November 25, 2023 | Trading Desk Notes For November 25, 2023

A man hears what he wants to hear and disregards the rest. Paul Simon, The Boxer

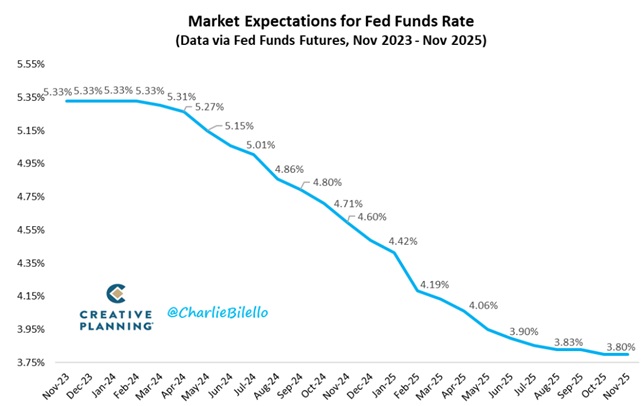

Over the last four weeks, the DJIA is up ~3,000 points (~9%), the Nasdaq is up ~14%, and the Mag7 is up even more. The 30-year Treasury is up ~10 points from 16-year lows, and the US Dollar Index is down ~3%. The main driver behind these moves is the idea that the Fed is DONE and will start cutting rates within a few months.

Ever since the Fed started raising rates in March of 2022, markets have been betting on when they would stop and reverse. In what might be a classic example of cognitive dissonance, markets have heard the Fed repeatedly say rates will stay higher for longer but have believed that the Fed would soon be cutting rates.

From time to time, markets have grudgingly accepted that the Fed would continue raising rates. For example, within days of the hawkish September 20 FOMC meeting, the S&P and the Nasdaq fell to 4-month lows, the long bond made new multi-year lows, and the USDX rallied to 10-month highs.

The irony in this “grudging acceptance” is that the combined weight of falling stocks and bonds and a stronger USD in September and October caused a severe tightening of financial conditions – the markets were doing the Fed’s job for them – and that set up a significant reversal around the end of October (on a combination of softer economic data, a “dovish” Fed, and a conciliatory Treasury – see the November 4 Trading Desk Notes for details) that led to the dramatic market moves note in my opening paragraph.

Have markets come “full circle?”

As my friend Kevin Muir so eloquently explains in his latest substack essay, “Watch For A Subtle Fed Shift,” the November rally in stocks and bonds, accompanied by a falling USD, has caused a substantial easing of financial conditions such that the Fed/Powell may once again “feel the need” to remind markets that they “aren’t sure rates are high enough, that rates will likely need to stay high, and, if inflation doesn’t fall, they may raise rates again.” (As Tiff Macklem, the Governor of the Bank of Canada, said this week, “Now is not the time to be thinking about cutting rates.”)

Priced for perfection?

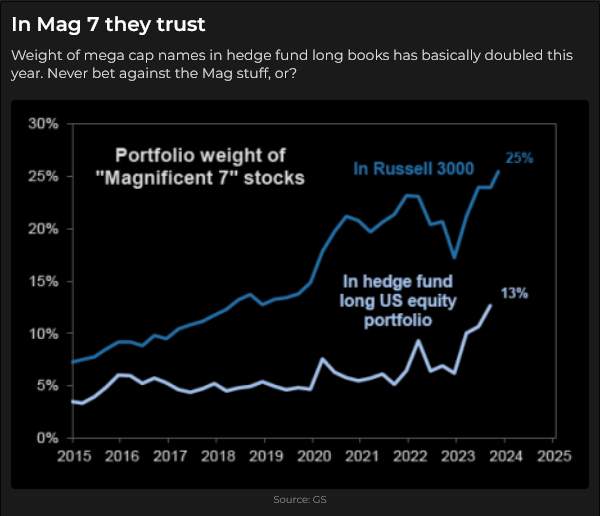

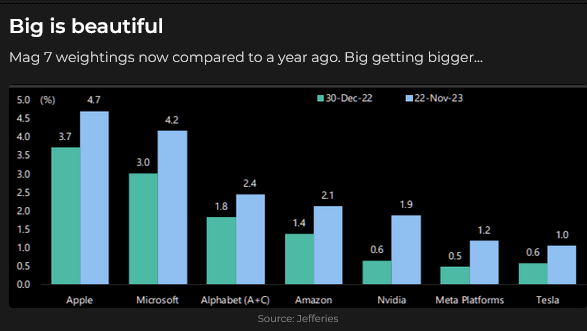

The Mag7 stocks have led the dramatic stock market rally off the October lows.

