February 10, 2024 | Trading Desk Notes For February 10, 2024

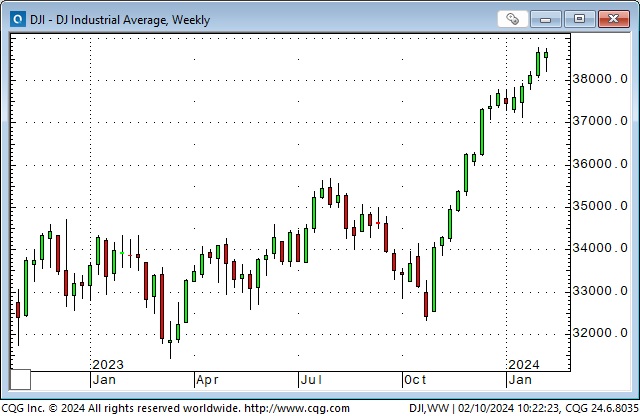

Stock indices continue to rally

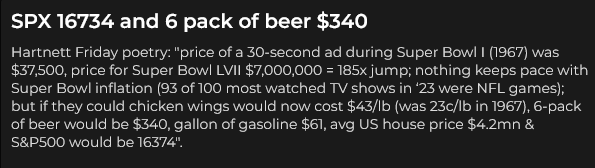

The DJIA is up ~6,500 points (~20%) from the October lows, closing higher for 14 of the last 15 weeks (a multi-decade record.)

The Nasdaq 100 is up ~68% in 14 months since the January 2023 lows.

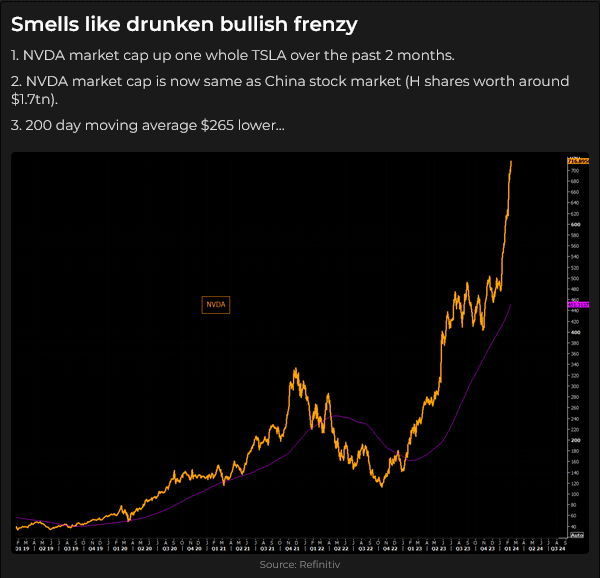

NVDA has rallied ~$250 (52%) in six weeks from its January 2024 lows and is up ~$581 (5x) from its January 2023 lows. The current market cap is ~$1.8 Trillion.

Eli Lilly, a heavyweight in the healthcare sector, is up ~28% in six weeks from its January 2024 lows (weight loss drugs) and ~140% from its March 2023 lows.

The Japanese Nikkei index is up ~ 45% from its January 2023 lows at a 34-year high. It is about 5% below the All-Time Highs made in December 1989.

The Nikkei has rallied ~4X since 2012 when PM Abe introduced his “Three Arrows” program to revitalize the Japanese economy. The Yen has fallen ~50% against the USD since 2012 as the Nikkei has rallied.

The Euro Stoxx 50 Index (the European version of the DJIA) is up ~46% from its October 2022 lows at a 23-year high.

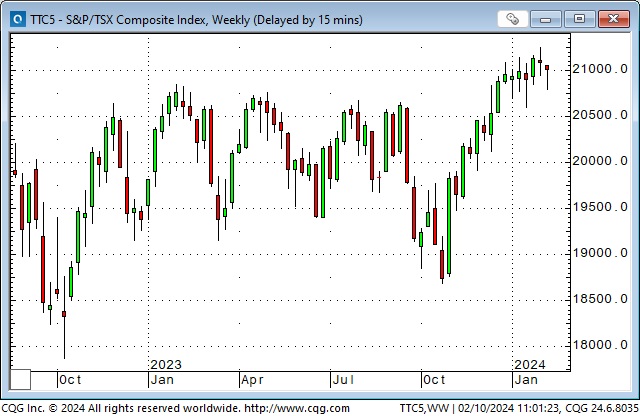

The Toronto Composite Index is up ~12% from its October lows at a 2-year high.

