October 7, 2023 | Trading Desk Notes For October 7, 2023

Was Friday a turning point?

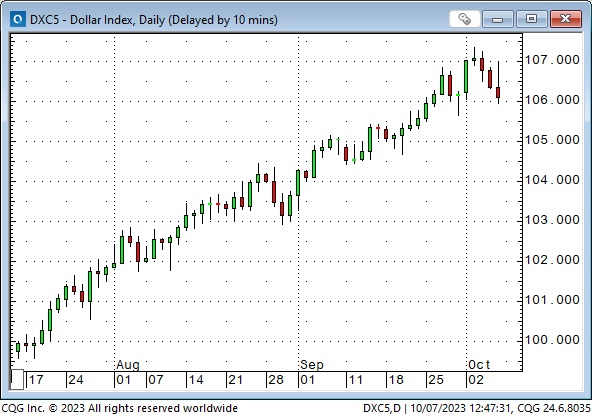

Bond prices collapsed to fresh 16-year lows immediately following Friday morning’s “stronger than expected” NFP report. The US Dollar Index surged higher, while S&P futures tumbled and appeared ready to make new 4-month lows.

But ~30 minutes after the NFP report, markets reversed course, and by the end of the day, S&P futures were up ~116 points from the lows, the USDX closed lower on the week for the first time in twelve weeks, and T-Note futures recovered about half of the early morning losses.

Why did the bond market not collapse on the “much stronger than expected” NFP report?

1) Bonds had fallen like a stone since mid-July (T-Note yields had risen from ~3.75% to ~4.87%. The 30-year yield touched 5% this week.) Perhaps there were “no more sellers,” or shorts decided to “take profits.”

2) This week’s employment data was not as “bearish” as the headline print. The household survey was much weaker than the establishment survey; hours worked were flat, average hourly earnings were lower than expected, and even though there were “more jobs,” full-time jobs were falling while part-time jobs were rising.

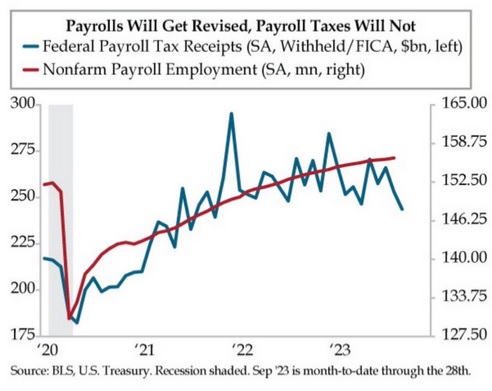

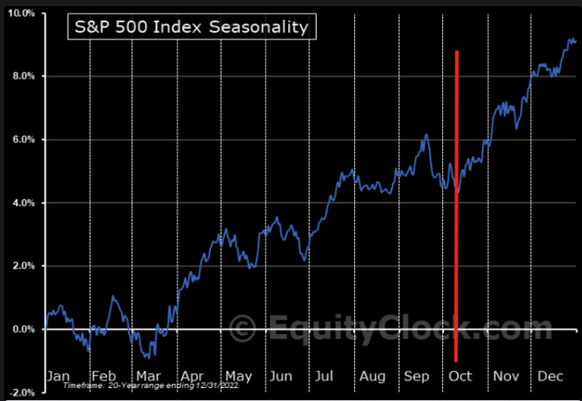

Earlier in the week, I had seen this chart posted by Daniel Demartino Booth on X (formerly Twitter.)

This chart shows that payroll taxes received by the Treasury had fallen to two-year lows by the end of September. This is hard data, not a survey, and would be inconsistent with “rising employment” unless “more workers” were collectively paying less taxes – which could be the case if part-time workers were replacing full-time workers, even as the number of “total” workers rose.

While most of the employment data this week was bond market negative, the ADP report on Wednesday (hard data, not a survey) buoyed bond prices as it showed that private sector US employers added only ~89,000 jobs in September, the fewest (in the ADP data series) since January 2021.

