January 20, 2023 | Canadian Housing is in a Slump But Not a Crash

The Canadian housing market is in a correction, but not yet in a crash. The CREA, a real estate industry association, put out a report that showed a 13.2 percent decline in house prices from the peak that occurred early in 2022.

Will this housing correction turn into a crash?

The CREA, a perennially bullish mouthpiece for real estate agents across Canada, released a report on January 16 with the headline “Canadian home sales edge up to end 2022”. This must be some kind of record for finding something positive to say when all the news is very negative.

The positive news refers to a very small uptick in sales from the month prior, when house sales were in a deep funk. The increase was about 1.3 percent, if anyone is keeping track.

The reality is that house sales on the MLS have been in the doldrums, even accounting for the usual seasonal dip that happens in December. Who wants to go looking for a new home during the run up to Christmas?

And the report goes on to admit that the slump is very deep, with activity 39.1 percent below December of 2021.

And it was not just sales activity that took a nosedive: Home prices were down 12 percent year-over-year.

The drop from the peak prices was a bit larger, recorded as 13.2 percent.

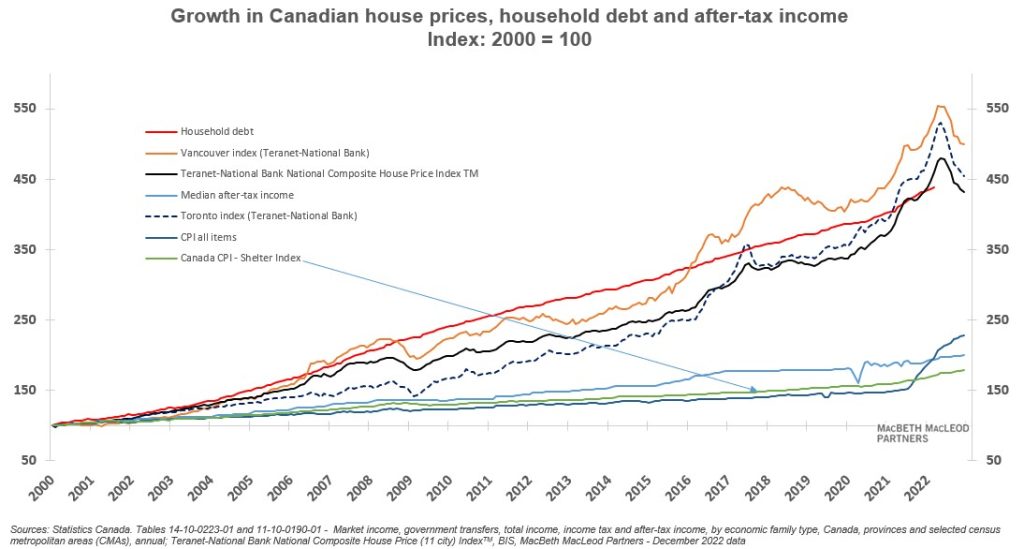

Here are the gains in residential real estate prices, and the correction that started last year, over the entire period since 2000:

As the chart shows, prices have started to come down, at a faster pace than in 2017. There was another correction during 2008-09 but that was small and brief as the uptrend resumed when the government allowed zero down payments and 40-yr amortization to get the housing market going again.

Economists are predicting that 2023 will be the year that house prices bottom, with further declines of a limited nature. These predictions, if they are correct, mean that the current downturn will be very similar to the 2008 and 2017 breaks that were mild, followed by a rapid return to the relentless upward trajectory of house prices. Too bad for first-time buyers!

TD economics said in a January 10 report that prices will bottom soon with a decline of 20 percent from top to bottom.

Of course, the economists who work for banks are employed by the biggest actors in the real estate sector. And that sector is very important to the continued prosperity of the banks and their customers, some of whom have very large mortgages that were taken out when interest rates were much lower.

Nobody knows if this correction will turn into a crash similar to the U.S. experience in 2006-10 when prices dropped by an estimated 38 percent.

Higher interest rates are just starting to bite, so it is too soon to call the end of this cycle.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth January 20th, 2023

Posted In: Hilliard's Weekend Notebook