December 22, 2023 | Get Ready for Excitement and Surprises in 2024

The year 2024 will be full of surprises and uncertainty.

A possible recession, the direction for the stock market, the housing bubble in Canada and changes in interest rates and inflation are all on the agenda for investors as we enter a new year.

What are some of the most likely surprises?

A surprise cannot be predicted, but that does not stop some of us from trying!

Here are three key areas with high uncertainty:

Regarding a recession, there is a signal that has a great track record of predicting a recession, well in advance of the onset. The inverted yield curve — a forecasting tool with demonstrated accuracy — has been anticipating a recession for close to two years. After the yield curve inverted in early 2022 the stock market declined from January to October 2022 by about 20 percent.

The yield curve in U.S. Treasuries 2-10 year inverted in early 2022, meaning 2yr rates are higher than 10yr rates. Every time this yield curve has inverted the economy enters a recession, but with a lag. In 2006 the yield curve inverted, by a small amount, and a bear market in stocks and recession started after a lag.

In this current cycle the yield curve has been deeply inverted, more than before any recent recession. Traders noticed this inversion in early 2022 and there was a lot of discussion about when a recession would start. But as time has passed speculators have come to believe that this time is different and have changed their view on whether there will be a recession. Now they expect a “soft landing” which is the same as saying there will be no recession.

A recession now would be a surprise.

The stock market is intricately linked to the arrival of recessions. If there is no recession the modest decline in stocks from January to October 2022 might have completed the cycle. But if there’s a recession, the bear market in stocks is likely to resume and the total losses from January 2022 would typically be in the 40-60 percent range. A resumption of the bear market in stocks after the rally from October 2022 to today would be a surprise to many.

The Canadian housing bubble has yet to burst. Higher interest rates, extreme unaffordability of housing for first-time buyers and record levels of debt could be enough to trigger a bursting of the bubble.

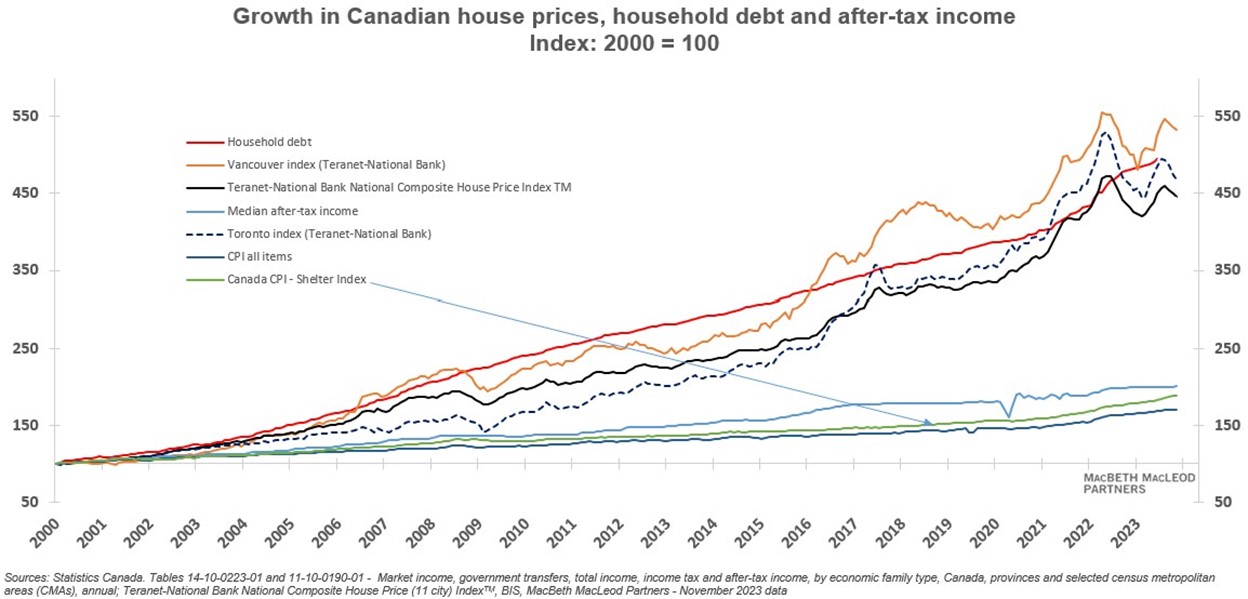

Since 2000 house prices have increased by more than 4.5 times in Toronto and almost 5.5 times in Vancouver, surpassing most other housing bubbles in the world.

Household debt kept pace with house prices, and far exceeded growth in incomes and inflation.

A correction in house prices in Canada would not be a surprise to most people, but if house prices plunged by 38 percent as they did in the U.S. from 2006 to 2010 there would be widespread shock.

The Weekend Note will take a two-week break until January 12, 2024.

Have a great holiday break everyone!

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth December 22nd, 2023

Posted In: Hilliard's Weekend Notebook