February 16, 2024 | Commercial Real Estate Slump in U.S. Could Trigger a Crisis

Commercial real estate is a major asset class for businesses, institutional investors, and banks. For decades, most lenders were eager to accept commercial real estate as collateral for loans. Also pension plans and insurance companies regarded properties like office towers as safe, long-term investments. But doubts are appearing over the quality of those holdings with recent sizeable price declines in the sector.

Will the current crash in commercial real estate trigger a full-blown banking crisis?

A year ago, three regional banks failed, because of losses on investment portfolios that included government bonds. The value of those bonds declined precipitously as interest rates rose, causing depositors to pull funds from several medium-sized banks. Silicon Valley Bank and Signature Bank disappeared as a result while Credit Suisse merged into UBS. But that mini crisis cast a spotlight on commercial real estate lending by small and mid-sized banks and the close-up picture was not pretty.

Last March 31, I wrote a piece on that bank crisis.

We see now that issues with commercial real estate loans are growing.

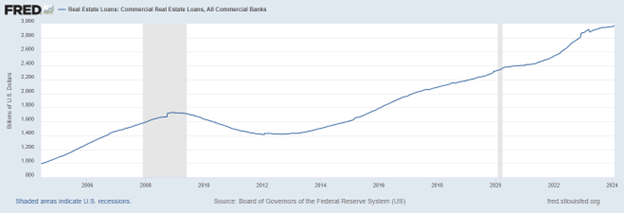

Source: FRED – St. Louis Fed

The size of commercial real estate loans has tripled in twenty years, with even faster recent growth in loans at smaller banks.

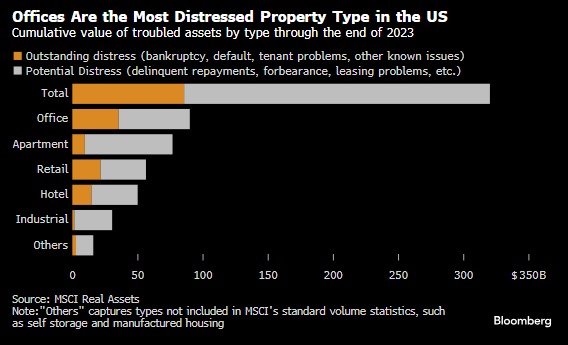

As it happens there is a substantial proportion of loans that come due in the next year — $1 trillion worth. Some of those loans are already in difficulty, with office buildings the most troubled asset class.

To put that into perspective, the total size of the U.S. commercial real estate market is $20 trillion.

While $350 billion is only a small fraction of the total value of all commercial properties, even a small number of sales of distressed properties at a big discount can cause trouble for all lenders. Other borrowers with loans backed by commercial buildings can be required to “mark-to-market” the value of their holdings to the current sale prices. This re-pricing can put them offside on the covenants in their loan agreements, which can force them to sell also.

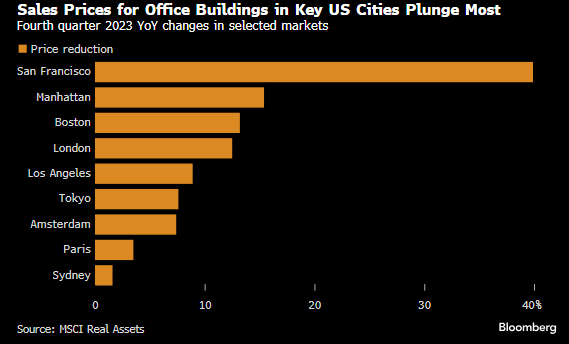

According to Bloomberg, some office towers in Manhattan and San Francisco are selling for fifty cents on the dollar:

“In Manhattan, brokers have started to market debt backed by a Blackstone Inc.-owned office building at a roughly 50% discount” Bloomberg February 13, 2024

A widely publicized example of distress is a Brookfield unit which defaulted on a 41-story office building in Los Angeles which had dropped in value to $210 million with loans outstanding worth $446 million.

Office towers in San Francisco are seeing price declines of 40 percent year-over-year to the end of December 2023:

While the same pressure on prices is seen in other world centres, large U.S. cities are feeling the most pain.

Janet Yellen, U.S. Treasury Secretary, said, “I am concerned … I believe it’s manageable, although there may be some institutions that are quite stressed by this problem.”

Of course, officials often make similar statements about “manageable” problems, but major crises still happen periodically, usually because of excessive debt and speculation.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth February 16th, 2024

Posted In: Hilliard's Weekend Notebook