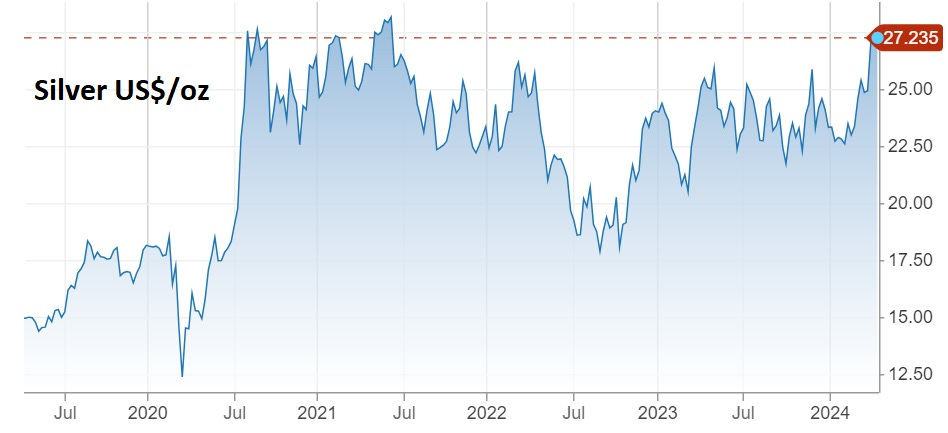

April 4, 2024 | Is This “Silver Squeeze” For Real?

How long has it been since silver generated any real excitement? So long that even most stackers would have to look it up to say for sure.

The answer is mid-2020, when a bunch of online traders called “Redditors” decided to chase the metal like it was a meme stock, nearly doubling its price in a few months.

That attempt fizzled — see Reddit Group Fails In Effort To Squeeze The Silver Market — and in the ensuing three years silver languished in a painfully boring trading range while its fair-weather friends drifted off to cryptos and AI.

But in just the past few weeks (see the upper-right corner of the above chart), silver’s price has jumped and “squeeze” chatter has resumed. So… is this squeeze for real, or just another case of wishful thinking? Let’s run some numbers.

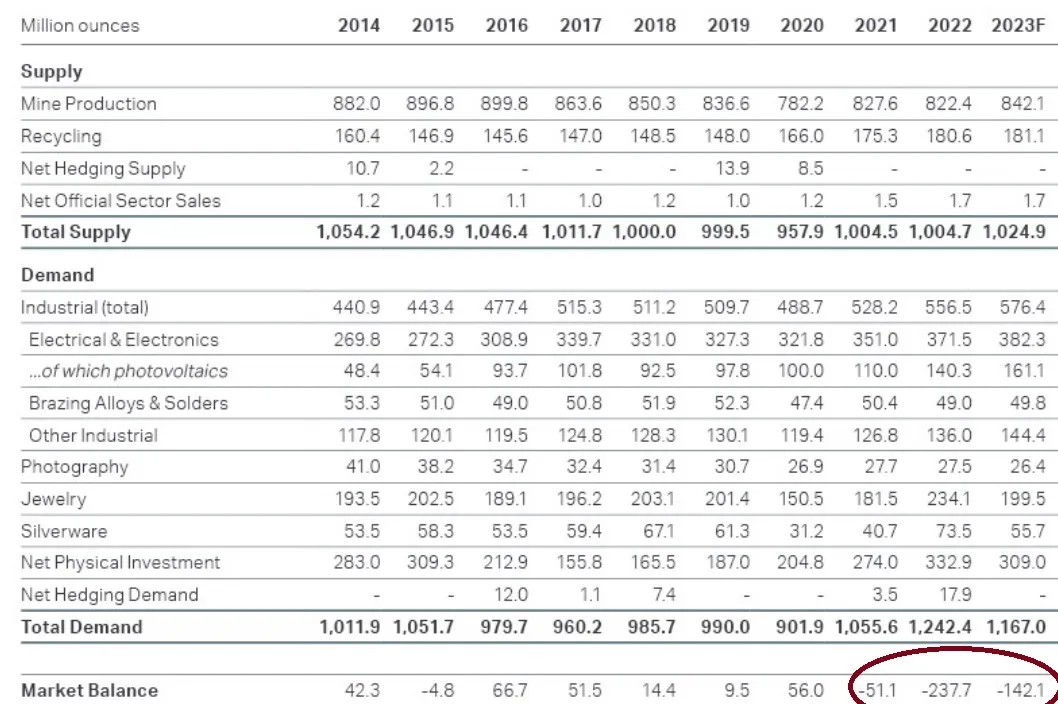

Supply/Demand

According to the Silver Institute, the world’s mines used to produce a bit more silver each year than industrial companies and investors consumed. In other words, the market was in surplus.

But that changed in 2021, when demand started outstripping (stagnant) supply, pushing the market into deficit (see the red circle at the bottom of the table).