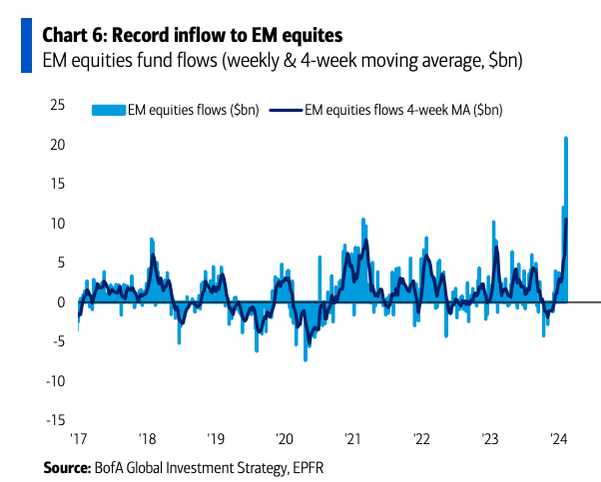

The Shanghai Index fell to a 5-year low early this week, down ~38% from the 2021 highs, but bounced back in anticipation of government action to reverse the decline. The Chinese market cap has declined ~$7 Trillion from the 2021 peak.

Capital flows into EM equities (China) have spiked over the last two weeks. Somebody is feeling lucky.

Chinese stocks have fallen (blue and green lines) even as the PBoC has ramped up liquidity (white line) as deflationary pressures from falling property prices weigh on consumer confidence. (CPI is down 0.8% YoY at a 15-year low. Will China export deflation the world?)

The Regional Banking ETF hit All-Time Highs of ~$79 in January 2022 before the Fed began raising interest rates. The ETF plunged in March 2023 on the SVB crisis and hit 3-year lows at ~$35 in May 2023. It rallied from October to December 2023 as virtually all stocks rallied but faltered the past two weeks as troubles at NYCB reawakened concerns about regional bank exposure to commercial real estate.

