February 5, 2023 | Consumer Stimulus the Easy Way

Treat the stock market as you would a sleazy carnival game and you hold the key to accurately predicting its behavior. Take AAPL, for instance. We should have known that permabears were being set up for a fleecing when an always-complicit news media worked slavishly to stoke anticipation of horrendous Q4 earnings. Apple certainly didn’t disappoint in that regard when the company on Thursday reported its first year-over-year sales decline since 2019.

Such announcements are usually made after the close, enabling the thieves who manipulate stock prices for a living to work their magic. As they have done countless times in the past, they pulled their bids in after-hours trading following Apple’s grim announcement. This induced widows and pensioners to vomit Apple shares at distress prices five percent below where they’d traded on the close.

QE Mythology

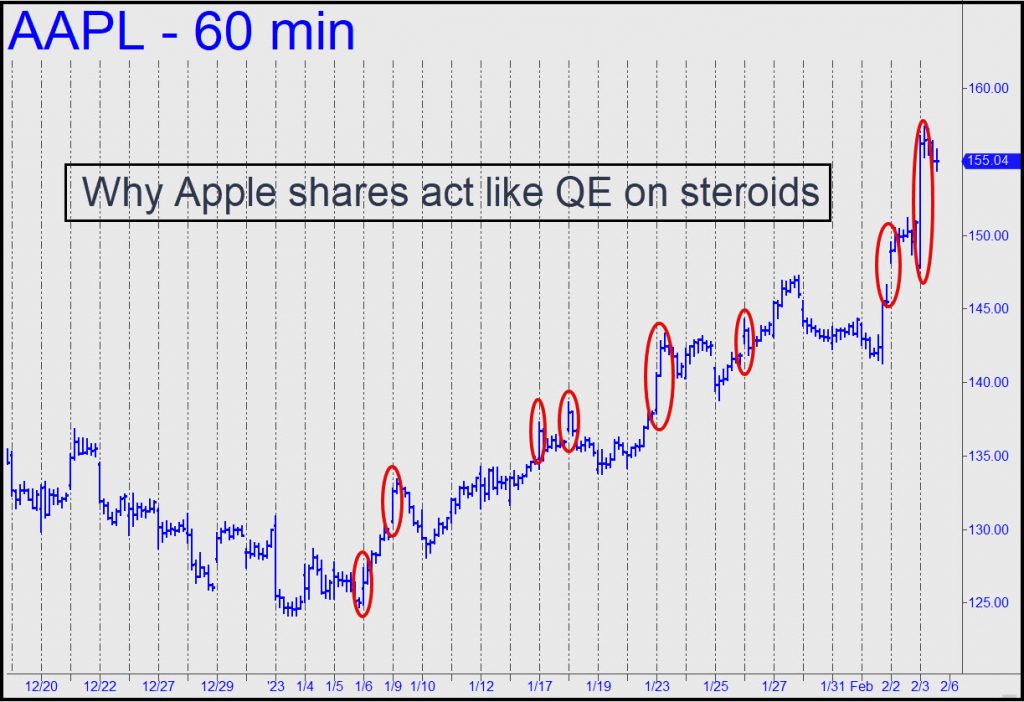

With sellers utterly spent, DaBoyz were easily able to short-squeeze the stock back up to the intraday high within hours. The rigged ups and downs that made this ruse work are shown in this chart. From that point forward, their clown-dunking antics were on autopilot. As the stock relapsed in the wee hours, they covered shorts laid out at Thursday evening’s secondary peak. Sellers didn’t realize how badly they’d been had until around 5 a.m., when AAPL finished basing on near-zero volume and launched into an 8% rally, from 145 to 157, before the regular session began.

QE mythology aside, this is how the Fed effectively injects large sums of instantly spendable money into the economy. With credit stimulus there will always be a lag between falling interest rates and their intended effect on consumer spending. But gift investors/consumers with an 8% rally in the world’s biggest-cap stock on a Friday afternoon and you have spiked the wealth effect with methamphetamine. By the time you read this, many of the day’s big winners will have visited their local yacht showrooms, while others will have blown $1,000 on beluga, foie gras terrine and truffled Goujonettes at Daniel. A few months down the road, this orgy will allow The Guvmint to report Q1 “growth” at a time when the economy was visibly imploding, led by big layoffs at some of the largest companies in the world.

Who Needs Bulls?

Keep in mind than an 8% rally in a $2.5 trillion stock is worth $200 billion, equal to six weeks’ GDP for Israel, Ireland or Norway. Wall Street can churn out sums of that magnitude for days on end — effortlessly and in just a few hours, even without help from bullish investors. That’s because the gaps created on the charts by short-covering leaps define places were little actual money has changed hands. Moreover, bear rallies don’t need “good numbers” to go ballistic. In fact, the opposite is true: The more despairing the earnings outlook, the easier it is for DaBoyz to trigger off short-covering rallies that can seem grotesquely illogical. This is mass folly in a seemingly benign form, but look out below when the psychosis has run its course.

It could be a few weeks or longer before that happens, since AAPL has an open path up to 168 from a current 154 before it hits any obvious technical impediments. There’s a downward sloping trendline that comes in at that price between now and mid-February. If the rally from the January low at 124 were to reach the trendline, it will have added around $720 billion to the U.S. economy. To put that number in perspective, it is only $100 billion less than the U.S. Defense Department spent in 2022. Since most of the stock’s rise could be attributed to short-squeeze leaps where relatively few shares or money changes hands, you can see how much easier it is for AAPL to grow the U.S. economy than for the Fed to do it by easing credit.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman February 5th, 2023

Posted In: Rick's Picks

Next: No Bull, Caution Ahead »