April 6, 2024 | Trading Desk Notes For April 6, 2024

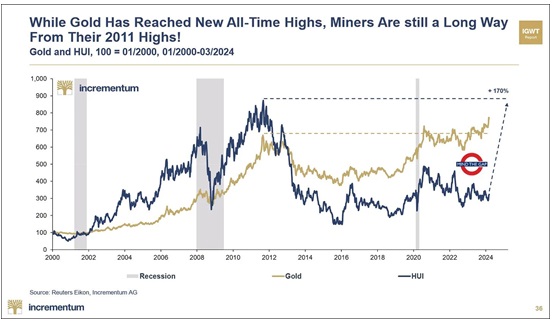

Gold closed at All-Time highs this week, up 29% from the 2023 lows made on October 6, the day before Hamas attacked Israel.

Gold rallied over $150 in the last seven trading days, making new highs every day this week and closing at its highs on Friday, as anticipation grows Iran will respond to the attack on their consulate in Damascus. Gold has rallied ~$300 (15%) since March 1 and is at All-Time highs against all fiat currencies.

Gold, bonds, foreign currencies and the stock market spiked to new highs late in the trading day on March 20 (circled in the chart above) following the FOMC meeting, which “seemed to confirm” that the Fed would start cutting rates in June.

The gold rally was extended in thin overnight trading on March 20 (I noted that it looked like “sophisticated traders” ran buy stops above the market) but then tumbled to end the week below pre-FOMC levels.

By Friday’s close, the stock market also fell back a bit from its post-FOMC highs, and the US Dollar staged a substantial rally on Thursday and Friday.

In my March 23 TD Notes, I thought that gold “giving back” all of its $70 spike to ATHs (on the biggest daily volume since the SVB crisis in March 2023) signalled a near-term high and that “Baring a “geopolitical” shock, this week’s spike high may remain the “high-water mark” for gold for some time.“

Gold’s price action after tumbling ~$70 from the post-FOMC highs was relatively quiet for a few days. Still, the market was aggressively bid on Thursday, March 28, and Comex registered a daily, weekly, monthly and quarterly closing high ahead of the 3-day Easter Weekend.

The geopolitical shock arrived on Monday when the Iranian consulate in Damascus was attacked, and gold was bid higher every day this week.

