Saturday’s Report on Business included an insightful investigative report on private debt funds that became all-the-rage during the 2009-2022 low-rate era. See The risks of Bay Street’s hottest funds: Investors often fly blind, and billions of dollars are now trapped:

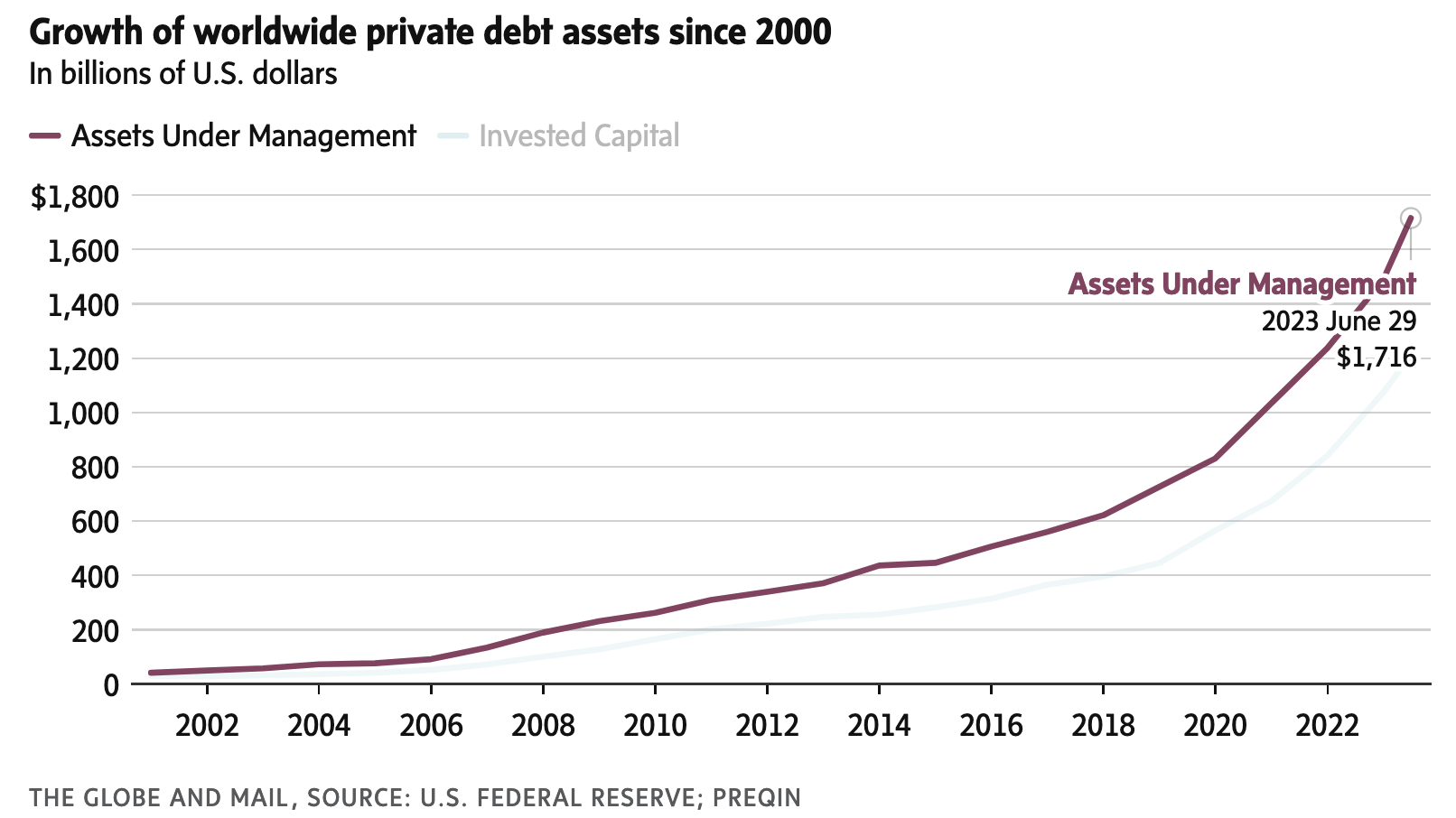

The 2008-09 global financial crisis was a major catalyst for the sector’s growth. Before the crash, there were plenty of other ways to find yield, such as bonds and income trusts. But after 2008, central banks cut interest rates to near zero and kept them there for years. To adjust, retail investors – and baby boomers in particular – went hunting for higher-yielding securities.

It wasn’t until 2015, though, that private debt really took off, driven by two additional forces.

Around this time, low-cost ETFs had become quite popular, so investors were demanding more from money managers who wanted to charge high fees. For many fund companies, the answer was adding a suite of “alternative investment” funds that specialized in sectors such as infrastructure assets, private equity and private debt, which used to be reserved for big institutions.

Financial strain has spread as central banks embarked on the most aggressive rate-tightening cycle in over 40 years. Lenders allowed borrowers to ‘extend and pretend’, adding interest to loan balances. At the same time, cash redemption requests from fund investors have exploded:

Over the past two years, redemption requests have exceeded …limits at multiple Canadian funds, and the rush to exit has been so strong that they’ve had to halt or limit redemptions.

Funds that invest in illiquid assets but promise liquidity to unitholders were always a lie. Investors are learning this the hard way, once more.