November 12, 2023 | Revved-Up Microsoft Is the Engine that Could

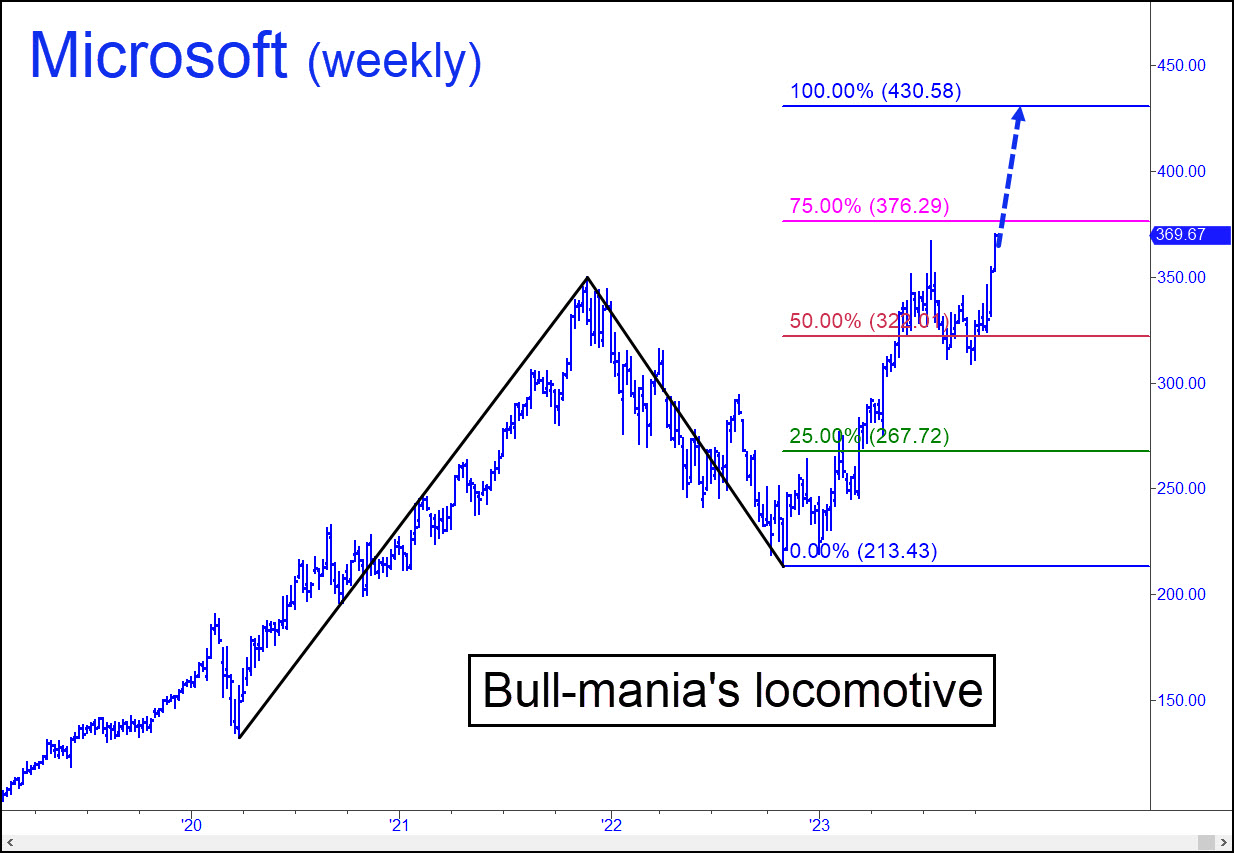

U.S. shares continued to climb a wall of well-justified worry last week, propelled with sufficient vigor to suggest new all-time highs are likely. Notice how Microsoft’s push into record territory on Friday occurred after the stock had spent nearly six months consolidating at the red line. This is a ‘midpoint Hidden Pivot’, according to our proprietary method of analysis, and MSFT’s decisive move above it has freed the stock from its gravitational pull. This is significant, because as long as Microsoft shares are moving higher, the broad average will follow in their vortex.

This is no longer true of AAPL, which until recently was our most important global bellwether for stocks. Although it is still the most valuable company traded on any exchange, sales growth for the near-to-intermediate term is no longer assured. That’s because iPhone sales have encountered strong headwinds in China and are certain to falter in the U.S. when — not if — the economy enters a recession. One has already begun for many Americans, most recently the 10% of Citicorp’s workforce about to be laid off, as well as tens of thousands of workers about to be terminated at 3M, Tyson Foods, Lyft and Whole Foods. Even Walmart is laying off 2,000 warehouse workers across several states.

Rock-Solid Revenues

Microsoft will not be inured to the effects of a slowdown, but selling Windows and Outlook software on a subscription basis that requires annual renewals will continue to help insulate the company from economic downturns, even if severe. For that reason, Microsoft should be regarded as the bluest of blue-chip companies, a profit engine even more powerful and reliable than Apple. The chart shows a bull-market target for MSFT at 430.58 that implies a 16.5% leap from the current 369.97. In comparison, to achieve new record highs the S&P 500 would need to rally 9.5%, from 4,415 to 4,817, to set a new record. As for the tech-heavy QQQ, an ETF that tracks the 100 largest Nasdaq stocks, it would need to climb 2.7% from a current 378 to top the old high at 388 recorded back in July. The steep trajectory of Microsoft’s rally suggests it is well capable of dragging the broad averages higher, or at least keep them buoyant, for perhaps another four to six weeks.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman November 12th, 2023

Posted In: Rick's Picks

Next: What Could Go Wrong? »