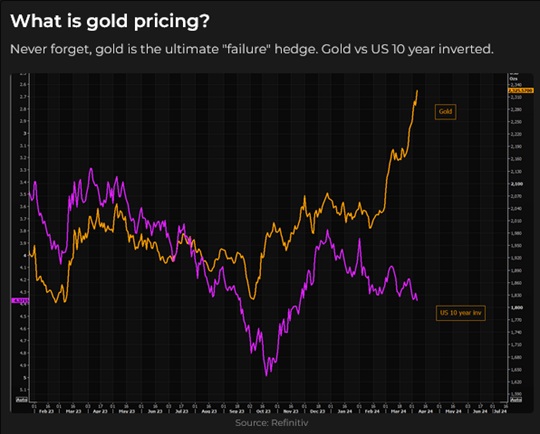

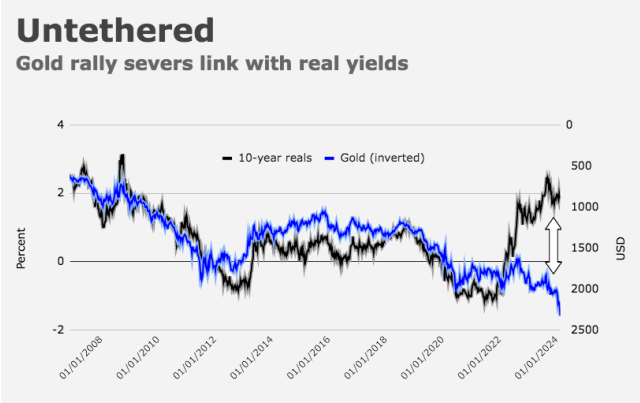

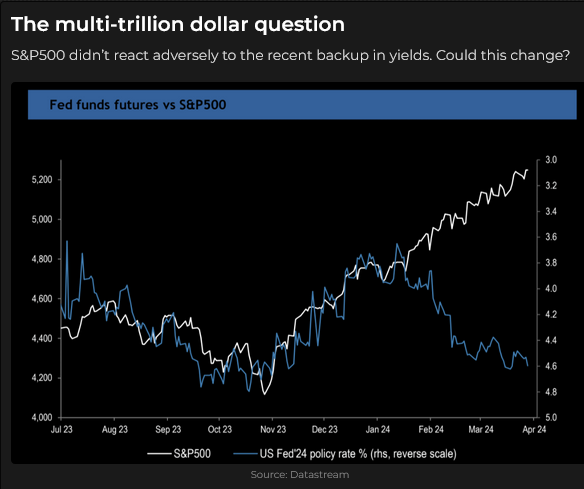

I pay close attention to correlations in the markets I trade, and I’m especially interested when correlations break down—that’s often a signal that “something new” is impacting prices.

Gold has a long history of being negatively correlated to interest rates, especially real rates. If interest rates are high, there is an “opportunity cost” to holding gold, which pays no interest. This chart is from the Heisenberg Report. (I’ve subscribed to this service for years, and I’m constantly amazed at the quality and breadth of the writing – at a fraction of the cost of other services.)

Interest rates have trended higher over the last two years, and if the historical correlation between interest rates and gold had been maintained, gold prices “should” have fallen – but they haven’t – they’ve raced higher.

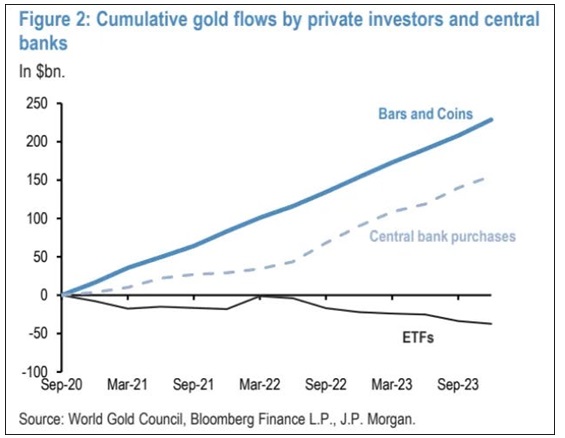

Martin Murenbeeld, a world-class gold analyst and my friend for more than three decades, writes, “Given that gold has really not suffered on the back of the shifts in interest rate expectations suggests that other factors – investment demand, retail demand, central bank demand – are the dominant factors in the gold market at this time. And behind this demand are geopolitical concerns, economic concerns (China) and concerns that governments will not be able to deal with their ever-rising debt levels without more inflation, financial repression and currency devaluation.”

Michael Harnett, the Chief Investment Strategist at BofA, writes, “Gold >$2,200 = real rates of -2%, not +2%…is discounting a collapse in rates. Investors are hedging the risk of Fed cuts…(and) an endgame of Fed interest-cost control, yield-curve control and QE to backstop US government spending.”