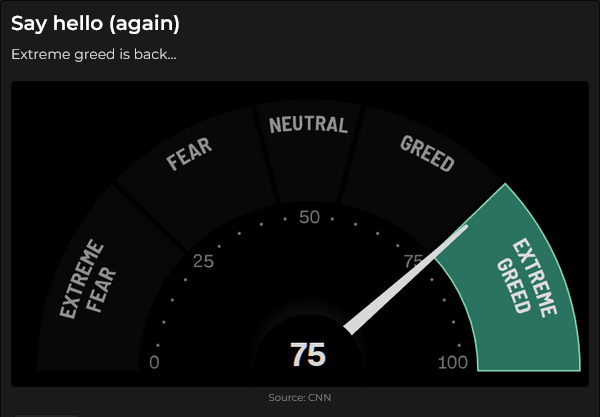

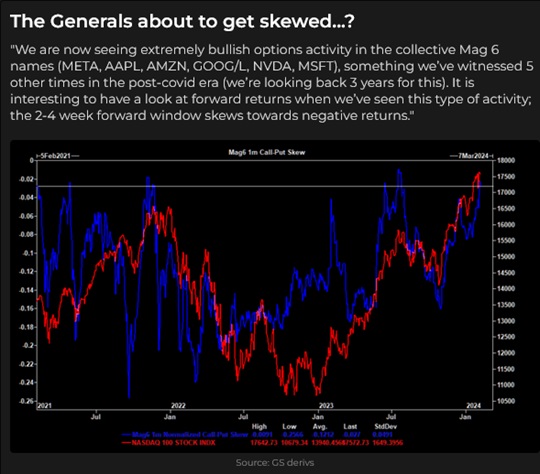

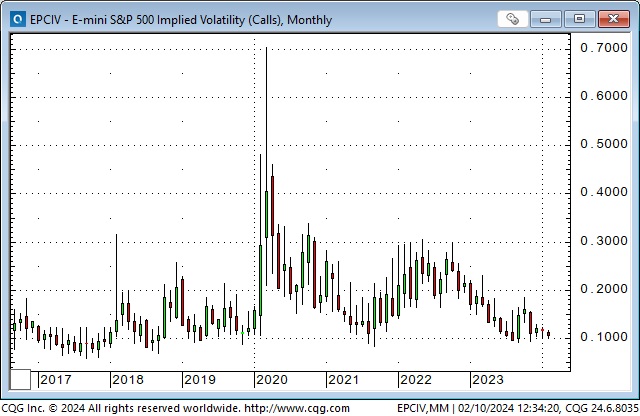

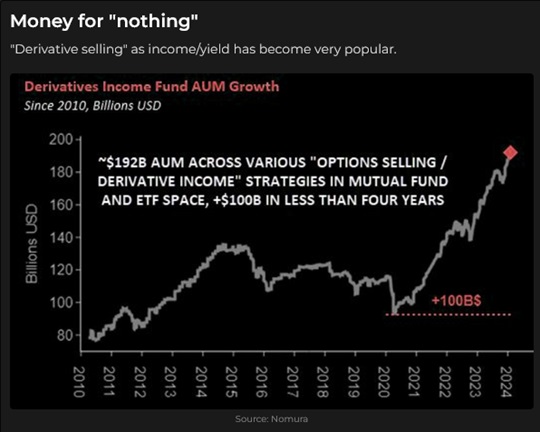

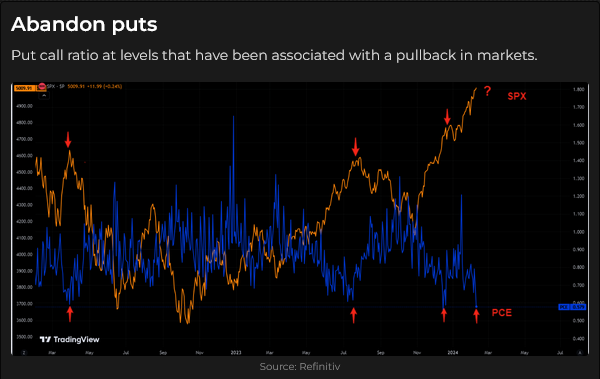

Stock options

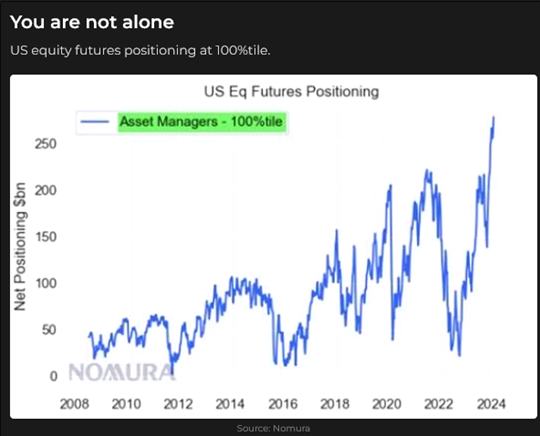

Option VOL has fallen to historically low levels as 1) share prices continue to rally, 2) nobody wants puts, 3) “yield enhanced” products (extra “yield” generated by writing options against core positions) receive a flood of new cash and 4) writing naked puts is seen as “free money.”

