March 10, 2024 | P.T. Barnum Would Have Loved Bitcoin

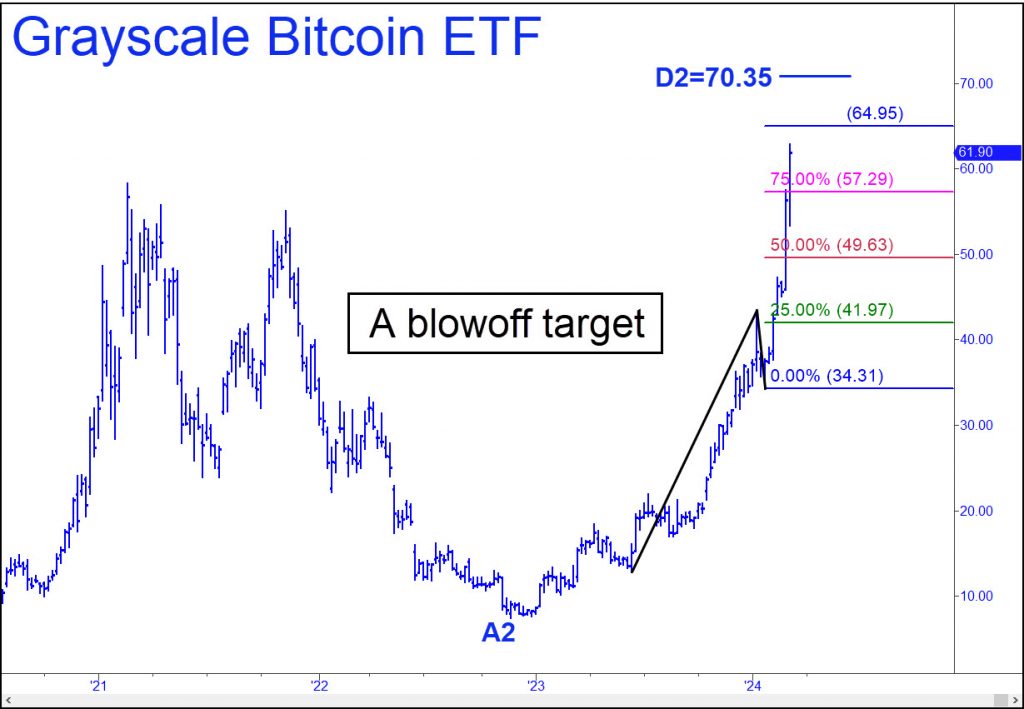

Bitcoin mania looks likely to blow itself out at somewhat higher levels. The bitcoin ETF chart above suggests buyers will encounter significant resistance at 64.95, a Hidden Pivot target that lies 5% above Friday’s closing price. If this impediment gives way easily or is exceeded for two consecutive weeks on a closing basis, however, you can expect more upside to the alternative target at 70.35. That’s fully 14% above these levels, and although that might seem to portend a powerful move, especially if it occurs in a matter of days, it would probably come as a huge disappointment to countless bitcoin fanatics who have been weaned and nurtured on predictions of $100,000 or more.

I doubt we’ll see anything like that, especially since the shitballs who control bitcoin, Black Rock chief among them, will have reaped more than their directors could spend in a thousand lifetimes if it climbs ‘only’ another 14% . It is for their benefit that regulators approved bitcoin ETFs in the first place, making the cryptocurrency affordable to riff-raff who had been priced out of the market even at its bear-market low near $15,000 in January 2023. Fractional ownership, including with leveraged options, made it possible for kids who were collecting Pokemon cards just a few years ago to become players in the global casino.

Virtual Tulips

It’s hard to imagine how high tulip-bulb prices would have climbed if Dutch teenagers had had access to virtual tulips in 1637, when the mania peaked. We are going to find out, though, when the crypto blowoff sputters out, as all manias eventually do, for lack of greater fools. In the meantime, here’s a link to a recent interview I did with Howe Street‘s Jim Goddard. It explains why bitcoin would be more reasonably priced at $1-$2 instead of $70,000-$80,000.

Full disclosure: I was involved in a crypto scam myself that promised to triple one’s stake in three years. It paid off not in dollars, but in crypto-credits that could be redeemed for Ethereum, which in turn could be swapped for actual money. Unfortunately, when bitcoin collapsed from $70,000 to $15,000 in 2022, my credits, along with nearly all of the 2000 boutique flavors of cryptocurrency that had come to exist at that time, became worthless. I lost only a few thousand dollars, however, because I signed up mainly to see how the scammers, mostly young Asians, worked the grift rather than to make a quick buck. I remain impressed to this day by how these ass-bandits were able to hang tough for long enough to rip off the public much worse this time and to vastly expand the pool of suckers far beyond anything P.T. Barnum or Bernie Madoff could have imagined.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman March 10th, 2024

Posted In: Rick's Picks

Next: Higher for Longer? »