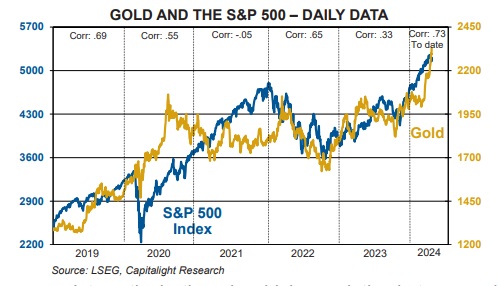

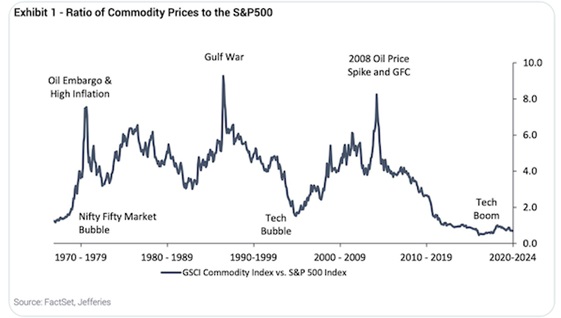

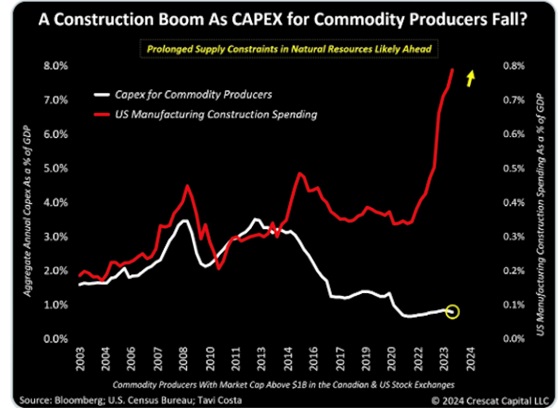

In last week’s TD notes, I headlined a paragraph with “Are Stocks an inflation hedge?” With that question in mind, consider this chart from Martin Murenbeeld’s latest Gold Monitor.

Stock Indices

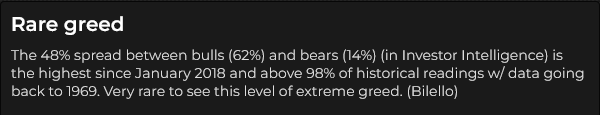

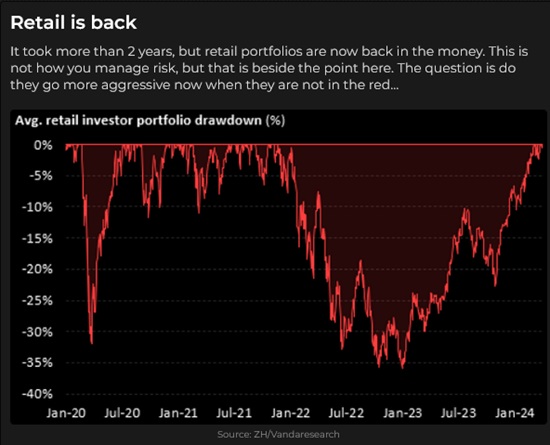

S&P futures traded to new All-Time highs during the Sunday overnight session, drifted lower on Monday and Tuesday, steadied on Wednesday, and then tumbled hard on Thursday (the DJIA fell ~800 points from intraday highs to lows) when some Fed speakers considered fewer interest rate cuts in 2024 and rumours swirled of an impending retaliation from Iran. (I should note that many traders were probably “on the sidelines” on Thursday ahead of the Friday NFP report, so liquidity may have been thinner than usual, exacerbating the intraday volatility.)

The NFP report was stronger than expected, but equity markets reacted as though good news (more people working, stronger economy) was good news (people and businesses will keep buying goods and services) even though interest rates surged higher (but the stock market hasn’t been concerned about rising rates for months.)

Mega-cap tech stocks get a lot of attention, but I keep an eye on Caterpillar Inc. as a barometer of the economy’s performance, apart from Silicon Valley and Wall Street. CAT hit All-Time highs this week, up ~70% from last October’s lows.

The Toronto Composite Index surged to All-Time highs on Friday after the softer-than-expected Canadian employment report. The Bank of Canada meets this Wednesday and may cut rates or indicate that rate cuts are coming.

Interest rates

Forward interest rate futures are currently pricing in less than 3 X 25bps cuts from the Fed in 2024, down from expectations of more than 6 X 25bps cuts in January.

10-year T-Note prices closed this week at their lowest levels since November, with a yield of ~4.4%.

Currencies

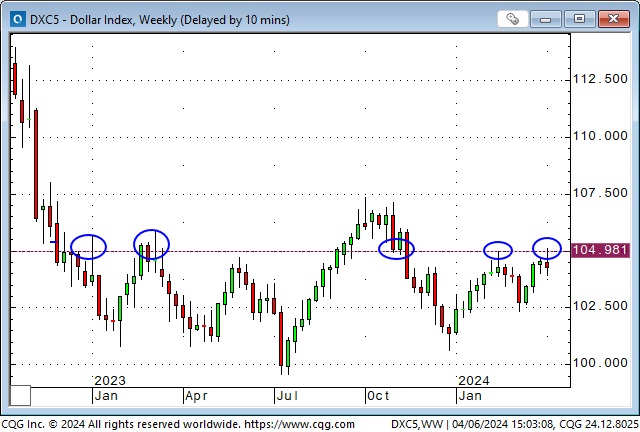

The US Dollar Index has trended higher from December’s turning point but has run into resistance around the critical 105 level. A convincing break above 105 would likely lead to a challenge of the 107.50 level, while another failure here might result in new lows for 2024.

