Danielle DB does a good job of summarizing the latest data, suggesting that a US recession is nigh and corporate revenues and employment are set for a drubbing.

From the NYSE site, Caroline Woods and Danielle DiMartino Booth discuss the Fed’s continued fight against inflation, the spending power of U.S. Consumers and how A.I. could impact the labor market. Here is a direct video link.

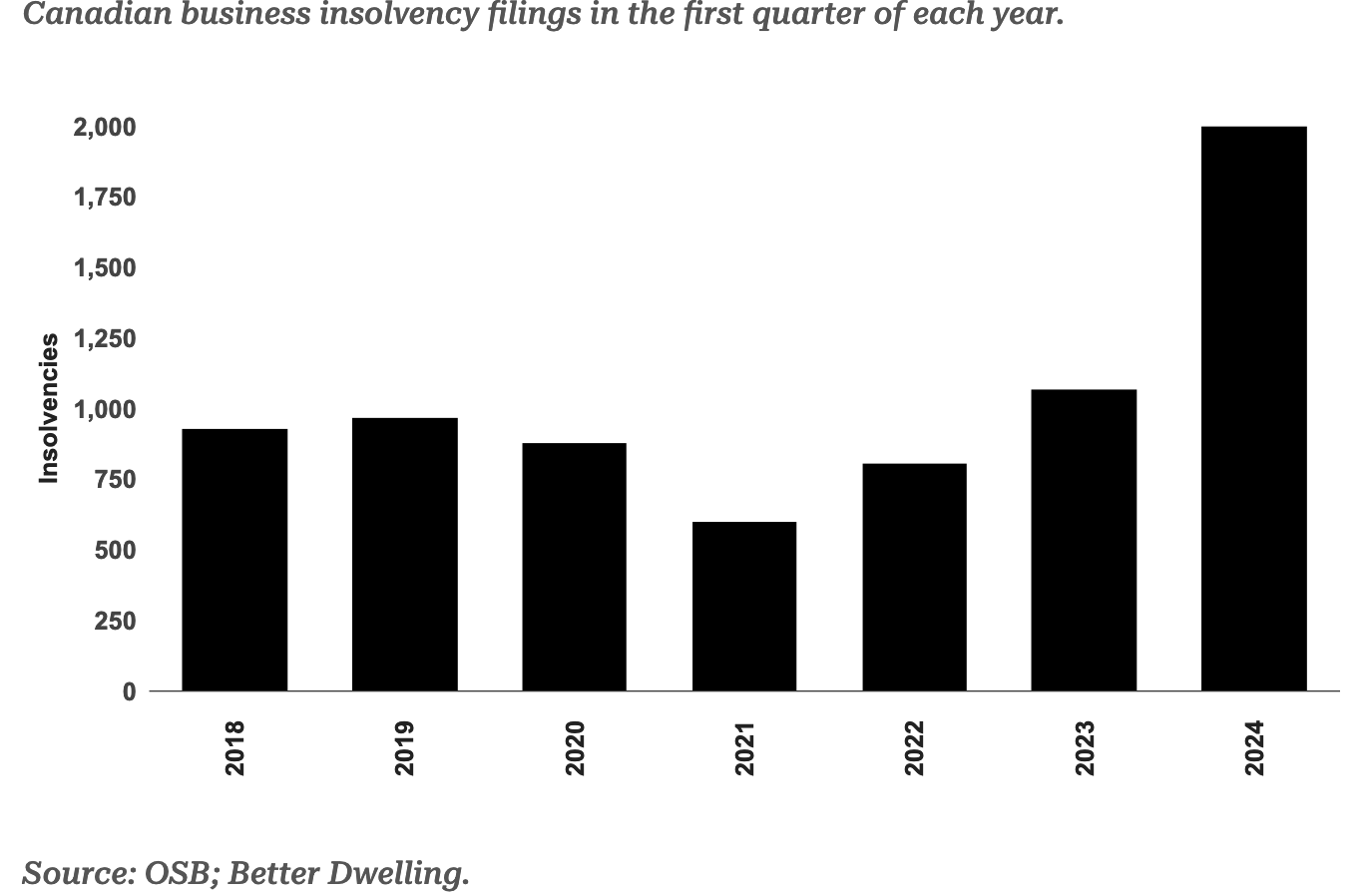

Canada is further into this downturn than America. Already, in the first quarter of 2024, Canadian business insolvencies climbed 87.2% higher than the same quarter last year:

A weak consumer combined with a soaring cost of doing business has led to a surge in businesses seeking protection from creditors. Experts warn the issue is likely much worse, since the vast majority of businesses that shutter don’t make an insolvency filing, they simply close their business.