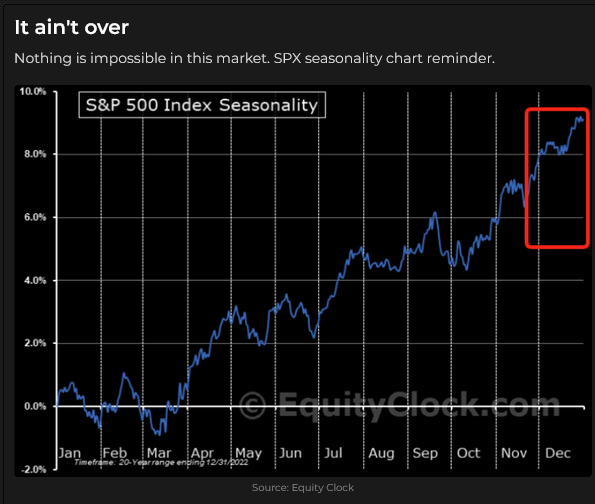

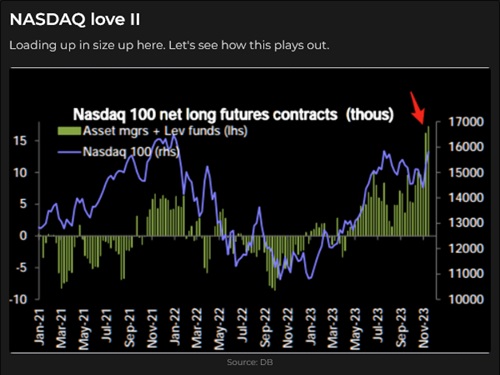

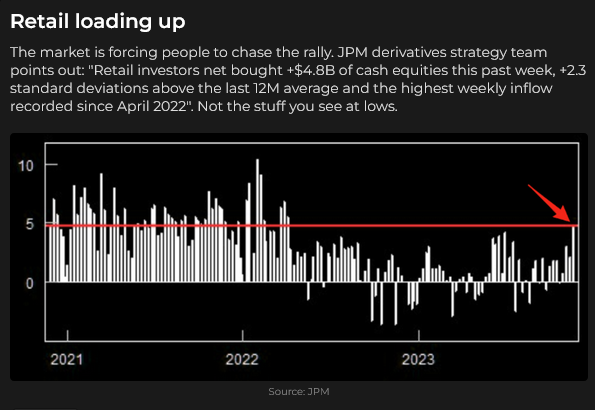

People (especially those who manage other people’s money) appear to have aggressively chased this rally. Everybody knows the seasonality pattern is higher; nobody wants to buy puts. Stock index volatility has tumbled as sharply as stock indices have rallied. We could see a significant correction if something (such as a “reminder” from the Fed) hits the market – but if nothing “terrible” happens, momentum could create a “Santa rally” for the ages!

This chart is an ETF of the equal weight S&P (each of the 500 stocks has the same weight.) This chart removes the effects of the ~30% weighting that the Mag7 stocks have in typical S&P charts. The equal-weight S&P has gone broadly sideways this year and is currently up ~4% YTD.

The bond rally has lost momentum

Long bond futures trended lower from All-Time Highs of ~180 in the summer of 2020 and are now ~110, a decline of ~40%. Bonds had several multi-week counter-trend rallies during that decline and have traded higher for the last four consecutive weeks after hitting 16-year lows in late October, but momentum is fading. I believe there will “always” be buyers for US Treasury bonds if the price is right, but prices will probably trend lower if supply trends rise. 2024 is an election year, and despite the efforts of some Congressmen, the supply of bonds will keep trending higher.

Currencies

The US Dollar Index has trended lower in the past two months as the Euro has trended higher.

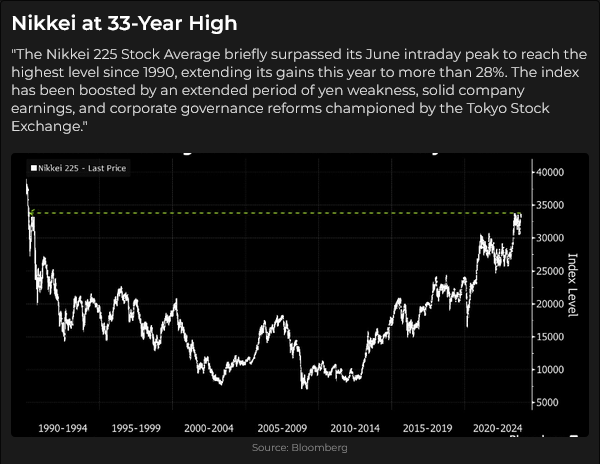

The Japanese Yen touched fresh 33-year lows in mid-November, and Japanese stock indices are at 33-year highs. Net speculative short Yen positions in the CME futures market are at a 6-year high.

The Canadian dollar hit 12-month lows at the beginning of October. Net speculative short positions in the CME futures market are at a 7-year high. If the CAD continues to rally, a short squeeze could develop.

