March 24, 2024 | Bullish and Bored? Here’s the Cure…

The Fed’s main job supposedly is to manage our expectations, but have Powell & Co. painted themselves into a corner? At the moment, it would appear that investors have no clue what to expect. That wouldn’t necessarily be a bad thing, except that their default mode has been to push stocks with multitrillion dollar capitalizations into unsustainably steep rallies. This trend is growing more dangerous and delusional by the week, and even a slight feint toward monetary clarity by policymakers could pop the bubble, turning an economic boom quickly into a global downturn. Meanwhile, the Fed’s credibility suffers every time they suggest inflation is mellowing. What their hemming and hawing suggest in reality is that no one on the Open Market Committee has bought gas or groceries in a long time.

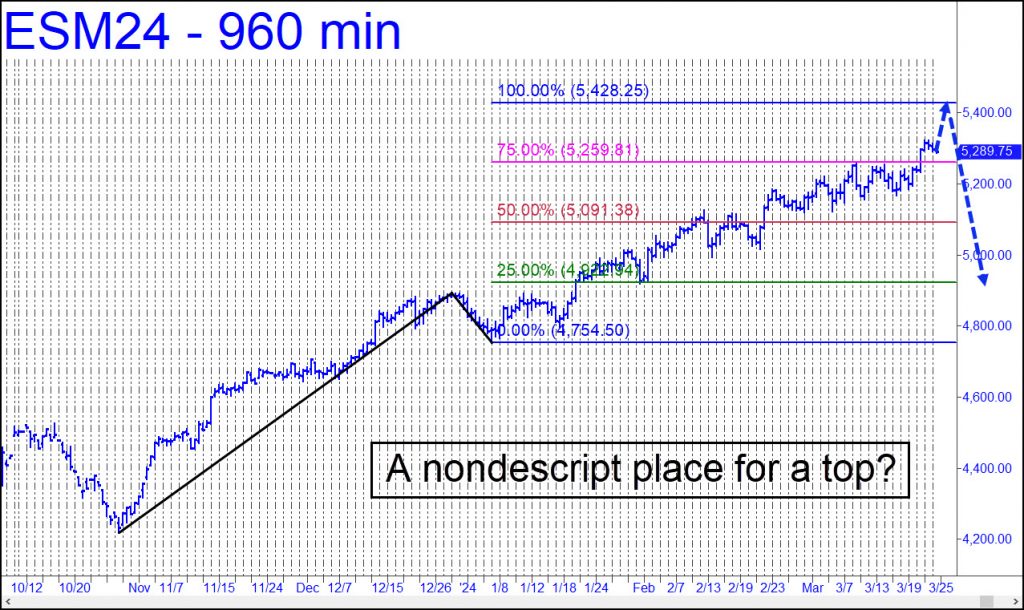

Stocks have been in an unnaturally steep climb since October, and no one would be surprised to see it end. Yeah, you’ve heard that before. But we’ll continue to serve up bear market porn anyway because the bullish case is too stupid and boring to write about. However bullish you might be, let’s face it: Stocks do not remotely deserve to be trading at these levels, and only an imbecile or someone paid to lie about it would argue otherwise.

Lunatic Sector

So how soon might we expect the market to go into a hellish dive? The chart above suggests the S&P Index could make an important top just 2.6% above these levels. We like the target because there is so little drama in the chart pattern that produced it. However, in order to entertain the possibility it will mark the end of the bull market, we must put aside the observation that some key stocks in the institutionally blessed lunatic sector — specifically Microsoft, Nvidia and Facebook — have already topped within a hair of major Hidden Pivot targets. NFLX in particular looks to have ejaculated last week with a high at 634.36 that exceeded a longstanding target at 632.47 by just 0.3%.

If you care, make a mental note of 5428.25 as an opportune place to short the bejeezus out of the S&Ps. And if we’re wrong, don’t let it distract you from the certainty that bear markets do happen, and that this bull is w-a-a-a-y overdue for a comeuppance.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman March 24th, 2024

Posted In: Rick's Picks

Next: The Immigration Relief Valve »