January 29, 2024 | Kneecapped

Happy Monday Morning!

As expected, the Bank of Canada maintained rates at 5% this past week. While Tiff pushed back on rate cut talk, he did leave us with some clues. “If the economy evolves broadly in line with the projection we published today, I expect future discussions will be about how long we maintain the policy rate at 5%.”

In other words, the discussion is transitioning as to when they should begin cutting rates. Markets are currently expecting the first cut in June, and finishing the year 100bps lower than we currently stand. There’s just one problem, markets are often wrong, and this time might be no different.

There are signs emerging that eager home buyers are trying to front-run the BoC. It’s early in the new year but housing activity has suddenly perked up, coming off one of the slowest years in recent memory. However, if housing gets too hot this spring (just as it did last year) it only boldens the case to push rate cuts further out, much to the chagrin of housing bulls and those facing mortgage renewals. As always, there are a lot of variables at play, let’s watch.

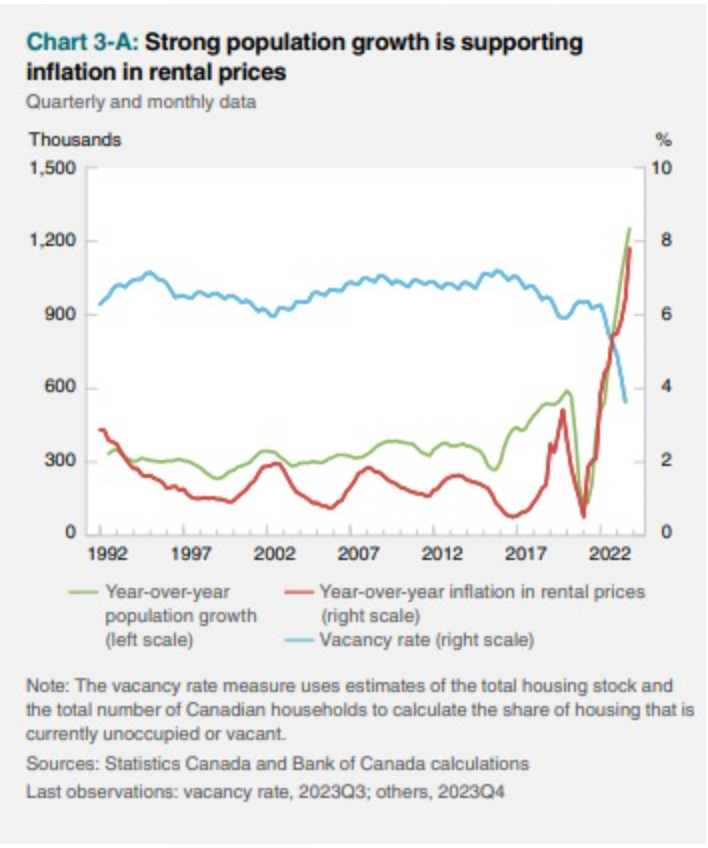

Speaking of variables, if you dig through the Bank of Canada’s recent monetary policy report an interesting chart emerges.

It turns out we’re not the only ones flagging rampant population growth overwhelming the rental market and pushing CPI higher. “We’ve had a long-standing structural supply issue on housing in Canada, with the rapid rise in immigration recently, that has exacerbated that problem.” Not necessairly an original comment but we appreciate it nontheless, Tiff.

The immigration fiasco has garnered enough public pressure not only from the media but now from the BoC, that the Feds have finally dropped the hammer.

The federal government has announced a 2 year cap on international study permits. The cap is expected to be set at 360,000 permits, a decrease of 35% from 2023. The cap space will be allocated by province, based on population. The cap will mean some provinces can increase the number they have while others, such as Ontario, will have to cut intake by about 50%!!

Furthermore, the province of Ontario also announced they will require all colleges and universities to guarantee housing is available for incoming cohorts. Not sure how that will work but there you go.

“The challenges stemming from the recent spike in students coming to Canada, including predatory practices by bad-actor recruiters, misinformation regarding citizenship and permanent residency, false promises of guaranteed employment, and inadequate housing for students, require immediate attention and collaborative action,” said Jill Dunlop, colleges and universities minister.

