October 20, 2023 | Banks Need To Revise Their House Price Forecasts Down a Lot

Forecasts of increasing house prices in Canada by the economics departments of the large Canadian banks are wildly optimistic. This matters because it directly affects the risk assessment for their most important lending division — mortgage and consumer loans.

Will they revise these forecasts lower in their reports for the year ending October 31 2023?

The Royal Bank of Canada is the largest bank with the second largest exposure to retail (household) lending in Canada. RBC’s personal and commercial loan book (mostly housing related) is massive, at $553 billion, about 70 percent of total loans.

Here’s their house price forecast from their 3rd quarter report which came out in August 2023 (an upgrade from their April numbers):

“Canadian housing price index – In our base forecast, we expect housing prices to increase by 2.3% over the next 12 months from calendar Q3 2023, with a compound annual growth rate of 4.2% for the following 2 to 5 years. The range of annual housing price growth (contraction) in our alternative real estate downside and upside scenarios is (30.0) % to 10.9% over the next 12 months and 4.2% to 9.6% for the following 2 to 5 years. As at April 30, 2023, our base forecast included housing price growth of 1.8% for the next 12 months and 4.8% for the following 2 to 5 years. As at October 31, 2022, our base forecast included housing price contraction of (1.0) % from calendar Q4 2022 for the next 12 months and housing price growth of 5.2% for the following 2 to 5 years.”

The CREA (Canadian Real Estate Association) is known for being wildly optimistic about Canadian residential real estate as their audience is made up of 1,000s of realtors, whose job is much easier if house prices are rising steadily. Here’s what the CREA says about 2023:

“The national average home price is forecast to decline by 3.3% on an annual basis to $680,686 in 2023. This is down from CREA’s previous forecast, owing primarily to the compositional impact of lower sales in Ontario and British Columbia, by far Canada’s two most expensive provinces for real estate.”

So, the national cheerleader for the industry is more pessimistic than a bank!

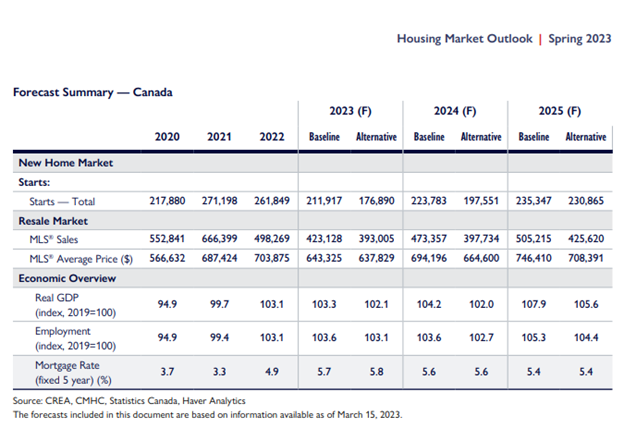

The CMHC, an agency responsible for providing mortgage insurance on home purchases where the down payment is less than 20 percent, predicts a 9 percent decline in house prices for 2023, as we can see with the average house price declining from $703,875 to either $643,325 or $637,829 (baseline or alternative scenarios). The CMHC predicts a mild recession and a decline in housing starts.

So as 2023 winds down we see a wide discrepancy between some optimistic forecasts and the reality of a difficult housing market. As mortgage rate increases start to kick in, we are likely to see even more downside, especially in a recession.

When will banks become more realistic about the housing market?

Watch for announcements from Canadian banks of their year-end results on November 30.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth October 20th, 2023

Posted In: Hilliard's Weekend Notebook