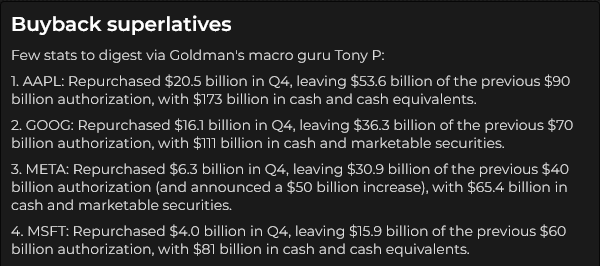

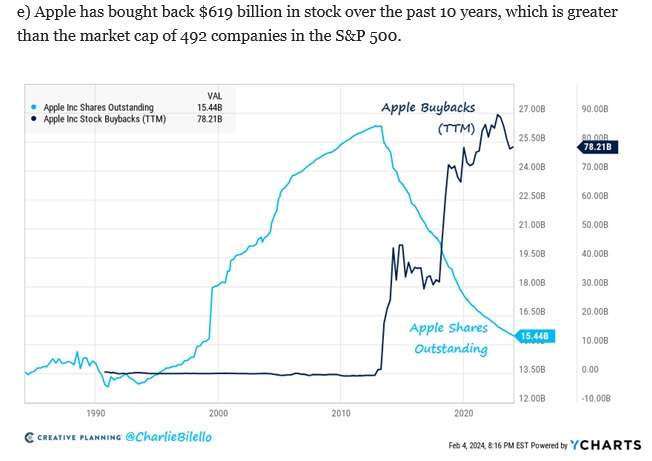

Share buybacks

Consumer confidence

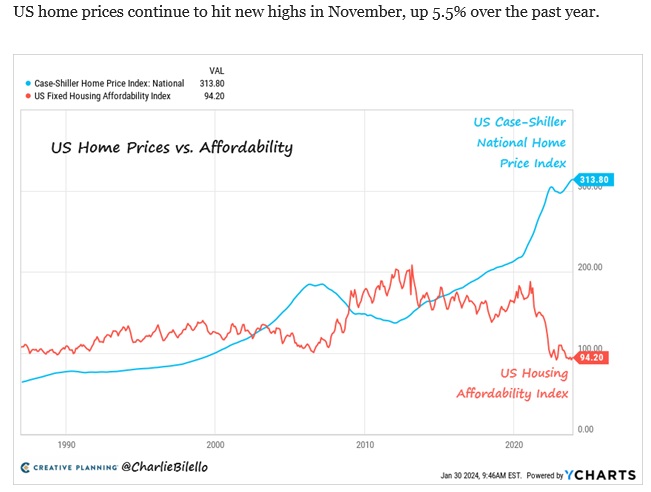

Housing unaffordability

Correlation breakdown

From late October to late December, stock indices, bonds, gold and foreign currencies trended higher together on thoughts that the Fed would aggressively lower interest rates (6 x 25bps) throughout 2024.

But since the turn of the year, markets have been pricing fewer cuts from the Fed (4 x 25bps) and bonds, gold and foreign currencies have fallen while stocks have continued to rally.

Energy

WTI fell ~$7 last week and rallied back ~$6 this week.

NYMEX Natural gas futures fell to a 4-year low (below $2) this week, near the lowest prices seen over the last 20 years. On an inflation-adjusted basis, NGE is probably the cheapest it has been in decades.

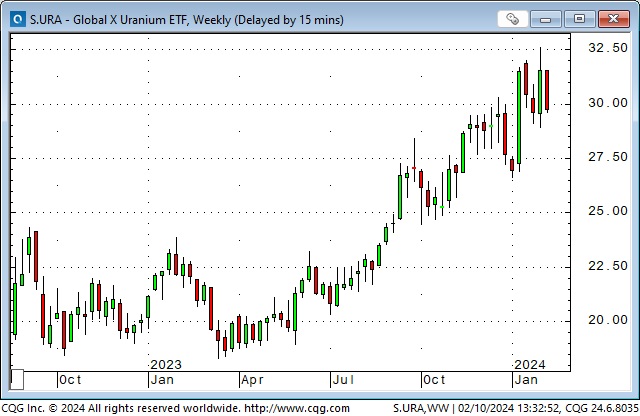

Uranium prices ran well throughout 2023 and early 2024, primarily driven by a bullish “supply shortage” story. The market ran too high too fast and has fallen back from its highs the past couple of weeks, even as critical producers have acknowledged that they will be unable to deliver on their commitments.

Commodities – hot chocolate!

Cocoa is up ~50% over the last five weeks to All-Time Highs on supply shortages from the two principal producers, Ivory Coast and Ghana.

Orange juice futures quadrupled to All-Time Highs from 2020 to 2023, fell back ~30%, but have rallied sharply the past few weeks.

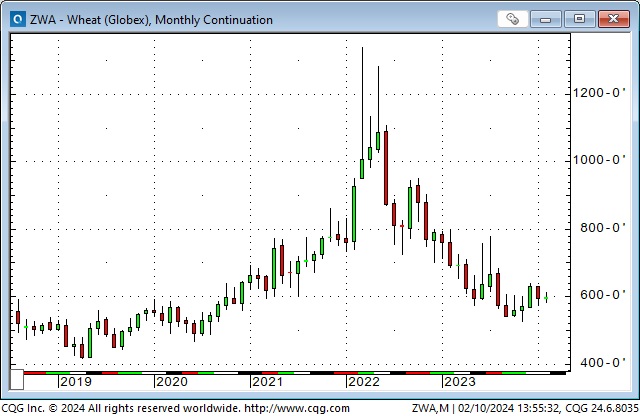

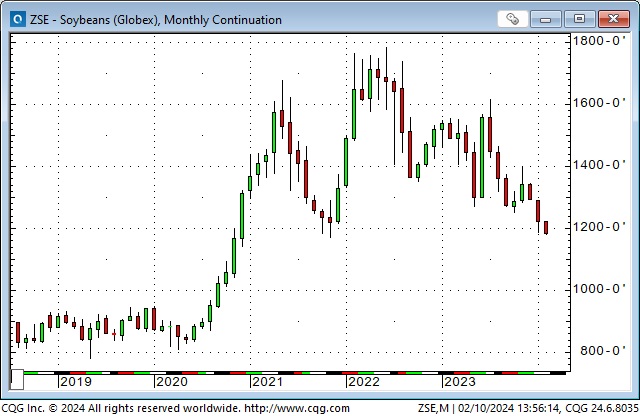

Grain prices soared in 2020 – 2021 on COVID-related supply worries, then rallied again following the Russian invasion of Ukraine, but have fallen dramatically from those highs.