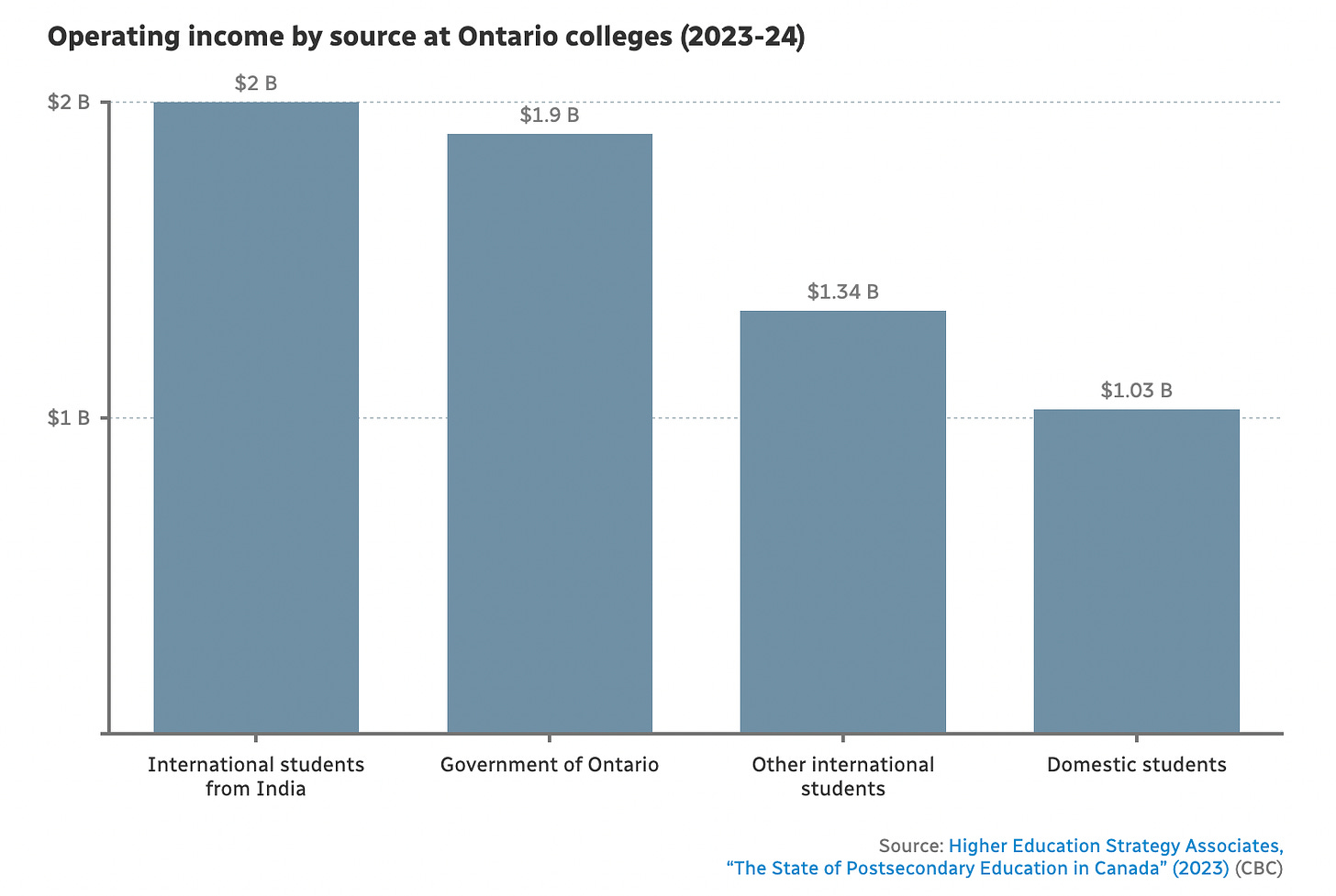

The province will also ban new partnerships between public and private colleges, which were seen as a key factor behind the threefold increase in foreign students over the past decade. Many of these students use education to gain post-graduate work permits and eventual permanent residency.

Suffice to say the gravy train is coming to an end for some of these Ontario colleges.

It may also mark a turning point for landlords operating in particular cities, who, in recent years, have not only enjoyed sub 2% mortgages but a 900% increase in students…

If you have a basement suite in Brampton, your revenues are about to get kneecapped.

As this all shakes out, it is perhaps a subtle reminder that all housing markets are local, and all of which are greatly influenced by government policy. Whether it be empty homes taxes, foreign buyer bans, interest rates, zoning bylaws, or immigration. Policy makers givith, and taketh. Stay nimble out there.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 29th, 2024

Posted In: Steve Saretsky Blog