November 6, 2023 | This Is What Inflation Does To Our Kids

Mainstream economics portrays inflation — defined as a currency that loses a bit of purchasing power each year — as necessary to lubricate the gears of commerce.

What they don’t seem to understand (or would like the rest of us to not understand) is that inflation is also a tool for redistributing wealth from one class to another. It pushes up the price of stocks, bonds, and real estate, enriching the owners of those assets while making day-to-day life a lot harder for people who live paycheck to paycheck.

This obviously makes the victims mad. Here’s a 20-something American explaining their situation:

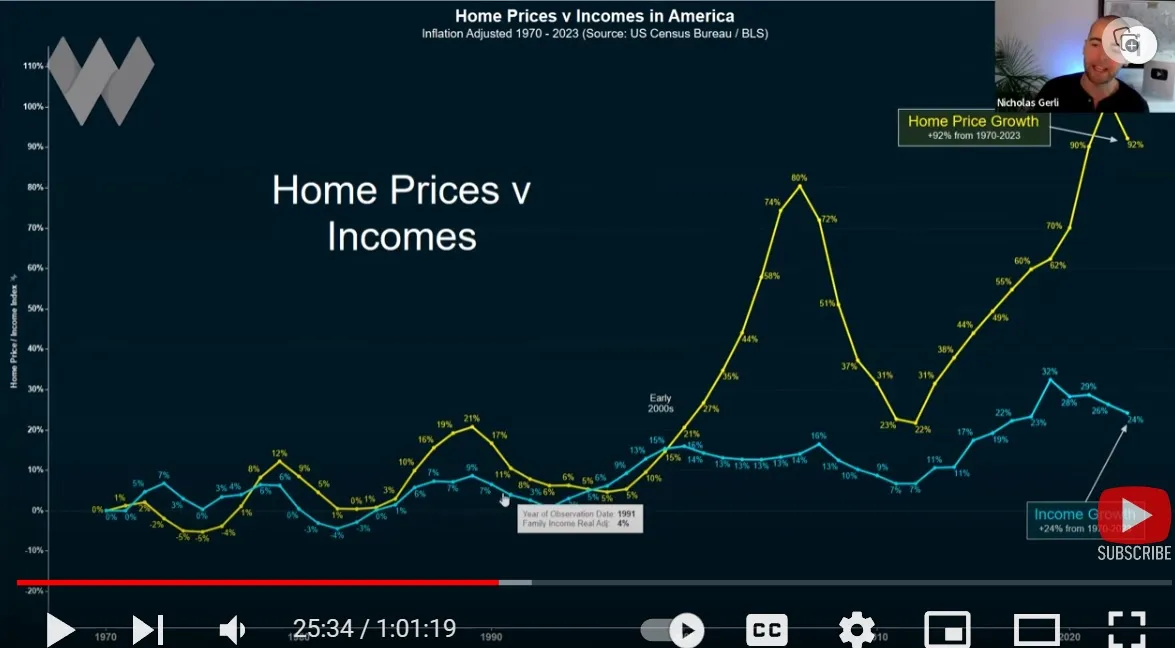

And here’s a chart that illustrates how this works for housing (the yellow line is home prices, blue is incomes).

Say you’re 28 years old in today’s America and you’d like the kind of starter house that your parents bought at a similar age. You’ve cobbled a couple of part-time jobs into 40 hours a week and make, in dollar terms, pretty much what your parents did 30 years ago. But the $90,000 house they bought back in the day is now $300,000, which is orders of magnitude beyond your means. What do you do? You rent, of course, with exactly zero chance of ever buying because your part-time jobs don’t offer a path to middle-class money.

The story is the same for health care, college tuition, food, cars, and pretty much everything else. The life that was easily accessible for your parents in the 1990s is out of reach for you.

Then add in all the headlines about illegal immigrants being put up in luxury hotels, politicians insider trading their way to massive fortunes, and hundreds of billions of dollars being dumped into proxy wars around the world, and you’re naturally going to resent the rigged game you’ve been born into. You’ll be open to populist and/or socialist political pitches. You’ll look for ways to cut corners the way boomers seem to do. Or you’ll just opt out of the system, joining the “I don’t want to work” movement that has your grandparents so aghast.

You’ll have valid a point. A financial system that relies on ever-increasing debt and a soaring money supply by definition transfers wealth from workers to investors. So it’s no surprise that the monetary reset of 1971 and the banking deregulation of the 1990s produced today’s world. The people in charge know exactly what they’re doing. And your generation is being impoverished and radicalized.

What kind of awakening?

A rebellion is coming, and there are (at least) two ways it could go:

- Authoritarian redistribution. This is the banana republic scenario that plays out regularly in Latin America’s oligarchies. A handful of people gain control of the economy and enrich themselves at the expense of the peasants until the peasants rebel and redistribute everything by force. The resulting police state turns into a different flavor of oligarchy and collapses via a military coup. Rinse and repeat.

- A return to first principles. The peasants (and an enlightened handful of elites) conclude that today’s widening inequality is caused by unsound money that gives governments and bankers carte blanche to manipulate markets for their own enrichment. But instead of going authoritarian, the rebellion takes the shape of a return to sound money and limited government — in other words, they just reinstate the Constitution. The big banks and other near-monopolies are broken up, the military empire is shut down, factories are brought back home, and competition for workers drives wages back up to their historical norms. And an updated version of the gold standard eliminates inflation as a wealth transfer scam.

Which is more likely? 90-10 in favor of scenario 1, based on recent history. But we can always hope.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino November 6th, 2023

Posted In: John Rubino Substack

Next: The Coming Great Crash? »