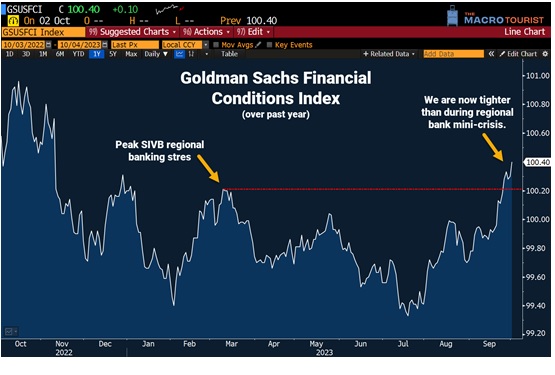

Sharply rising bond yields reduce the need for more Central Bank interest rate increases

Bond yields are rising as the “term premium” rises. (Term premium is the additional compensation investors demand for the risk of tying up their money for an extended period rather than rolling over short-term investments.)

Bond yields are rising even though inflation is falling as the market anticipates a tsunami of new issues as governments maintain deficit spending. (Even though the recent rise in bond yields is not driven by the fear of inflation, continuing government deficits will reduce the purchasing power of currencies, which is inflationary.)

The increase in nominal yields has been driven by fast-rising real yields. 10-year REAL yields hit 2.5% this week, up ~55bps since Labour Day and the highest in 17 years. (This chart is a week outdated but gives an excellent historical perspective.)

Bond yields have risen sharply, while short-term rates have increased only slightly since the mid-July Key Turn Date. Short-term rates remain above long-term rates (an inverted yield curve), but the “steadiness” of short-term rates means that markets anticipate Central Banks are at or near the end of their tightening cycle.

The CME futures markets are pricing a ~10% chance that the Fed will raise rates by 25bps at the October 31/November 1 FOMC meeting and a ~40% chance of an increase at the December 12/13 meeting.

The CB tightening cycle was intended to slow the economy to get inflation down, but sharply rising bond prices have dramatically tightened Financial Conditions – reducing the need for further CB rate increases.

Currencies

The US Dollar has risen against ALL other currencies over the past ten years.

The Swiss Franc has been the 2nd strongest global currency over the past ten years.

Asian currencies have been particularly weak against the USD; the Yen has fallen ~46% against the USD since Abe launched his Three Arrows program in 2012 to revitalize the Japanese economy.

The US Dollar Index traded higher for twelve consecutive weeks since the Key Turn Date in mid-July, as the US 10-year T-Note yield traded higher for 11 of the last 12 weeks. (There might be a correlation!)

The Canadian Dollar made its YTD high against the USD in July but has fallen ~4 cents (5%) to this week’s lows.

The Mexican Peso was the strongest currency in the world from October 2022 to July 2023 as stock markets rose, but it tumbled against the USD in September and early October as stock markets weakened. (Despite the rally from the summer of 2022, the Peso is down ~30% against the USD over the last ten years.)

Gold

Comex Gold futures (very) briefly traded to an All-Time High of ~ $2,085 on May 4 but have trended lower since then (down ~$275 or 13%) as the USD and interest rates, particularly real interest rates, have soared.

The gold price decline accelerated in late September as real interest rates surged and nearly fell to a new YTD low after Friday morning’s NFP report. Gold bounced back ~$25 from Friday’s lows as interest rates and the USD fell.

Energy

Front-month WTI crude oil futures traded to a 13-month high of $95 in late September but tumbled to a low of $81.50 on Friday.

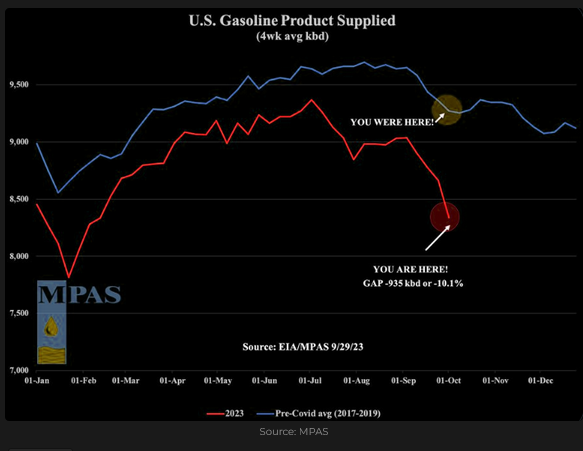

NYMEX wholesale gasoline futures dropped ~20% from mid-September to Thursday’s lows as demand has fallen sharply over the past three months.