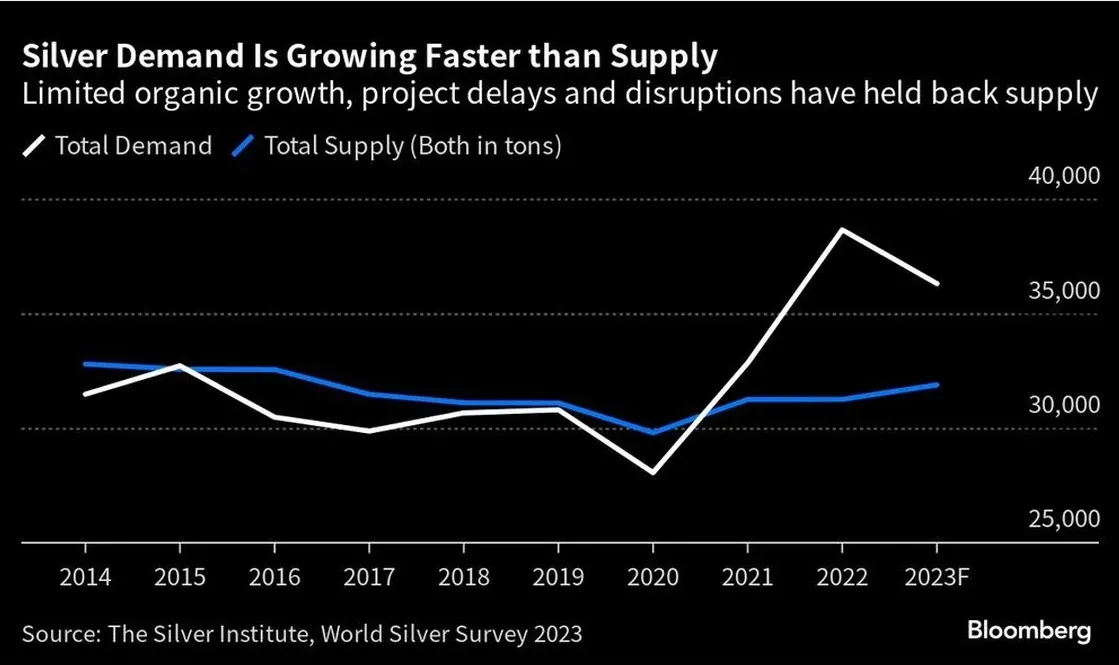

Here’s the supply/demand situation in graphical form:

Today’s supply/demand situation looks good for the squeeze scenario. But the future is where it gets really interesting.

Demand for solar panels, most of which contain silver, is growing steadily (see the “photovoltaics” line in the supply/demand table) and should continue thus for a long time, taking an increasing amount of silver off the market. Scientists at the University of New South Wales predict that solar will use an amount equal to 20% of today’s annual silver production by 2027, rising to 85% by 2050.

And AI chips — which also use silver and are seeing explosive demand — will consume dramatically more silver going forward.

What about existing stockpiles?

A modest deficit can be managed forever if there are inventories sufficient to cover the difference. But that may not be the case for silver.

#silversqueeze is coming, stocks could be depleted in two years – TD Securities

(Kitco) – Daniel Ghali, senior commodity analyst at TD Securities, noted that the growth in silver demand and significant underinvestment in mine supply has created a “universally-recognized structural deficit.” He added that this fundamental imbalance has been largely ignored as markets have focused on massive above-ground stocks instead.

However, Ghali said markets have misjudged just how much silver is available, and this depleted reserve will squeeze prices higher.

“For many years, market participants could safely assume that the behemoth stockpile of above-ground silver would be sufficiently large to satisfy any reasonable scale of demand growth,” Ghali said. “Today, we believe this assumption could potentially be challenged within the next 12-24 months.”

Ghali said that industrial demand, driven by the green energy transition, has completely transformed the silver market. He noted that in 2019, there were expectations that it would take about 165 years to deplete the stockpile of silver.

Ghali said his new two-year target could be accelerated if investors jump back into the market.

“The potential ETF buying activity associated with a typical Fed cutting cycle could dramatically shorten this time span. This poses a significant liquidity risk for silver markets, and makes a legitimate case for a potential #silversqueeze on the horizon,” he said. “Pressure release valves could eventually help the missing silver make its way back to markets, but necessitate higher prices in order to do so. This is an extreme upside convexity trade that is severely underpriced.”

Enter Gold

As central banks become massive net gold buyers (and as the world’s governments destroy their financial systems), that metal’s price is rising. Gold bull markets typically do two things: They attract a lot of generalist money. Then — once the gold price has jumped — they steer investors to silver, which is relatively cheap. Here’s a real-world example of how this works:

‘Silver is the new gold’ as Egyptians try to protect savings

(Reuters) – Egyptian women traditionally receive a gold jewelry set, or “shabka,” on their engagement.

But in the year to Jan. 30, the price of a gram of 21 carat gold rose more than 120% to 3,875 Egyptian pounds ($126), data from the Federation of Egyptian Chambers of Commerce showed.

Demand for gold coins and bars surged nearly 58% from 2022 to 2023, according to the World Gold Council’s annual report.

But as surging prices and a weakening currency have driven up demand for the precious metal, some are getting silver instead. “Silver is the new gold,” said a salesman at a Cairo silver store who only gave his first name, Abanob.

Conclusion

Today’s silver is a very different asset from that of 2020, for several fundamental reasons. Back then, it was in surplus, solar was a tiny source of demand, and AI was nonexistent. Now it’s in deficit, solar is huge, and AI is taking over the world.

Toss in record-high gold prices generating buzz for the precious metals space, and the the silver story is ridiculously favorable. Whether it’s squeeze-worthy depends on when the supply deficit consumes the last available inventory on Comex and other exchanges. At least one analyst views that as imminent.

Coming soon: How Stackers and Other Silver Investors Should Behave During A Squeeze

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino April 4th, 2024

Posted In: John Rubino Substack