The Swiss Franc has long been considered one of the world’s strongest currencies. Last December, it reached record highs against the Euro (and record highs against the USD outside of a brief spike in August 2011 when a combination of the Greek sovereign debt crisis and a cut by S&P in the US sovereign debt rating to AA+ from AAA caused the CHF to briefly spike to ~1.40.)

The Swiss National Bank may have tolerated the Franc’s strength to keep inflation down in Switzerland, but they were likely happy to see it turn lower against the USD and the EUR (and other currencies) in December. They accelerated the Franc’s weakness with a surprise interest rate cut on March 21. The Franc has closed lower for 12 of the last 14 weeks.

Currency futures market speculators aggressively built their largest net short Franc position in five years as the CHF fell ~8% since December. If the Franc were to rally, especially if it traded above the lows made on March 21 when the SNB cut rates, those speculators might scramble to cover their shorts.

Energy

WTI has rallied ~$20 (30%) from December lows, closing this week at its best levels since October. Rising global demand and geopolitical stress have combined to boost prices.

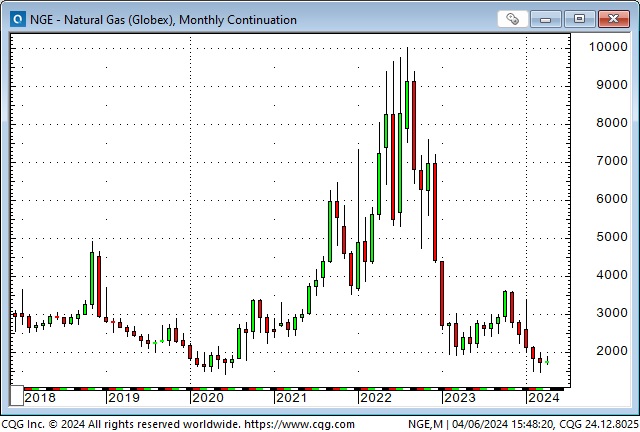

Natural gas prices in North America remain near multi-year lows on plentiful supplies.

Share prices of energy company ETFs are at 10-year highs, outperforming WTI. Exxon shares closed this week at All-Time highs.

Marathon Petroleum shares are up ~14X from their 2020 lows.

Uranium plays rebounded sharply this week after selling off 20 – 30% from multi-year highs in early February.

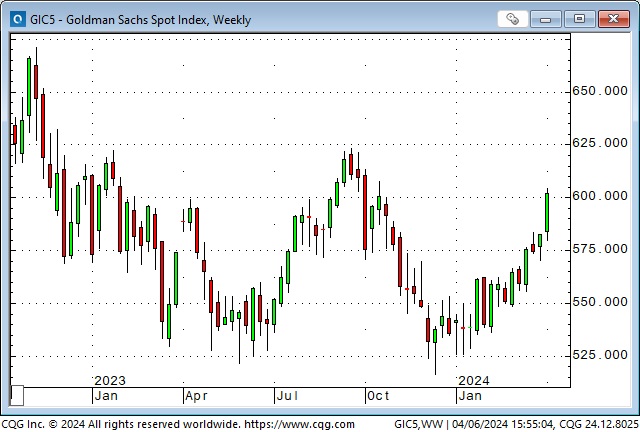

The (energy-heavy) Goldman Sachs commodity index rallied sharply this week to close at a 6-month high.

