November 21, 2022 | EPB Macro: The Economic Data Just Got Worse

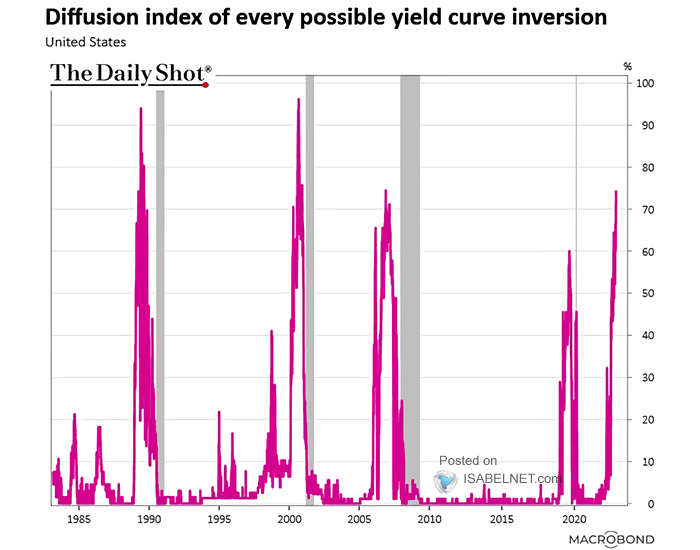

Last week, the entire US yield curve inverted (a diffusion index of all spreads is shown below via ISABELNET.com since 1981), with the one-month Treasury yield rising above the 30-year Treasury yield.

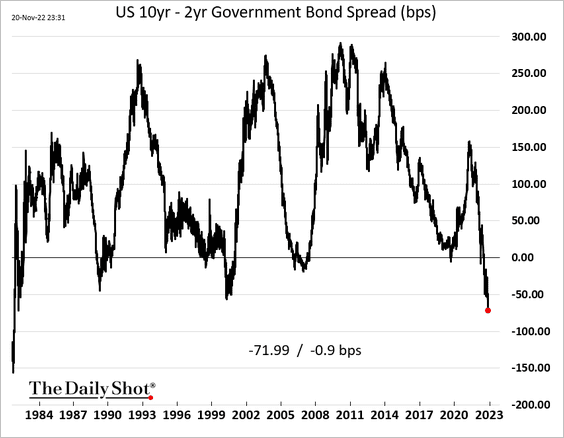

The spread on two and 10-year Treasury bonds widened to -71bp–the most negative since before the double dip recession of the early 1980s (shown below courtesy of The Daily Shot).

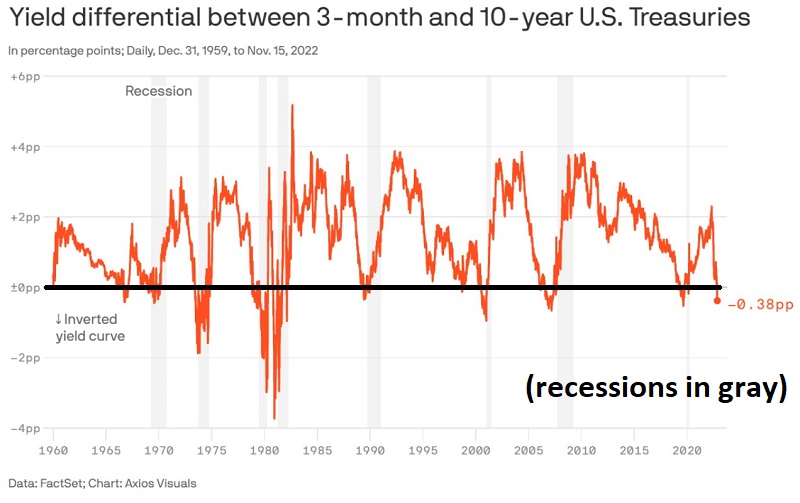

At the same time, the spread between three-month and 10-year Treasury bonds (below via Jay Kaeppel from 1960 to November 15) ended Friday at -52bp, approaching the -64bp peak spread in February 2007 before the Great Recession began in December 2007.

EPB Macro’s latest economic update offers further insight into incoming data.

EPB Macro’s latest economic update offers further insight into incoming data.

This weekly update will cover the economic data that was recently released, including industrial production, retail sales, and some leading indicators of inflation. Here is a direct video link.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 21st, 2022

Posted In: Juggling Dynamite