September 22, 2023 | Stock Market Traders Wishing for Rate Cuts Will Be Disappointed

The U.S. stock market sold off this week after the Federal Reserve announced that rates will have to stay higher for longer.

But the stock market should be careful what it wishes for. The record shows clearly that rate cuts are usually bad for the stock market and the economy.

This week Jerome Powell, chair of the Federal Reserve, announced no change to the 5.5 percent policy rate. The consensus after the news conference was that the Fed did a “hawkish hold”.

The market fell on Wednesday and continued to decline on Thursday, as traders absorbed the news that there might be more rate hikes coming in 2023 and no rate cuts perhaps until 2026 at the earliest. Yikes!

The bond market also sold off, with long-dated Treasury yields rising to multiyear highs of about 4.55 percent, the highest since 2011. Even inflation-protected Treasuries now provide a yield of 2.1 percent, which is the highest since 2009. Mortgage rates are above 7 percent, compared to 2.7 percent before the Fed started hiking.

Traders appear to be rattled by the possible end of the “soft landing” dream, as the Fed signals that if the economy stays strong the Fed will keep hiking rates until they achieve a “hard landing” in order to quell inflationary tendencies. Of course, the Fed never used the words “hard landing”, but it seems clear they believe that’s what it will take to get inflation back to target.

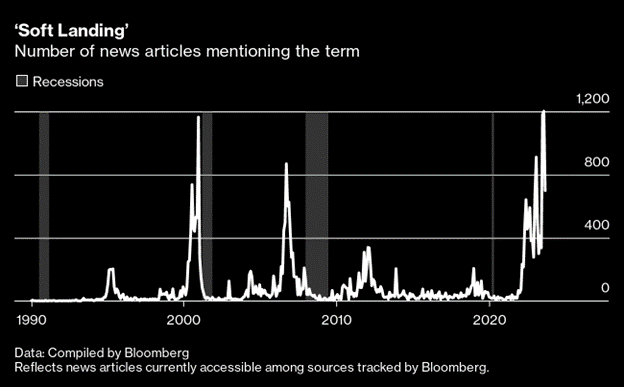

The term “soft landing” is interesting, for two reasons. First, increased searches for the term often precede a recession. And second, there are few instances of a “soft landing” historically. There is either continued economic growth or a real recession and seldom anything in between.

Prior to the bear market recessions in 2000-2002 and 2007-2009 there was a surge in searches for “soft landing”. And recently another jump.

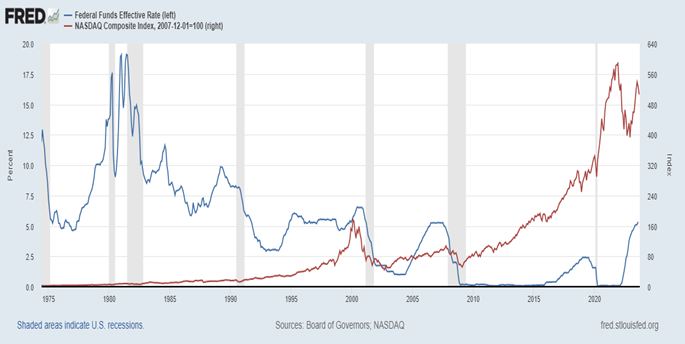

The other thing that seems pertinent at a time when traders are hoping that the Fed cut rates rather than raise them is the historical record back to the 1970s, which shows that stock markets do very poorly after the Fed starts cutting the Fed funds rate. The Fed is probably not leading but rather following the trend and acts when there are strong signs of weakness, so rate cuts are confirmation that a recession is about to start or has already started. And stock markets usually decline during a recession.

We can see in this chart that the Fed started cutting rates in 1981 before the start of the recession (grey band) of 1982. And, again, the Fed cut in the late 1980s before the onset of a recession in the early 1990s.

Similarly in 1999 they cut just after the NASDAQ turned negative — red line — and before a recession. In 2007, the Fed cut just before a recession and a bear market began.

So, market traders are going to be disappointed when rate cuts arrive. As the saying goes, “Be careful what you wish for.”

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth September 22nd, 2023

Posted In: Hilliard's Weekend Notebook