Cameco shares rallied to 12-year highs in late September, up ~8X from their 2020 lows as “uranium plays” were aggressively bid. Prices have fallen back ~10%.

Stocks

My short-term trading

I started this week short WTI, short the Mexican Peso and long T-Notes. I had unrealized gains in all three positions at the end of last week.

I was stopped for another slight loss on the TNotes overnight Sunday. (I’ve been unsuccessfully trying to pick a bottom to the tumbling bond market!) I covered both the WTI and the Peso on Tuesday. I made a small profit on the WTI and a good profit on the Peso.

I bought the S&P on Monday when it bounced back from taking out last Thursday’s and Friday’s lows, but I was stopped for a slight loss overnight.

I didn’t trade Wednesday or Thursday ahead of the NFP report but bought gold and the Mexican Peso on Friday after they rallied off of the post-NFP lows. I held both positions into the weekend with unrealized gains.

This week, my realized and unrealized gains more than made up for the losses I took over the last two weeks when I was trying to bottom-pick the T-Notes.

On my radar

Low prices may be the best cure for low prices in the bond market, as rising interest rates pressure borrowers, leading to slower economic growth and rising bond prices.

Even without rising unemployment, consumers seem to be “pulling back” a little, and consumer spending is ~70% of the US economy.

The attacks on Israel by Hamas on Saturday morning could trigger a swift escalation if “anybody else” gets involved.

American money market funds have received ~$973 Billion YTD, taking the total holdings to ~$5.7 Trillion. I don’t see this money as “dry powder” waiting to enter the stock market. It is a sign that people are “relieved” to get ~5% return on a risk-free investment.

Seventy-five thousand healthcare workers went on strike against Kaiser Permanente this week, but apparently, they will have to return to work on Monday (special strike rules for healthcare workers.) 50,000 hospitality workers in Las Vegas may strike soon while the UAW strike is getting wider. I expect more strikes as workers realize the cost of things they (have to or want to) buy has increased much more than the CPI.

The September CPI report is due Thursday, October 12.

Quarterly earnings reports start this week, and corporate share buyback programs will mostly be in a “blackout” period.

Thoughts on trading

I took five consecutive small losses trying to bottom-pick the falling T-Note market. The good news is that the total losses were less than 1% of my trading capital, but I wondered what “went wrong.”

I’ve decided that my trading time frame was shorter than my analysis time frame. My analysis was that even though bonds were pricing a secular change from a deflationary to an inflationary environment, they were oversold and due for a bounce.

I “liked” that idea so much that I didn’t want to “miss” a bond market rally, so I started buying without any “reasonable” confirmation that the bottom had been made.

As my friend Kevin Muir might say, I was trading what I thought the market should be doing, not what it was doing!

Another example of having my trading time frames out of sync is that I “caught” the beginning of the USD rally in July/August, but I certainly didn’t take “full advantage” of the enormous move that happened over twelve weeks.

My trading time frame on that USD rally was much shorter than my analysis time frame; I took profits too quickly and could not “find a good spot” to get long again.

Trading Desk Notes next week

I’ll be away from my desk on Thursday, Friday and Saturday this coming week to attend Josef Schachter’s “Catch the Energy” conference in Calgary. I will likely not post any notes next weekend.

The Barney report

My wife brought Barney home nearly two years ago when he was an eight-week-old puppy. I’d never had a pet before and had no idea what I was getting into! Barney and I have become “best buds.” I’ve become more patient because of him – and that’s good.

Listen to Victor talk about markets

I talked with Mike Campbell for about 8 minutes this morning on his top-ranked Moneytalks podcast. We discussed the surge in interest rates and my idea that the market action following the NFP employment report on Friday may signal a turning point across assets. My segment with Mike starts around the 1 hour and 12 minute mark. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys tries to help men struggling with depression.

This week, I read a five-minute essay written by Sean McLaughlin in 2017 when he was deeply depressed. He had been a trader for 20 years, and it wasn’t going well. He felt inadequate, lost, scared, anxious, depressed, unloved, and unhealthy. He had run out of money and was in debt. He was afraid of losing his family.

The good news is that Sean turned his life around and is a happy, successful man today.

Some men aren’t so lucky.

If you or someone you know is struggling with depression, talk to them and contact headsupguys. They can help.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 7th, 2023

Posted In: Victor Adair Blog