April 29, 2024 | Happy Monday Morning!

Happy Monday morning!

Last week we wrote about the big lie, the federal government claims they are going to build 3.9 million homes over the next seven years. Remember that’s 1528 homes per day, or 64 homes per hour for 7 straight years, no weekends off.

So unless the homes look like this, I have some bad news.

Here’s the reality. Housing starts, particularly for condo units have a long lag time. The housing start data you see from CMHC is roughly a year behind the actual market. The projects that are starting were already years in the making, some developer spent a bunch of time and money to rezone, obtain permits, and launch a marketing campaign for pre-sales. At this stage they’re already millions in the hole and have to keep pushing forward.

However, anything that is currently in the planning stages is largely being shelved.

In fact, the entire housing supply chain is at a standstill. The very ingredients that lead to a housing start are hard to come by. Land sites are not transacting, financing is scarce, and pre-sales are slow.

Most projects do not pencil at today’s land prices, yet sellers are often holding firm on pricing. Construction pricing is so high that even a significant reduction in land prices still makes new development challenging. The BC government, albeit well intentioned, has unleashed a flood of new land supply via mass upzoning around transit hubs creating further uncertainties around land pricing.

Financing is at a premium and hard to come by. Many lenders I chat with today are just trying to get their capital back and mitigate losses. There were a lot of bad loans dished out, as one would expect when money was basically free over the past decade. You can paper over a lot of problems when land prices are rising by double digits every year, as they say- a rolling loan gathers no loss. Unfortunately the music has stopped and these loans can no longer be refinanced, for many of these small and medium sized developers the capital calls are simply too large, and the litigation process has begun. It takes time for the pig to pass through the python but the foreclosures are coming.

It appears others in the industry are seeing the same. From an article in the Vancouver Sun this past week.

Beau Jarvis, president of Wesgroup Properties, keeps a running list of Vancouver development site foreclosures, court-ordered sales, and receiverships, which he estimates could total close to 7,000 homes across dozens of different projects at last count.

Jarvis has also tallied another 3,000 or so homes in several Metro Vancouver residential projects that have been put on hold, some of them from established B.C. development companies — including his own.

“Today, the development environment is probably the most challenging it’s ever been in my career over 20 years,” Jarvis said. “There’s a huge amount of risk and the returns are absolutely not commensurate with that risk.”

Alan Frydenlund, a lawyer with Vancouver firm Owen Bird, which specializes in commercial foreclosures, has seen upticks in foreclosures over his four-decade career, but says the past year or so in Vancouver has been busier in terms of big real estate insolvencies than any time since the early 1980s, including the 2007-08 financial crisis.

Of course none of this is bullish for pre-sales, but like I said, some developers are already pot committed, and the big ones need to keep the lights on and the staff employed. So there’s still a trickle of pre-sales hitting the market.

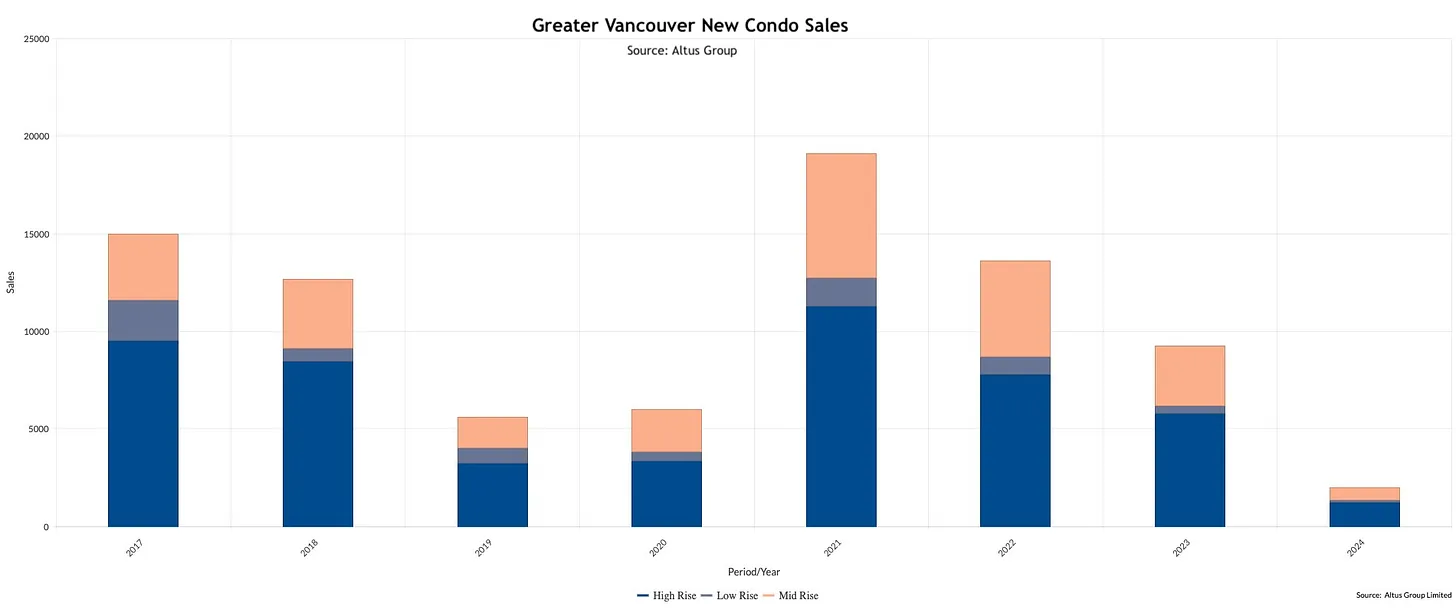

We are on track for less than 5000 pre-sale condo units sold this year across Metro Vancouver, per data from Altus group. Down from nearly 20,000 during the free money era.

Pre-sales lead housing starts and it doesn’t look pretty.

There are a lot of political careers hanging in the balance, hoping they can arrest the economic cycle and keep the shovels going. Unfortunately there’s nothing that can be done, the insolvency phase is in motion, and not even a few rate cuts from Tiff Macklem can turn this ship around.

Bon voyage.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky April 29th, 2024

Posted In: Steve Saretsky Blog