The U.S. government bonds were downgraded a notch by the ratings agency, Fitch. This means the safety of the US treasuries has slipped and there is growing concern about the longer-term outlook for debt.

Is the U.S. government at risk of default?

Economists reacted negatively to the downgrade with Larry Summers calling it “absurd” and Mohamed El-Erian calling it “strange”; saying the majority of economists are likely to be “perplexed”.

Paul Krugman, Nobel prize winner, said the decision will be “widely and correctly ridiculed”. Jason Furman of Harvard said the decision is “completely absurd”. The Biden government disagreed vehemently. Treasury Secretary Janet Yellen says that “Treasury securities remain the world’s preeminent safe and liquid asset, and the American economy is fundamentally strong.”

But the U.S. fiscal position has slipped for several years as tax cuts and increased spending have widened deficits under both Republicans and Democrats.

Fitch Ratings Inc., one of the big three which also includes S&P Global Ratings and Moody’s, has downgraded the U.S. government to AA+ from AAA, a move which echoes a downgrade in 2011 by S&P. The debate over the debt ceiling and the brinksmanship used by politicians leading up to the deadline for raising the debt ceiling was a factor in both downgrades.

Only Moody’s still rates the U.S. as a AAA credit risk.

Germany, Australia, Singapore and Switzerland are the only remaining countries with a AAA rating from all three ratings agencies. Canada is rated at AA+ at Fitch while China gets A+.

Only a few corporations get the AAA designation, including Microsoft and Johnson & Johnson.

Fitch warned on May 24 that a downgrade was possible. At that time the deadline for the debt ceiling increase was fast approaching, causing uncertainty in bond markets for U.S. Treasuries.

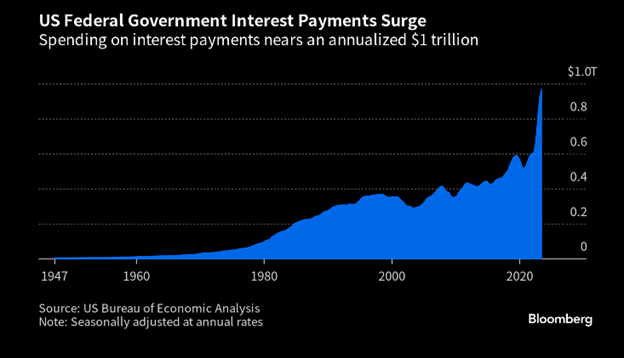

The agency cited the brinkmanship over the debt ceiling, the rising fiscal challenges over the medium term and the growing debt burden. The U.S. has a very high debt burden compared to other AAA-rated governments with debts greater than 100 percent of GDP.

The governance aspect of the rating was cited as weak also, as the contested 2020 election and the January 6 2021 uprising demonstrated. The lack of consensus in political parties over handling the growing debt burden was a factor, according to Fitch.

Large annual deficits of more than 6 percent of GDP are forecast for 2023 and 2024. With higher interest rates the interest burden will grow and keep deficits above 7 percent for a decade or longer.

The debt-GDP is extremely high at 112 percent, compared to an average of 36 percent for other AAA countries.

Fitch is predicting recession for the last few months of 2023 and the beginning of 2024 which will make the deficit situation worse as tax receipts weaken.

The U.S. situation has deteriorated but there is no alternative to U.S. government bonds for investors seeking safety.

Until a better option for safety becomes available the credit rating change will be a non-event.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.