December 19, 2023 | China Offers Warning on Euphoric Asset Prices Elsewhere

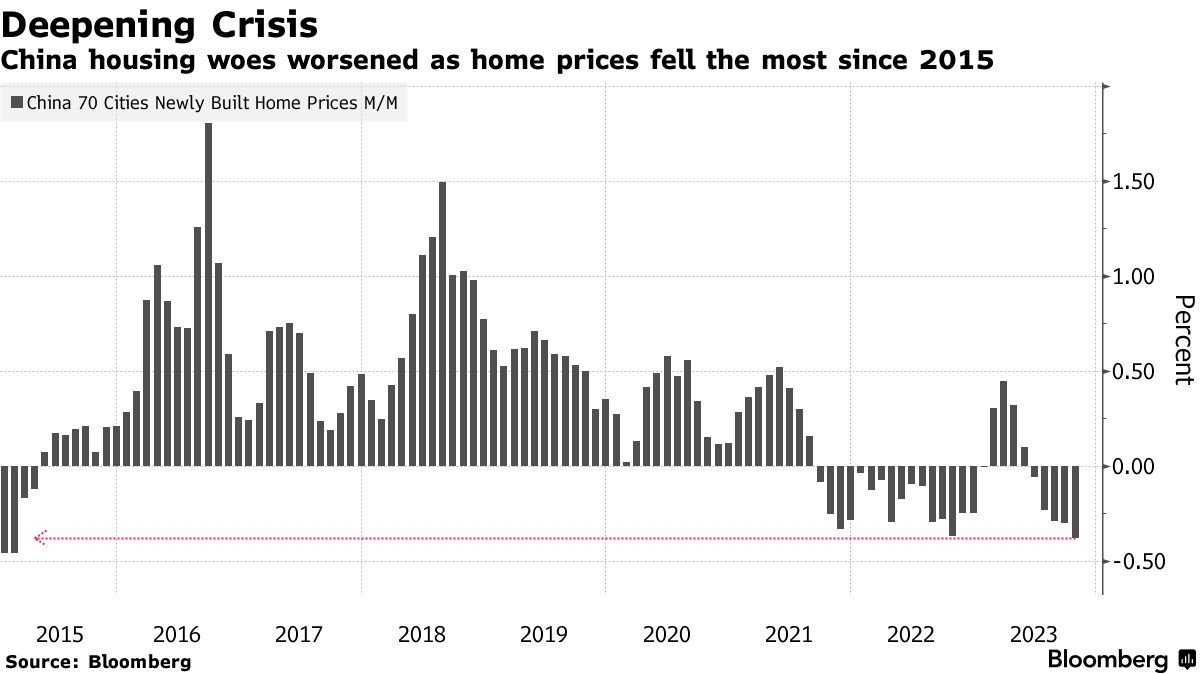

China’s economy is struggling through a multi-year downturn in the property market, a slump in manufacturing activity and falling exports. Other countries and markets should take note.

A triple whammy of falling real estate and stock prices amid credit defaults has hurt household net worth and consumer confidence. See, China’s real estate meltdown is battering the middle class.

Unlike the 2023 rebound in North America, Chinese stocks have continued to slump, with the Shanghai Composite -5% year-to-date, -19% since the COVID-rebound peak in July 2021, -47% since July 2007 and today back at the same level as January 2007–almost 17 years ago. Word to the wise: extended capital loss cycles are the historically common outcome after credit abuse and investor euphoria bid asset prices to irrational levels. Other countries, like Canada, have been warned.

Word to the wise: extended capital loss cycles are the historically common outcome after credit abuse and investor euphoria bid asset prices to irrational levels. Other countries, like Canada, have been warned.

All of this is bad news for investment banks/brokers who make their fees from getting people to buy risky assets. See, China’s Millionaires are Worried. That’s a Problem for Wall Street:

For years, banks including Citigroup, JPMorgan and UBS competed hard to win business from China’s giant pool of wealthy people. They hired thousands of relationship managers with the language skills and cultural know-how to gain the trust of mainland China’s moneyed class, and helped them buy shares in Hong Kong, real estate in the U.S. and expensive paintings from European collections.

There was a bonus: Wealthy investors in China had a reputation for taking risks, including using margin loans to buy shares and plowing millions into junk bonds sold by Chinese companies. That gave their banks an extra source of potential profits since private banks earn fees when their customers trade stocks, bonds or other assets.

But three years of stock-market declines in mainland China and Hong Kong, a wave of bond defaults in the real-estate sector and the faltering performance of China’s economy have dealt a huge blow to the business model of these banks.

China’s wealthy investors are increasingly shying away from risky assets, instead switching their money to deposit accounts or other safe investments.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park December 19th, 2023

Posted In: Juggling Dynamite