The budget this week contains an impressive number of substantial measures designed to improve housing unaffordability.

Will these measures make housing affordable again?

Housing in Canada has been more expensive than the average family can “afford” for a long time.

The old benchmark from the 1990s was a home should be no more than three times household income. In the higher income parts of Canada this would mean a maximum of $300,000 for a home. This has not been the case for in many areas for about 25 years.

In the early 2000s, house prices began moving higher and higher and stretched the ratio further and further, until Toronto and Vancouver reached ten times or more. The Canadian average is over five times.

Several successive governments exacerbated this problem by relaxing lending rules and, recently, forcing mortgage rates to very low levels.

Those low rates (under 2 percent) allowed home buyers to qualify, and lenders announced “you’re approved” to most people who walked through their doors. The rules kept getting massaged as the construction industry, property developers, bankers, mortgage brokers and realtors were desperate to attract the money required to prop up housing prices. And, for those with willing parents, the “bank of mom and dad” enabled them to get in by offering gifts of down payments and/or co-signing mortgage loans.

But interest rates have moved up to normal levels, following the trend in other countries, and now the average family is unable to stretch into the cheapest home in many cities and suburbs. At current rates most young couples with average household incomes cannot qualify for a condo, much less a single family home.

So, the federal government was under immense pressure, and it responded. The housing section of the budget is 58 pages: Chapter One.

There are a lot of good ideas in this plan. I especially like the idea of “unlocking” the enormous inventory of underused public land and buildings for real estate development, as land is a large part of the cost of new homes. There’s also mention of a “land value tax” which means taxing private land that sits idle.

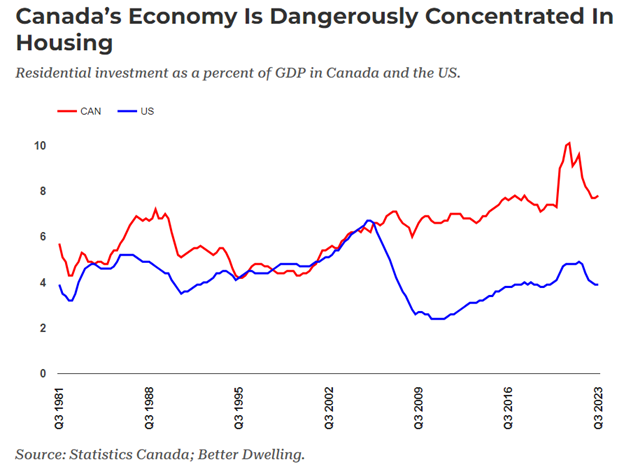

But housing is already a huge sector. At times it has been 10 percent of GDP — counted as new homes, renovations and other costs such as sales commissions and transfer taxes on new homes. Recently that amount was about 8 percent of GDP ($2.2 trillion) or about $176 billion, which is much larger than in the U.S., as a portion of GDP:

These new measures will increase our investment in new homes and apartments for rent, when Canadians are already investing too much. And compared to the current annual investment the numbers in the plan are too small to make a meaningful impact.

The better option is to allow home prices to fall to a level that most Canadians can afford. But this painful adjustment would be unwelcome to large segments of the voting population and politicians are understandably reluctant.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.