As I wrote last October in Resisting financial sentinels, financial-tainment is dominated and sponsored by sell-side firms that urge us to buy risky assets–that’s their business model:

Most of the investment industry sees client accounts as product distribution channels. To hit revenue targets, they pump and dump the highest-risk securities onto their customers.

Even where clients pay a fee for asset management, most firms reserve the right to collect additional, often hidden compensation from product creators. If clients own the least-risk securities like government bonds and cash equivalents, investment fees are relatively little, so, unsurprisingly, these assets are rarely recommended.

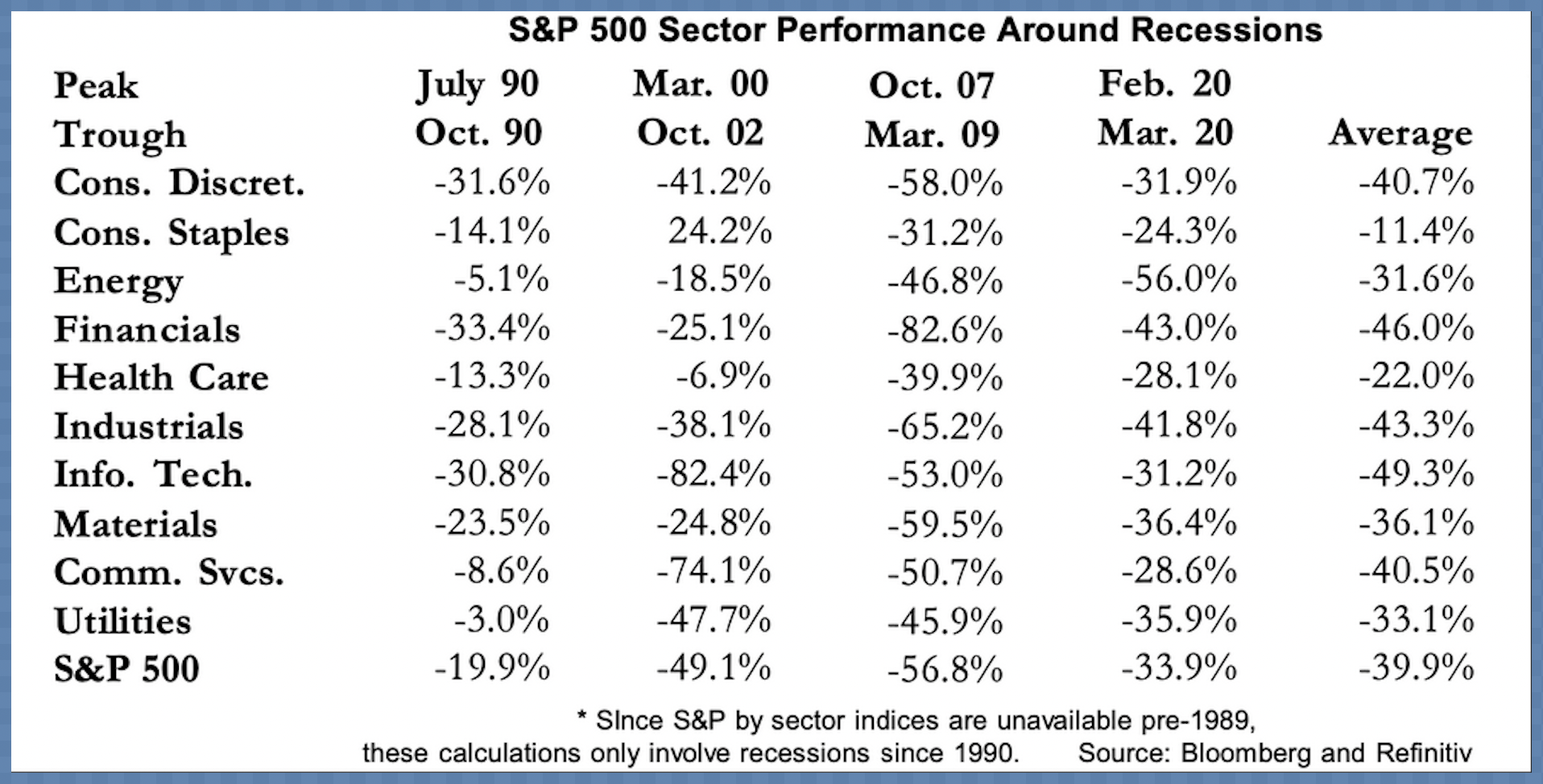

But make no mistake: It is typical for dividend-paying equities to drop sharply in recessionary bear markets while central banks are easing financial conditions. “Defensive” for whom, you should ask.

The table below (courtesy of A. Gary Shilling) shows the peak-to-trough price decline for all equity sectors during past recessions (1990, 2000-02, 2007-09 and 2020), as well as the average loss over all four (5th column). Mind those defensives!