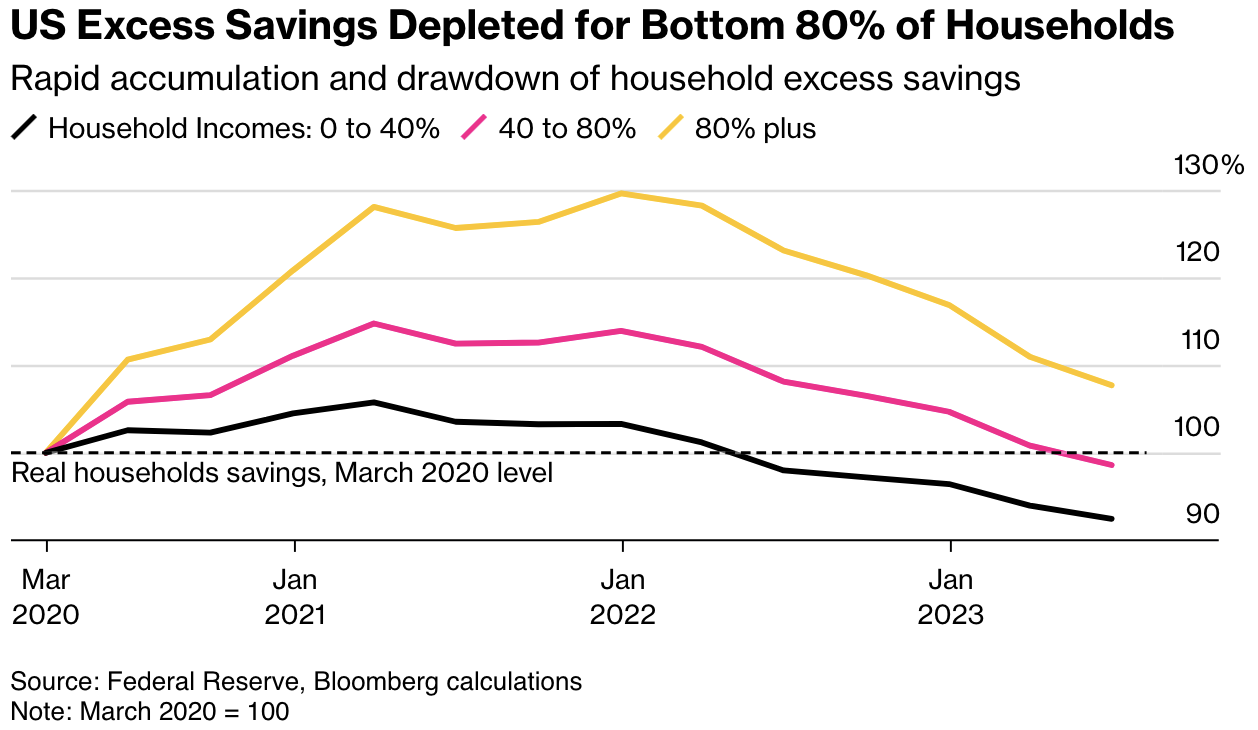

Trillions in emergency government handouts have been spent. Eighty percent of Americans now have less cash than when the Pandemic began.

Only the wealthiest 20% of Americans still have some excess Pandemic savings, and that is expected to be fully consumed by the end of this month.

All income groups have seen their balances decline in real terms from a peak in 2021, according to the Fed survey…The figures point to dwindling firepower available for US consumers, whose resilience has kept the economy growing at a rapid clip this year and staved off the recession that many expected. Some analysts warn a downturn is still in the cards as households run low on spare cash.

The Federal Reserve Bank of San Francisco estimates that the aggregate stock of excess savings will likely be fully depleted by the end of September.

At the same time, the epic credit tightening since March 2022 is starting to hit households, businesses, and investment accounts hard.

At current prices and rates, the median family cannot afford to finance the median-priced home, never mind the growing supply of properties asking far above the median. The cost of auto ownership has leapt 13% year over year (on higher prices, financing costs, insurance and petrol costs).

The interest rate on brokerage loans to buy securities (margin accounts) is 8% from 3% last year. Borrowing to “invest” always sounds easy and sophisticated until it magnifies losses and obliterates users. A time-worn reason why financial advisers who recommend borrowing to invest should be jettisoned, accountants too. Capitulation selling is only getting started; see, Americans finally start to feel the sting from the Fed’s rate hikes:

Mike Law, 71, wanted to buy a home in Estero, Fla., last fall but didn’t want to deal with the hassle of getting a mortgage. Instead, the certified public accountant took out a roughly $600,000 loan backed by his investment portfolio.

The bank charged him the Secured Overnight Financing Rate, or SOFR, plus 2.40 percentage points. Then SOFR rose, sending his total rate about 2 percentage points higher.

The high rate was a jolt after a decade-plus of ultralow rates. “My psyche just wasn’t used to that,” Law said. He sold off part of his investment portfolio to pay back the securities-backed loan.

Add in significant sectors striking, the October resumption of student loan payments, and $1.5 trillion in just U.S. commercial real estate loans up for renewal by 2025. See, The U.S. economy could withstand one shock, but four at once?

The U.S. Index of Leading Economic Indicators (LEI) has fallen for 17 consecutive months, while the U.S. dollar index (DXY) is above 106 for the first time since last November. Global trade volumes have fallen 4.27% year-over-year, the weakest in nearly three years and consistent with past recessions.

It makes sense that the equal-weighted S&P 500 stock index and Canada’s TSX have had zero gains for 2.5 years, but more giveback is in order. Remember, the bulk of bear cycle losses have always happened as the US Fed is back slashing interest rates, not before.