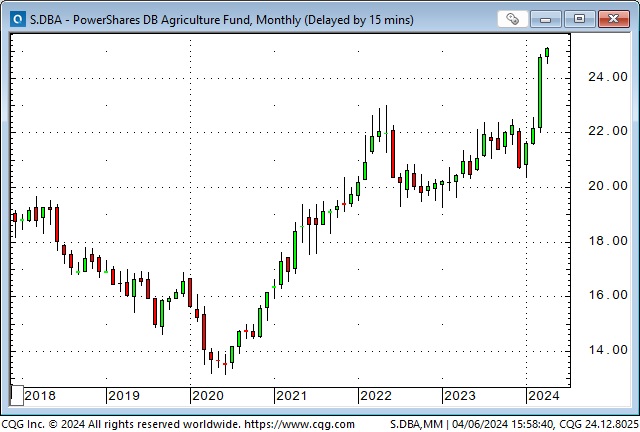

The DBA Agriculture Fund ETF has risen sharply YTD, closing at a 9-year high this week.

Copper has rallied ~16% since mid-February and closed at 14-month highs this week.

My short-term trading

I started this week with the short S&P position I established last Thursday when the market tried to make a new high but failed. My stop nearly got hit in the Sunday overnight session when the market made a new ATH but turned lower. I was ~75 points ahead on the trade at Tuesday’s lows and covered on Wednesday for a gain of ~50 points.

I was happy to have covered when the market rallied above 5300 on Thursday, but I missed the 100+ point plunge later in the day. (I had told myself that I would not establish a new position before Friday’s NFP report, so I wasn’t paying close attention!)

I shorted gold on Tuesday when it made an ATH and started to fall sharply, but the break didn’t last, and I covered within a couple of hours for a tiny loss.

I bought the Swiss Franc on Wednesday as it rallied off 5-month lows, but I was stopped for a slight loss overnight when the Franc tumbled on a weaker-than-expected Swiss CPI report. (I didn’t see that coming!)

I bought the Yen on Thursday after it failed to take out Tuesday’s lows and looked like it was catching a bid on concerns over Iran retaliation. (I could see the Yen rallying if Middle East tensions rose.) I was stopped for a tiny loss on the NFP report Friday morning.

I bought the Swiss on Friday after the NFP report and held it into the weekend with a modest unrealized gain.

My net realized P+L on the week was a tiny loss.

On my radar

US CPI on Wednesday. Bank of Canada on Wednesday.

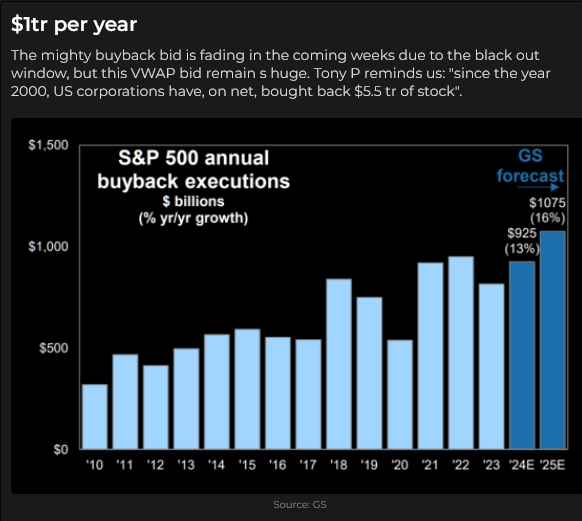

Earnings season starts, and the blackout on corporate share buybacks will grow.

Iranian retaliation?

The Masters starts on Thursday.

The Barney report

Barney and I go for many short walks near our house, but when we want long off-leash walks, we must buckle up in the car and drive for 15 – 20 minutes. I cover the passenger seat with dog towels because Barney gets muddy when we go for long walks, and we’ve made the trip so many times that he knows precisely what will happen when we get in the car together!

Listen to Victor talk markets with Mike Campbell

Mike and I discussed gold and silver markets on the Moneytalks show this morning. I suggested that Chinese retail buying, in addition to geopolitical tensions and concerns about sustained higher inflation and higher interest rates, might be helping to drive prices higher. My spot with Mike starts around the 48-minute mark. You can listen to the entire show here.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES FROM THE PAST SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair April 6th, 2024

Posted In: Victor Adair Blog