November 20, 2023 | Here Comes the Kitchen Sink

Happy Monday Morning!

The Canadian housing market is a funny thing. Despite a constant barrage of policy measures hoping to fix the crisis, affordability continues to deteriorate. As affordability issues deepen, policy measures are becoming more aggressive. Just to recap, over the past few years various levels of government have introduced a foreign buyers tax, an empty homes tax, a mortgage stress test, a speculation tax, rent controls, and finally an outright foreign buyers ban. We’re at the phase where you throw things at the wall and see what sticks.

And here comes the kitchen sink.

According to the Toronto Star, Property owners in areas that already restrict short-term rentals will no long be able to claim their rental expenses against the income they make, a senior federal official told the Star, in a bid to take away the incentive to flout local restrictions and list properties on platforms like Airbnb.

“This is going to change the financial equation,” the official told the Star.

The new tax measures are expected to be announced on Tuesday and take effect on January 1, 2024.

This comes on the heels of recent legislation proposed by the BC Government last month in which they are requiring short-term rentals in B.C. to be offered only in the principal residence of a host. This will apply to all municipalities with a population of 10,000 people or more. Failure to comply could result in fines as high as $50,000.

Suffice to say the new measures around short term rentals a political hot potato that I don’t really care to touch. I sympathize with the argument that AirBnb is taking away units from the long term rental pool. By running AirBnb full time you’re also effectively running a hotel in residential zoning. In other words, we need regulation but where do you draw the line? I don’t have the answer here.

Finance minister Freeland said she’s seen estimates that turning short-term rentals into properties available for the longer term in Toronto, Montreal and Vancouver could immediately free up 30,000 units of housing.

