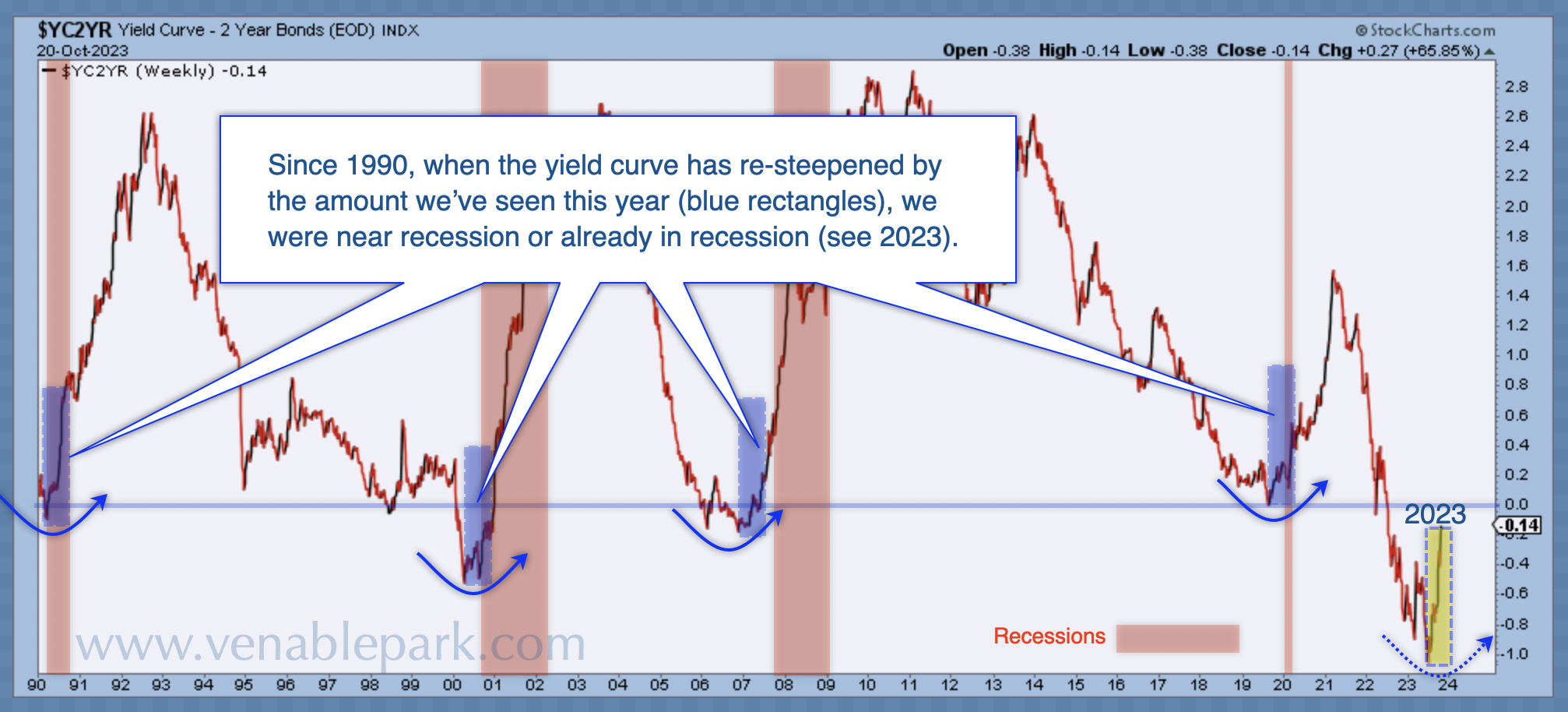

In the past few months, short-term treasury yields have risen more than long-term such that the yield curve, which has been inverted since April 2021, is now un-inverting. This move typically signals the near-term onset of recession and the worst stock market losses.

The chart below from my partner Cory Venable shows the move in the US 2-10 yield spread from a deeply negative 108 basis points in June 2023 to -22 this morning. Past re-steepening episodes are highlighted in blue, with the recessions that followed in red.

Komal Sri-Kumar, president of Sri-Kumar Global Strategies, joins ‘Squawk Box’ to discuss rising Treasury yields, with the 10-year Treasury yield breaking above 5% for the first time in 16 years, the impact on markets and economy, the Fed’s inflation fight, and more.Here is a direct video link.