January 10, 2023 | Real Estate Prices Typically Contract for Years After Bubbles Burst

In the first quarter of 2021, residential ‘investment’ in Canada (real estate commissions, construction of homes, significant renovations, and ownership transfer costs) comprised some 9% of Canada’s GDP, while business investment plunged. US residential investment peaked at 6.7% in 2006 before that epic bubble burst. We have noted repeatedly that Canada’s exuberance in real estate was an unsustainable malinvestment that undermined our future productivity and growth while increasing household debt and vulnerability to recession.

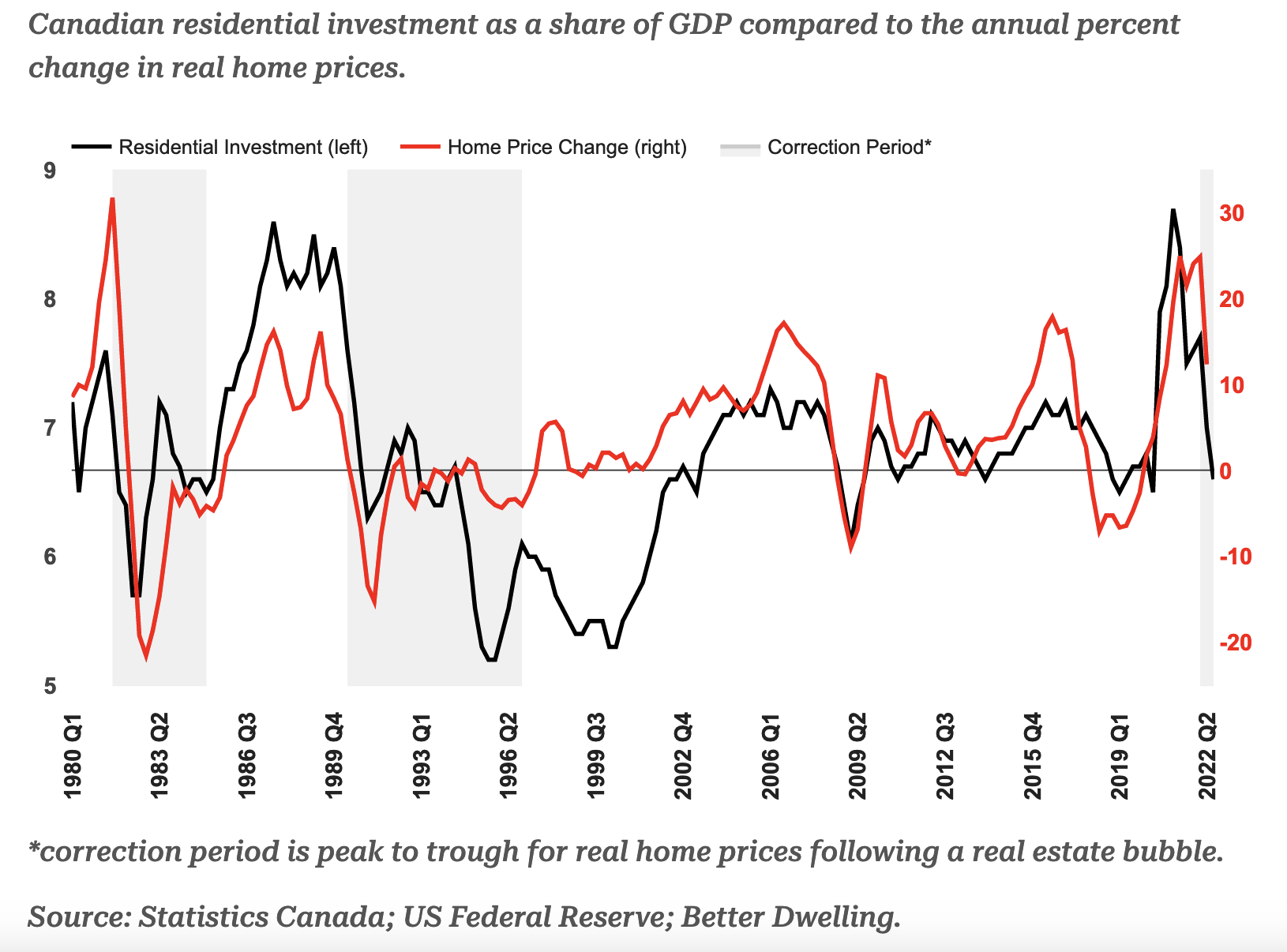

Since 2022, a rapid normalization in interest rates after years of ultra-low has understandably zapped ability and appetite to buy grossly inflated housing. Prices (in red below) are finally following buying activity lower (in black as a percentage of GDP since 1980), and history suggests that prices should follow for years.

A 2018 Bank of International Settlements (BIS) study found that contracting real estate investment typically brings a recession within two years and falling property prices for an average of 4 years.

As pointed out by Better Dwelling, the last two major Canadian real estate bubbles in the early 1980s and early 1990s saw average and worse outcomes:

The early ’80s bubble saw residential investment peak in Q2 ’81, and home prices a quarter after. The correction lasted peak to trough for nearly 4 years, close to the average.

The ’90s real estate bubble saw residential investment peak in Q4 1989. Real home prices followed two quarters later, before a correction in ’96. Nearly 7 years of sliding prices until the market returned to growth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park January 10th, 2023

Posted In: Juggling Dynamite

Next: Gold v Dollar »