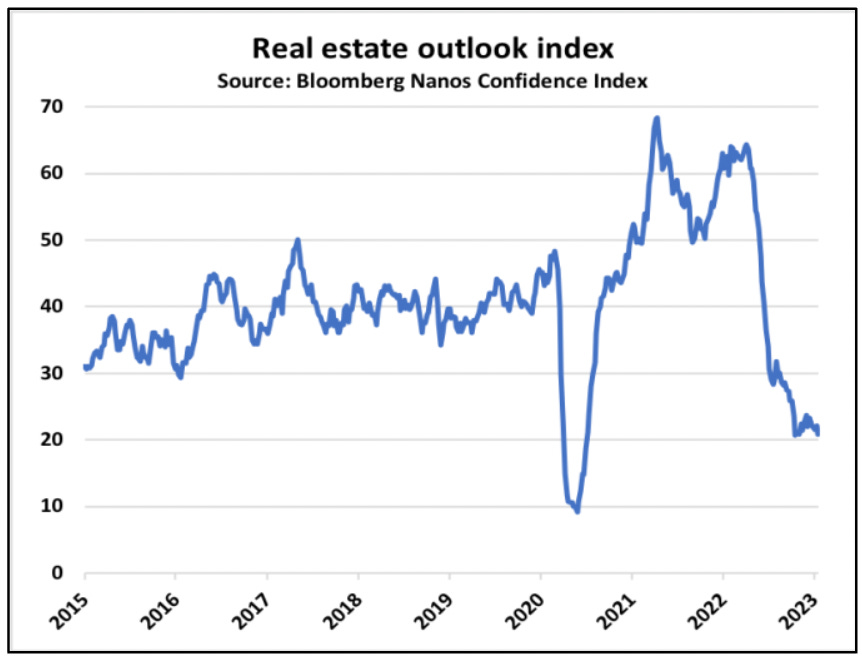

It is true sentiment has improved after the Bank of Canada paused rates last month. People have clarity on borrowing costs and there’s a belief that the worst of interest rates are behind us. Markets have a funny way of swinging too far in either direction. People were incredibly bearish on housing over the past six months.

However, caution is still warranted. Any re-acceleration in home prices is simply more reason for the Bank of Canada to hold rates HIGHER for longer. Why on earth would you start cutting rates if home prices are rising…

Just last month Fed economists wrote a report suggesting home price gains over the last 2 years could have produced a wealth effect for homeowners that drove one third of the increase in the CPI (non-shelter prices).

Meanwhile, a new report last week from two economists out of UBC suggests the Great Resignation in the United States can be fully explained by increases in housing wealth. Stronger house price growth tended to coincide with lower participation rates in the labour force, but only for home owners around retirement age. The report suggests if housing returns in 2021 would have been equal to 2019 returns, there would have been NO DECLINE in the labor force participation of older Americans.

You think the Bank of Canada isn’t paying attention to this when they’re trying to moderate demand, temper wage growth, and ease labour constraints?

In other words, a flat housing market is probably what we should be hoping for.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 6th, 2023

Posted In: Steve Saretsky Blog

Next: Can the Future be Altered? »