January 8, 2024 | Poetic Justice, Part 1: The Corporate Profit Squeeze

The past few years were — we were told — an emergency in which all had to sacrifice for the greater good.

So how did corporate profits rise by $1 trillion during that same time?

Charles Hugh Smith, whose excellent substack recently launched, just posted an explanation for this seemingly impossible (or at least counterintuitive) event. I’m just going to paraphrase a bit and cut/paste a single chart before moving on to the schadenfreude, so read Charles’ entire post at What’s the Source of the Astounding 50% Boost in Corporate Profits?

To summarize, companies made everything smaller, lower-quality, and less available, and then jacked up prices (because supply chain!). Voila! Profit margins expanded, and earnings popped. Oh, and stock prices rose on all the positive earnings surprises, thus enriching the architects of the disturbingly convenient cash grab. Charles summarizes the process in this chart:

Now for that poetic justice

The fun thing about pendulums is that they frequently overshoot from one extreme to the other. The coming the overshoot will favor:

- Workers, who will get much higher pay packages, shifting operating profits from management/shareholders to labor.

- Consumers, who — because they’re broke are therefore becoming more discerning shoppers — will demand and get better treatment and higher quality.

The losers? Stockholders and traders who feasted on all those positive profit surprises will face a decade-long drumbeat of disappointing earnings as companies have to pay their workers more and treat their customers better at the expense of the bottom line.

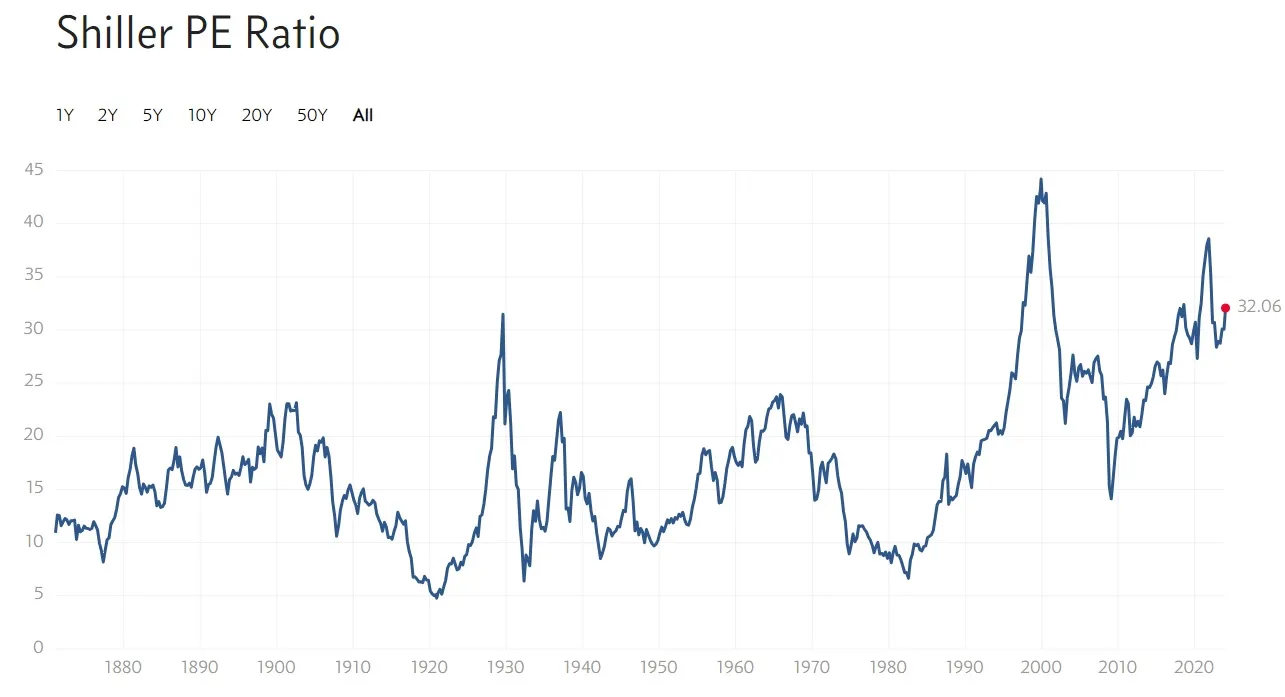

Below is economist Robert Shiller’s “cyclically adjusted” P/E ratio for the S&P 500. As you can see, stocks have been this richly valued just a few times in the past 150 years, and each time the result was brutal. So combine today’s overvaluation with a long stretch of falling corporate profits, and only the short sellers will be looking at “easy money.”

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino January 8th, 2024

Posted In: John Rubino Substack