My February 2, 2024, World Outlook speech highlights

*Global energy demand will keep growing, but where will the energy come from, how will it get delivered, and who will decide how it gets used?

*My favourite macro energy analysts are Doomberg, Robert Bryce, Goehring and Rosencwajg.

*Energy is a story of transitions – from using “fire” for heat and light, we have developed the technology to provide electricity on demand to billions of people.

*People have moved up the “food chain” of energy sources as they became more affluent and had greater access to technology.

*Emerging and developing markets will be a vast new source of energy demand (over 1 billion people still have no access to electricity) as those people want the kind of life that people in developed markets take for granted.

*Energy transitions from now forward will be far more expensive and “contentious” than we can imagine. Governments have become more “bossy” as they mandate new energy policies, and citizens object.

*Remember Thomas Sowell: There are no solutions, only trade-offs.

*”Contentious” energy negotiations will add to price volatility.

*Relatively small changes in supply/demand ratios can create price volatility.

*Geopolitical stress and “political interference” can add volatility to energy prices.

*Natural disasters, like the Fukushima tsunami (and its knock-on effects on nuclear energy and the uranium market), can cause price volatility.

*The proposed transition from ICE to EV vehicles is causing price volatility.

*Lithium prices have been subject to dramatic volatility.

*There is an incredible range of trading and investment opportunities in the energy markets; fortunes will be made and lost – learn how to manage risk.

My short-term trading

I did minimal trading in the week leading up to and the week following the February 2 & 3 World Outlook Conference. I twice shorted stock index futures, and each time, I was quickly stopped for a slight loss. I had no open positions at the end of this week.

On my radar

The US CPI report Tuesday morning will be the key scheduled event of the week ahead. A stronger-than-expected number could cause a sell-off in stocks, bonds and FX; a weaker number could have the opposite effect.

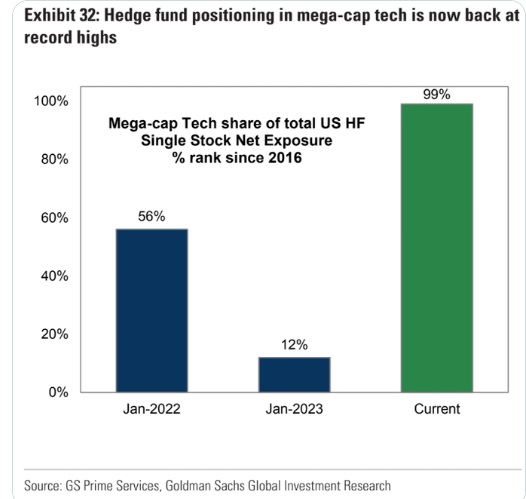

I was on the closing panel at the Conference, and when asked for a trading idea, I said that I thought the market was much more fragile than people were pricing. Volatility was very low (complacency, vol selling, nobody wants puts), and I would watch for an opportunity to fade consensus by buying options (positive convexity.) For instance, buying stock index puts could produce a double-whammy of gains (falling stock prices and rising volatility) with limited risk.

Quotes of the week

“Emerging markets are markets you can’t emerge from in an emergency!” Donald Coxe

“Reversion to the mean is the iron rule of the financial markets.” John Bogle

“If I have to wait (for a long time) for (price action) confirmation (i.e., a bull market falters on good news), then I will wait because not losing money is just as important as making money over time.” Jason Shapiro.

“Policymakers are imposing too many restrictions on working people in the name of environmental progress.” Alice Hancock and Andy Bounds in the Financial Times February 9, 2024

Thoughts on trading

The Barney report

I was away from home for four days at the Conference in Vancouver (my trip to Mexico was cancelled when my host had unexpected heart surgery – he recovered well), and Barney was delighted to see me when I got home! We had several long off-leash walks (off-leash runs for him), and I thoroughly enjoyed seeing him so happy to be running free.

Listen to Victor talk markets with Mike Campbell

This morning, in my 9-minute segment with Mike on the Moneytalks podcast, we discussed the complacency in the soaring stock market, emerging markets (China especially), interest rates, natural gas and the declining purchasing power of currencies. My segment starts around the 53.30 mark. You can listen to the show here.

Online streaming access to The World Outlook Financial Conference: https://mikesmoneytalks.ca/

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES GOING BACK SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair February 10th, 2024

Posted In: Victor Adair Blog

Next: Desperately Seeking Neutral »