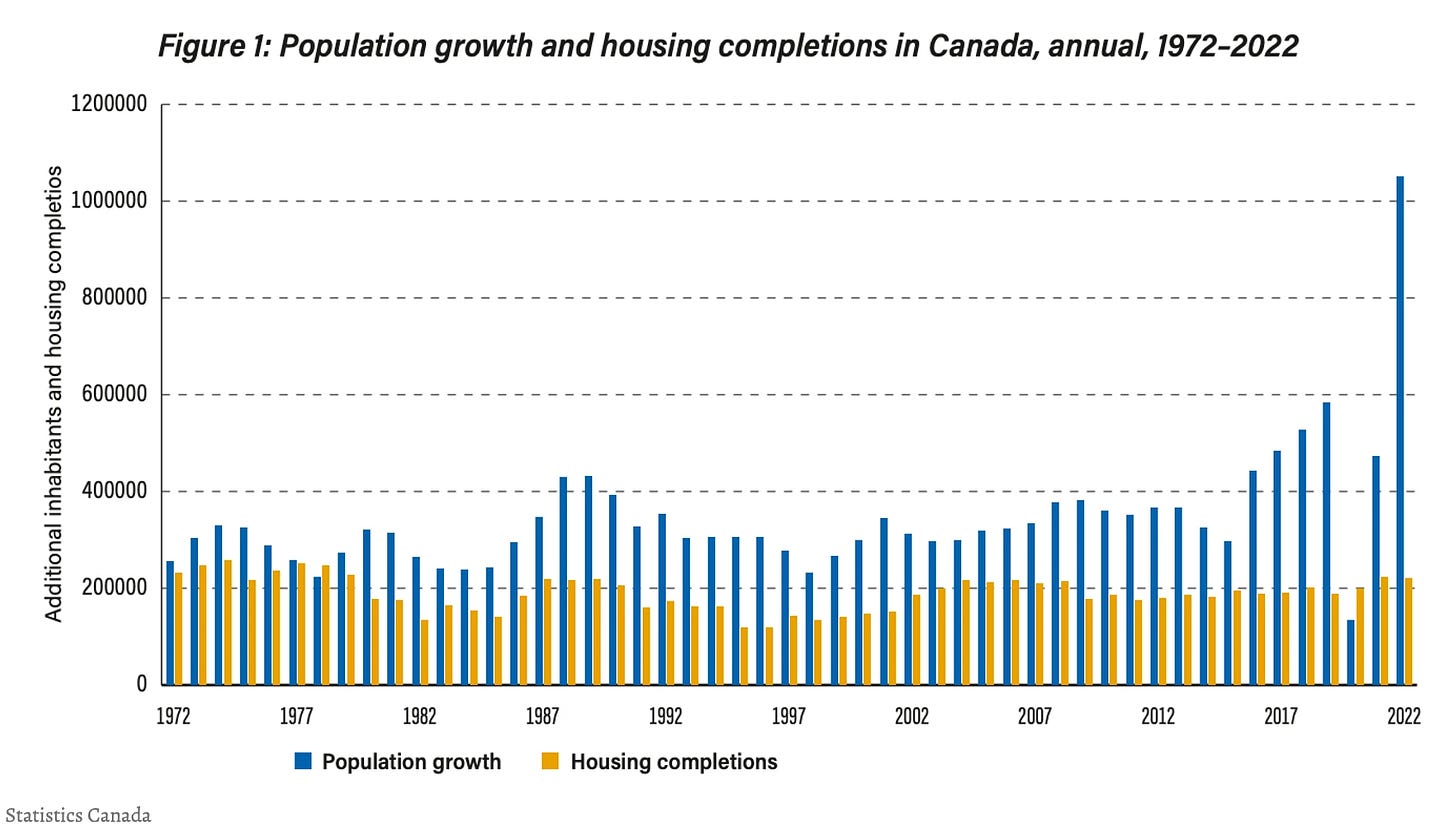

Even if it were true it’s a drop in the bucket in the grand scheme of things. Remember we are importing a million people a year into this country and completing less than 250,000 new homes each year. Furthermore, a lot of homeowners who choose to rent out basement suites or laneway homes do so specifically because they don’t want long term tenants, nor do they wish to deal with the horribly flawed tenancy regulations in places like BC and Ontario. So trying to determine how many units end up back in the long term rental pool is a guessing game, but i’ll take the under.

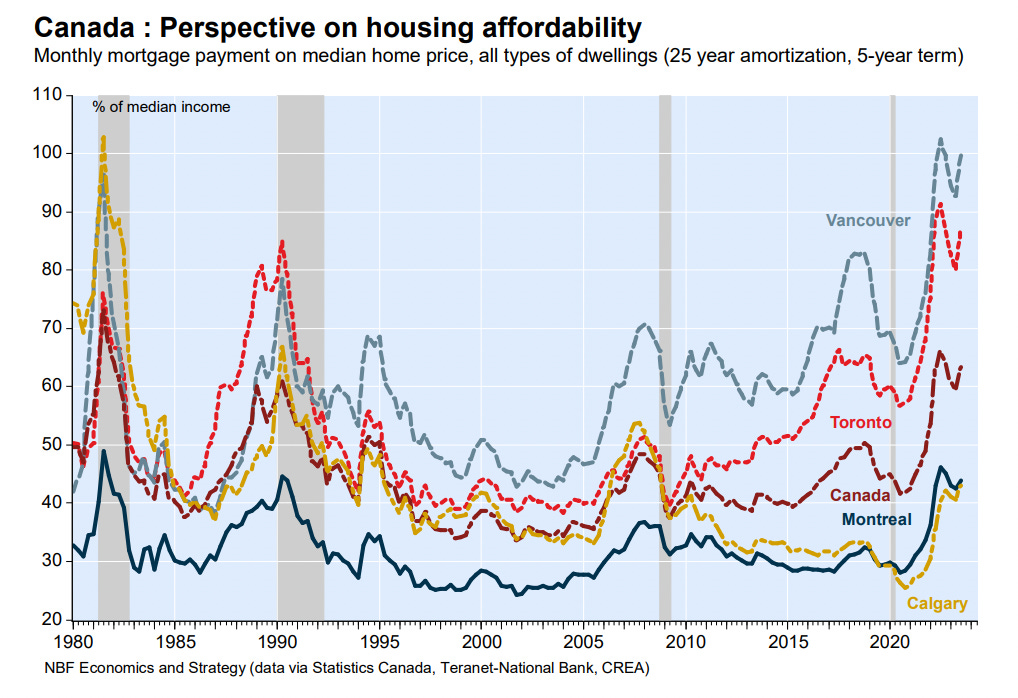

Anyways, it doesn’t matter what I think. Policy makers are scrambling in the midst of the worst affordability crunch in decades and so the policy response is becoming more aggressive. This should not be surprising.

