March 19, 2024 | Housing Wealth

Happy Monday Morning!

In what seems like a recurring theme of late, inflation came in hotter than expected in the US this past week. Consumer prices increased 0.4% for the month and 3.2% from a year ago. Meanwhile, core CPI rose 0.4% on the month and was up 3.8% year-over-year. The last mile on getting inflation back within the feds 2% target is proving increasingly difficult.

The takeaway here is that the US data really doesn’t warrant rate cuts, and markets are now coming around to that view.

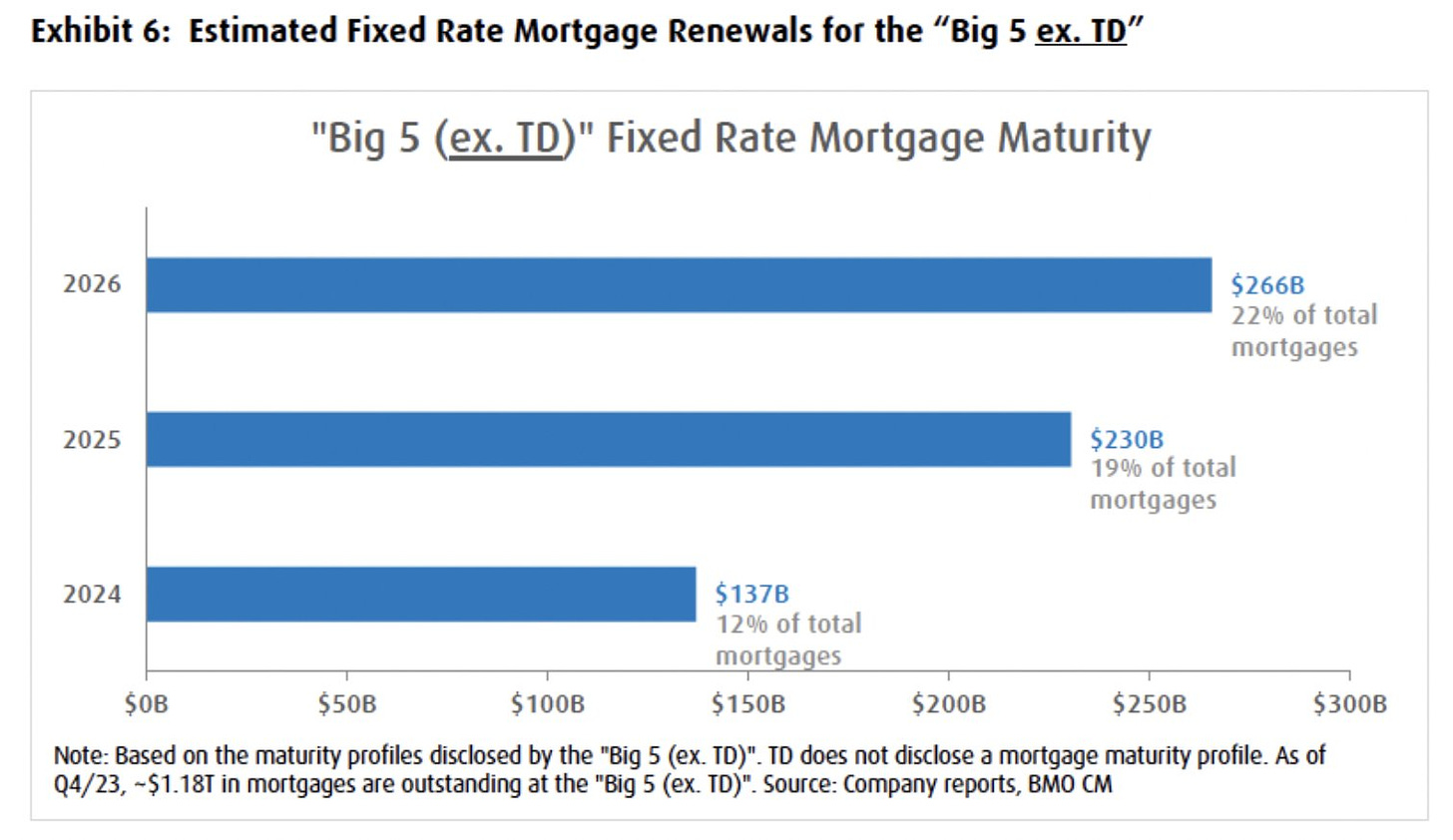

Up north, this is quite the predicament for the Bank of Canada who, let’s be honest, wants to and needs to cut rates but can’t. Tiff and friends are stuck between a rock and a hard place. Real GDP per capita has been falling for six consecutive quarters and highly levered households are facing a wall of mortgage renewals. Over 50% of the mortgage float still has to renew at significantly higher rates.

This would be less of a problem, of course, if rates come down soon- but those hopes are slowly fading as evidenced by the recent string of US data we highlighted earlier.