Energy

WTI crude oil dropped from ~$95 in September to ~$75 (with considerable interday volatility) as markets struggled to price supply/demand issues. OPEC+ has a meeting scheduled for November 30 and may announce additional production cuts to boost prices.

Gold

Gold nearly made a new low for 2023 in early October but bounced back ~$200 following the Hamas attack on worries that the conflict could spread. Over the past two weeks, I’ve noted that the gold market seemed to be pricing a “negotiation phase” in the Israeli and Ukraine conflicts, and prices have steadied within a ~$50 range.

Central banks (notably China and Russia, who together produce ~20% of global newly mined gold) continue to buy gold at a record pace. In some respects, this is similar to Saudi and Russia supporting the price of oil by limiting the amount of their oil that is available to world markets.

From a charting perspective, the 2020, 2022 and 2023 triple tops appear to “invite” new All-Time Highs. From a fundamental perspective, continuing government deficits, which lead to a continuing decline in the purchasing power of currencies, appear to “invite” new All-Time Highs.

The gold miners ETF continues to underperform gold.

My short-term trading

I started this Thanksgiving holiday-shortened week with a short position in the S&P established on Friday last week when the market appeared to run out of upside momentum. I was stopped in the Sunday overnight session for a slight loss.

I bought the Canadian Dollar on Monday. I had made a small profit short the CAD Thursday/Friday last week but was impressed at how it rallied back on Friday, so I bought it on Monday. I was also aware of the large net short speculative position in the CAD and thought that could result in buying pressure if the CAD rallied.

I was stopped for a slight loss on the long CAD trade on Wednesday when it traded below Monday’s lows, but I reestablished the long position that day when the market started to rally back from the lows. I stayed long CAD into the weekend.

On my radar

Based on sentiment and positioning, my market view is that stocks and bonds are priced for perfection and are at risk of correction. I will be watching market action for a setup to get short. Given that option VOL is very low, I may buy puts or put spreads.

Speculators are VERY long Nasdaq.

My process is to 1) develop a “market view” based on sentiment and positioning, 2) keep my trading time frame in sync with my analysis time frame, 3) look for market action to a) confirm my view, b) time my entry into a market and c) define my risk levels.

For example, I bought gold on October 6. My market view (sentiment and positioning) was that gold was “unloved” and oversold and that speculators were short and would have to cover if gold rallied. Regarding market action, I bought after gold made a new low on October 6 (on stronger-than-expected employment data) but reversed higher. I initially placed my stops below the day’s low (Market action – it would not be a reversal if gold took out the October 6 lows) and moved the stops higher as gold rallied. I took profits of ~$120 on Oct 18 when gold surged ~$40 higher to 2-month highs but then began to fall back.

November 30: COP 28 meeting in Dubai and OPEC+ virtual meeting. (Both meetings should provide traders with some comic relief.)

December 12/13: FOMC meeting (Thank you, sir, may I have another one, sir?)

The Barney report

Barney loves to find some “high ground” to get a better look around. We found a large rock on some flat ground deep in the forest, and Barney had to get up there and see what he could see. This rock may be a “glacial erratic” given that the surrounding land is relatively flat.

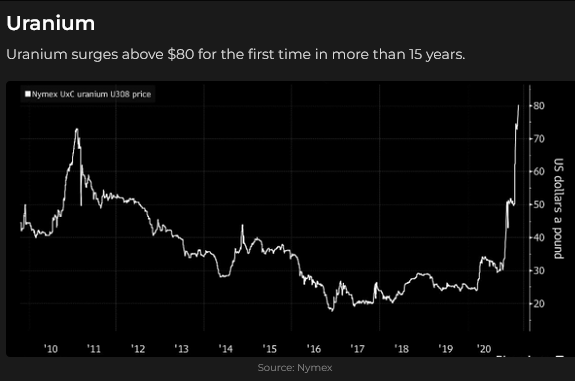

Listen to Victor talk about markets

Mike Campbell and I discussed the consequences of the “cognitive dissonance” in the markets as traders “want to believe” the Fed will soon be cutting rates despite the Fed continuing to say that rates will be higher for longer. Mike’s feature guest this week is Dr. Chris Keefer, who has some good news about developing new nuclear power options. You can listen to the Moneytalks show here. My discussion with Mike starts around the 1 hour 9 minute mark.

The World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

This Week in Money interview

I did a 30-minute interview on November 24 with Jim Goddard for This Week In Money, discussing how the “common denominator” of the big swings in stocks, bonds and currencies has been the big swings in what the market thinks the Fed will do. We also discussed specific issues affecting currencies, stocks, bonds, gold and crude oil. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair November 25th, 2023

Posted In: Victor Adair Blog

Next: What Has AI Done for YOU Lately? »