Investors are the new scapegoat. By eliminating the ability to deduct rental expenses on short term rentals we are opening up pandoras box for these tax changes to be expanded in the future. Don’t forget In 2020, a group called Generation Squeeze received $250,000 from CMHC to write a report on housing policy. The report published on Jan. 5, 2022, called for a home equity tax. CMHC also gave them an additional $200,000 in 2022 to influence public opinion in favour of a home equity tax.

Nothing is off the table. So long as the housing crisis fails to subside, policy measures will get more extreme. Need I remind you that the BC Government effectively removed zoning power from municipalities just a few weeks ago. This would have been considered unfathomable even a few years ago.

In other words, if you’re betting on another decade of record house gains think again.

Ironically, policy makers might get what they’re looking for, lower prices. Arresting the economic fallout from that will be the tricky part. National house prices are sliding once again, falling 0.4 % in September and another 0.8% in October.

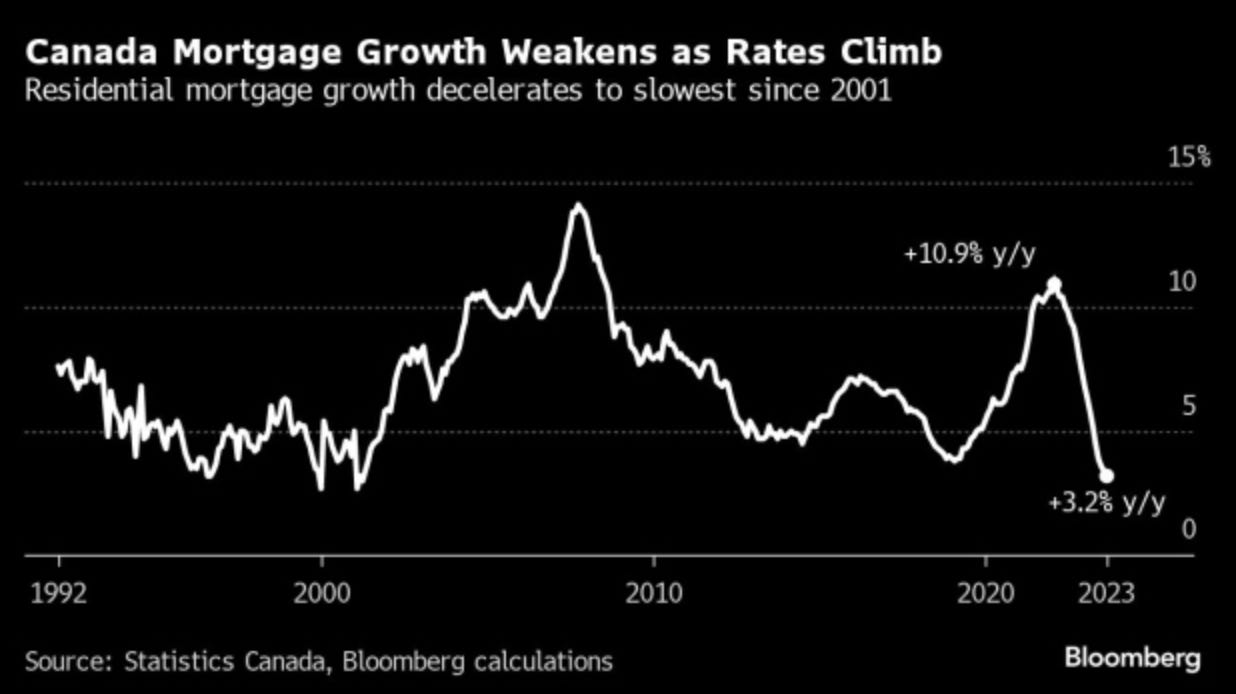

Meanwhile, leading indicators suggest there’s likely more to come. Mortgage credit growth in this country rose just 3.2% from a year earlier, the weakest annual rate of growth since 2001.

Hard to support house prices if people aren’t taking out mortgages. If Freeland doesn’t kill AirBnb the economy will.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky November 20th, 2023

Posted In: Steve Saretsky Blog

Next: Your First Gun »

If you have a 3,000 seat theatre, you don’t sell 4,000 tickets to the show. Yet this is exactly what the federal government is doing with their immigration policy.