It’s worth asking ourselves how things will look if the Bank of Canada is only able to squeeze in a couple of rate cuts this year, and perhaps, none. Seems unthinkable today, but the market was also pricing in five rate cuts at the start of the year and that is now increasingly unlikely.

Meanwhile, bond yields are moving higher once again, and it appears we may have seen the low in fixed rate mortgages for this spring market. If so that means the floor for mortgage rates this spring will rest at a minimum of 5%.

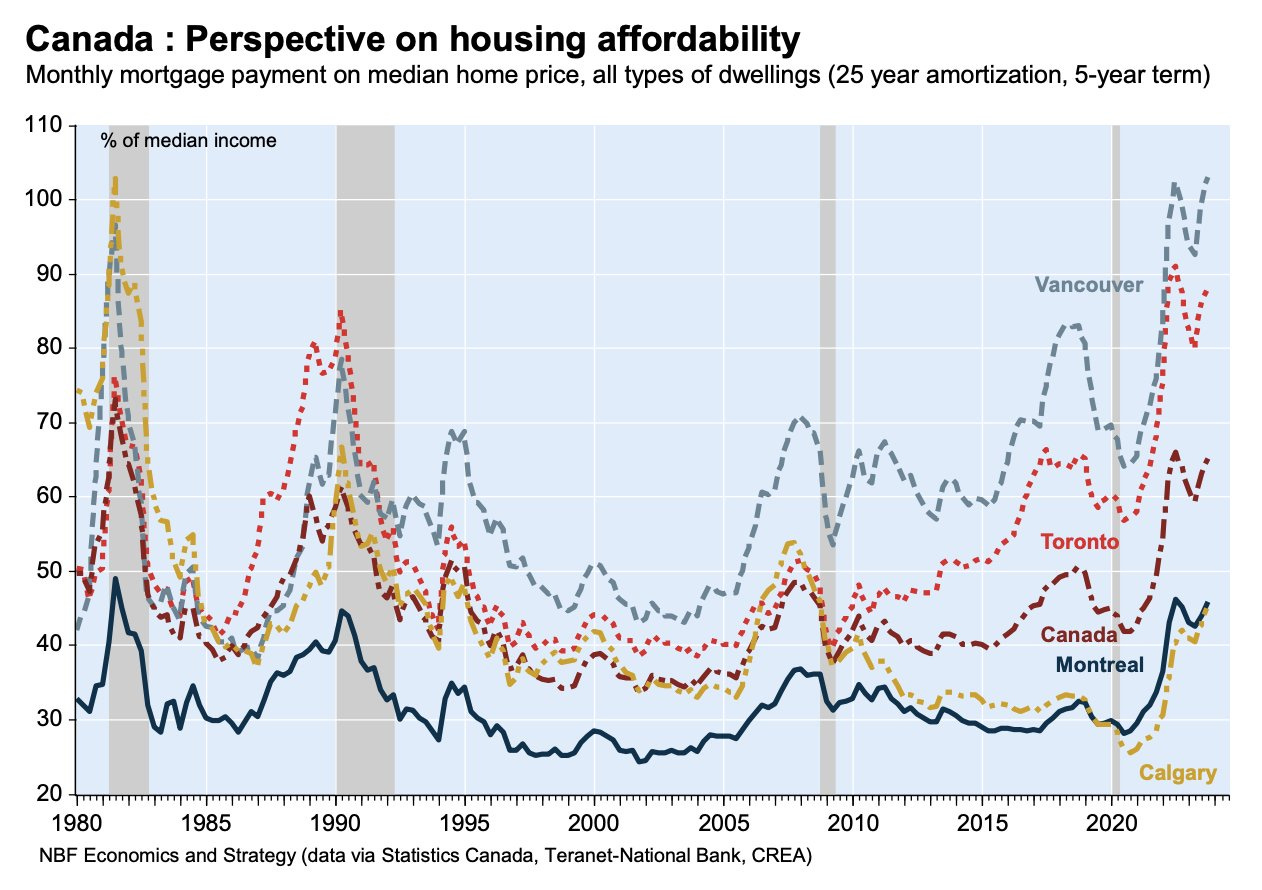

Barring an unforeseen drop in mortgage rates and or a material drop in house prices, housing affordability will remain challenged in this country. Housing affordability in many Canadian markets is approaching or exceeding the worst levels of affordability dating back to the 1980’s.

Homeownership has become a pipe dream for many without access to existing home equity or family wealth. According to a recent report from RBC, it has never been more difficult to get into the housing market.

Only about one-third of Canadian income earning households earn enough to purchase a single-detached home on their income alone. This is a stark difference from 2005 when half of Canadians earned enough to purchase a home on just their income. More middle and upper-income earners are joining the rental pool, which is pushing rents higher. Per Urbanation, asking rents for all residential property types in Canada averaged $2,193 in February, jumping 10.5% year-over-year — the fastest rate of annual growth since September 2023.

