September 6, 2023 | Real Estate Has Earned Us a Drubbing

US mortgage rates (30-year fixed) jumped an extra 50 basis points this week to 7.7%, while Canadian mortgage rates are 6% plus. Higher carrying costs are causing many owners to need to maximize rental income from their properties. Short-term rentals are attractive because they have yielded more per night than long-term leases.

However, many cities are responding to unaffordable living costs by restricting short-term rentals to increase the supply of homes available for full-time occupancy. New York City is one of the latest, as discussed in the segment below with Robert Frank. Here is a direct video link.

CNBC’s Robert Frank joins ‘Power Lunch’ to discuss the new law impacting Airbnb listings in New York City, rental legislation enforceability problems, and competition for rental properties leading to record high rates.

At the same time, strained consumers and a slowing economy are cutting demand for travel and short-term rentals globally. A broader hour-plus deep-dive video on these issues is available in AirBnBust update with housing analyst Amy Nixon.

Adding insult to injury, many of today’s owners and landlords bought or refinanced their properties between 2019 and 2022 when prices were irrationally engorged via ultra-low interest rates. As a result, the costs paid compared with rental income potential left no margin of error even when interest rates were less than 3 percent. At double that, the math’s positively toxic.

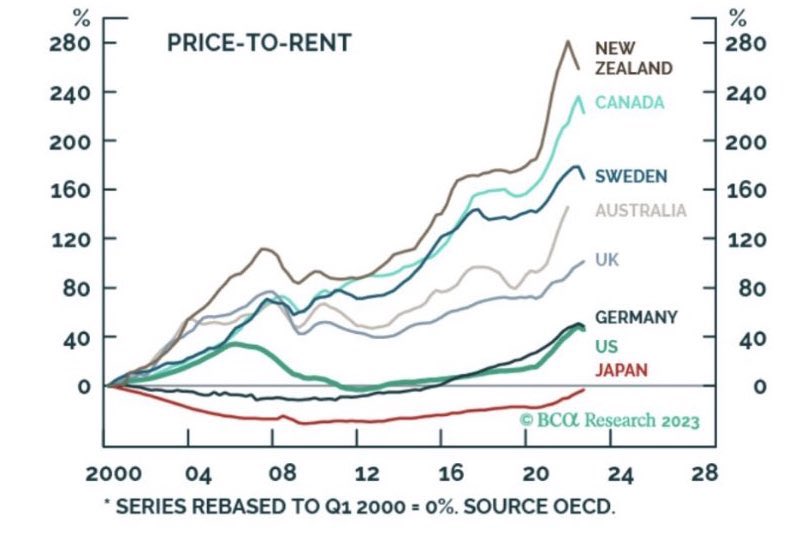

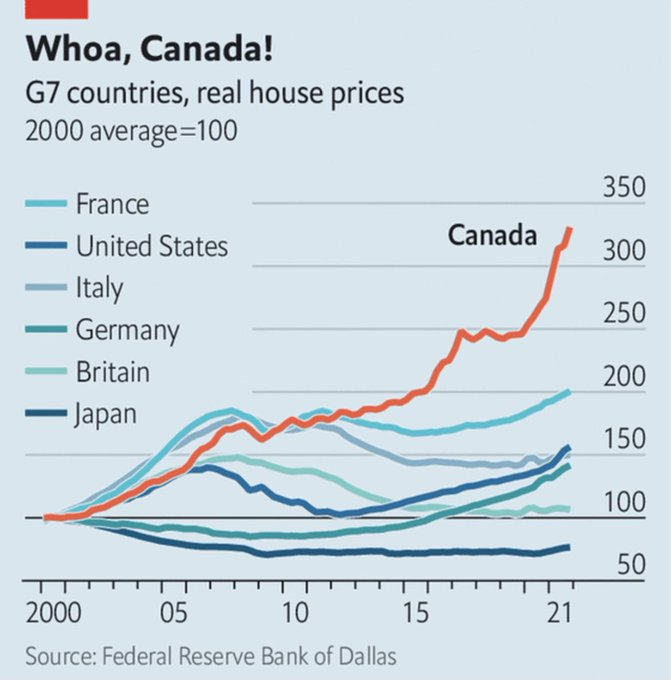

Shown below, since 2000, New Zealand and Canada have held top honours for the craziest prices relative to rents in the world. The inflation-adjusted doubling in Canadian home prices over the last thirteen years is the most garish of all G7 countries (as shown below) and much worse than the 155% average price increase in America. Further evident in this chart is the subsequent multi-year price stagnation after property bubbles burst in other countries. Japan’s bubble burst in 1991; prices then deflated for a decade, and real prices have never recovered to the ’91 peak since.

The inflation-adjusted doubling in Canadian home prices over the last thirteen years is the most garish of all G7 countries (as shown below) and much worse than the 155% average price increase in America. Further evident in this chart is the subsequent multi-year price stagnation after property bubbles burst in other countries. Japan’s bubble burst in 1991; prices then deflated for a decade, and real prices have never recovered to the ’91 peak since.

Even if central banks hold base rates here and start easing them again in 2024, years of reckless and wilfully blind financial behaviours have cast the die for a well-deserved real estate bust. The supply of motivated sellers is on the rise. Unfortunately, real estate downturns have historically perpetrated the most severe recessions and job loss cycles.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park September 6th, 2023

Posted In: Juggling Dynamite

Next: Silver: A Sure Thing? »