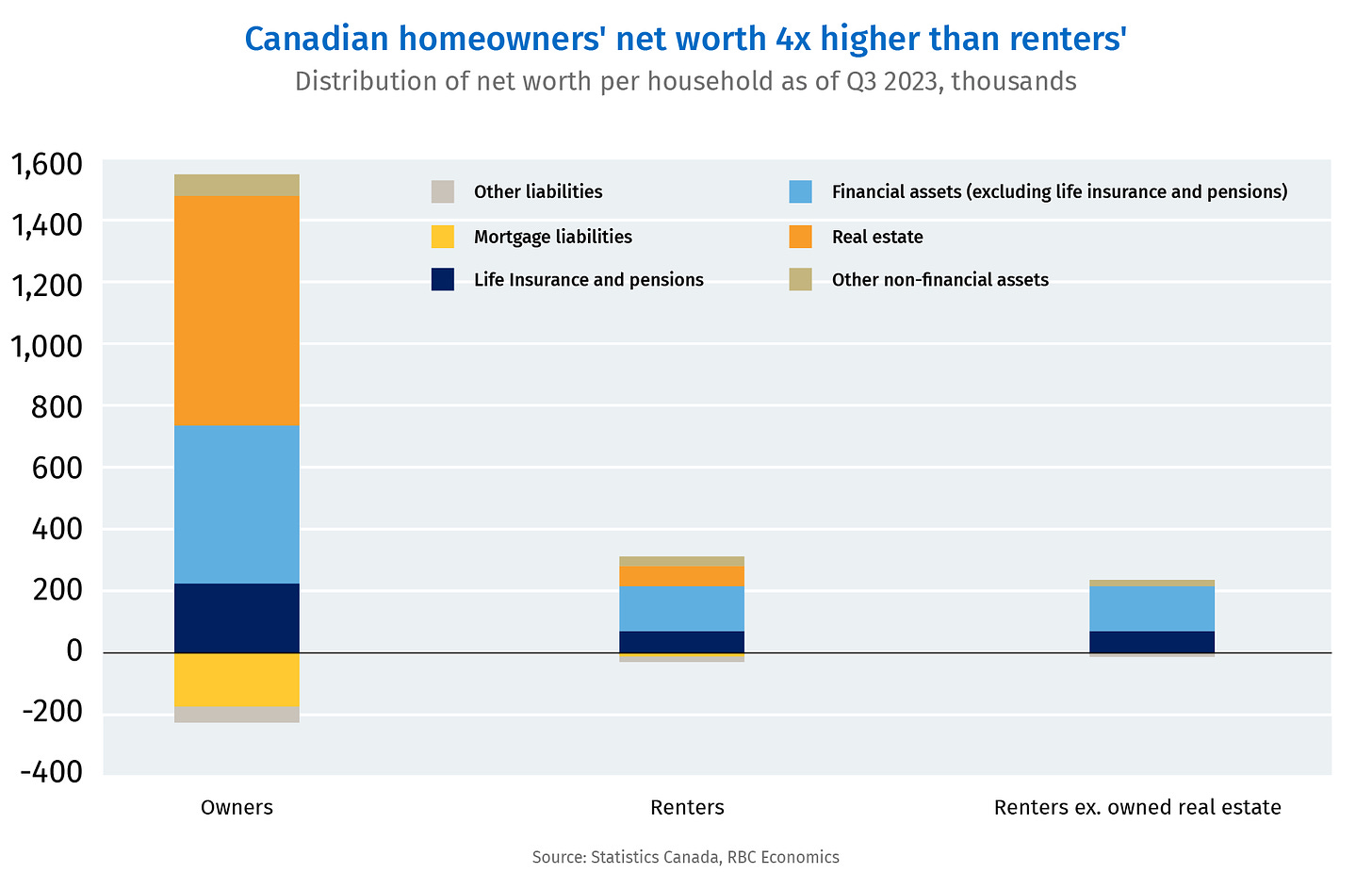

As such, renters are dissaving to a greater extent because they are grappling with higher living costs, making saving for a down payment harder than ever.

In other words, if you’re not on the housing ladder you are falling further and further behind. Per RBC, Canadian homeowners networth is four times higher than renters!

Eventually this housing wealth will be passed down to the next generation, you just have to hope you’re part of the lucky sperm club.

It’s no wonder tensions are mounting.

Let’s be honest, the housing crisis isn’t going to be resolved anytime soon, the wealth gap will continue to balloon further, especially when the next crisis hits and the fiscal and monetary floodgates unleash another wave of currency debasement.

This is setting the stage for further volatility, even the RCMP are worried. In a recent RCMP report called ‘the Whole-Of-Government Five-Year Trends For Canada’ they note, “The coming period of recession will also accelerate the decline in living standards that the younger generations have already witnessed compared to earlier generations.”

Further adding, many Canadians under 35 are unlikely to ever buy a place to live. The fallout from this decline in living standards will be exacerbated by the difference between the extremes of wealth, which is greater now in developed countries than it has been at any time in several generations.”

Concerning yes, but still avoidable. Let’s hope our elected officials are paying attention.

Stay nimble out there.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky March 19th, 2024

Posted In: Steve Saretsky Blog